Withholding Tax USA Explained 2026 | How Withholding Tax Works in the USA

Introduction

If you’ve ever opened your paycheck and thought, “Why is my take-home pay less than what I earned?”, you’ve already met withholding Tax USA Explained 2026.

For millions of Americans, withholding tax feels like a mystery. But here’s the truth: it’s not a punishment, and it’s not your employer pocketing extra money. It’s simply a pay-as-you-earn system where taxes are deducted throughout the year.

In fact, the IRS reports that in 2023, the average refund was $2,812, and about 75% of taxpayers received a refund — proof that most people actually overpay taxes through withholding.

In this guide, I’ll walk you through Withholding Tax USA Explained 2026 step by step, explain the IRS role, show practical examples, and answer the most common questions — all in plain English, like a friend explaining it over coffee.

What Is Withholding Tax USA?

Withholding tax is the portion of your paycheck that your employer deducts and sends directly to the IRS or your state’s tax authority.

Instead of waiting until tax season, you pay your taxes little by little every payday. That’s why it’s often called the “pay-as-you-go” or “pay-as-you-earn” system.

- Covers federal income tax, and in many states, state income tax.

- Includes payroll taxes like Social Security and Medicare.

- Calculated based on your Form W-4, income level, and filing status.

👉 Think of it like this: instead of saving $10,000 to pay your tax bill in April, you’re paying $200–$300 each paycheck so you don’t feel the financial hit all at once.

Why Does Withholding Tax Exist in the USA?

The U.S. government relies heavily on withholding tax because:

- Steady cash flow: In 2022, the IRS collected $4.9 trillion, with withholding making up the largest share.

- Protects taxpayers: Spreads out payments so you don’t get a shocking bill.

- Encourages compliance: Automatic deductions reduce the risk of missed or underpaid taxes.

📊 Fun fact: In 2022, 163 million tax returns were filed, and withholding was the primary way those taxes were prepaid.

Federal Withholding Tax vs State Withholding Tax

- Federal Withholding Tax: Paid to the IRS. Applies to everyone.

- State Withholding Tax: Depends on where you live. States like California, New York, and Illinois have income taxes. States like Texas, Florida, and Nevada don’t.

👉 Always check your pay stub to see whether your state has deductions on top of federal taxes.

Types of Withholding Taxes in the USA

- Federal Income Tax Withholding – Based on your income and W-4 details.

- State Income Tax Withholding – If your state charges income tax.

- FICA Taxes – Social Security (6.2%) and Medicare (1.45%), making up about $1.5 trillion in 2022 revenue.

- Backup Withholding – On certain investment income if you don’t provide a Taxpayer Identification Number (TIN).

How Withholding Tax Works (Step by Step)

- You get hired and fill out Form W-4.

- Your employer calculates withholding using IRS tables.

- Taxes are deducted every paycheck.

- Employer sends those funds to the IRS (and state if applicable).

- You file your return at year-end.

- If too much was withheld → Refund. If too little → Payment due.

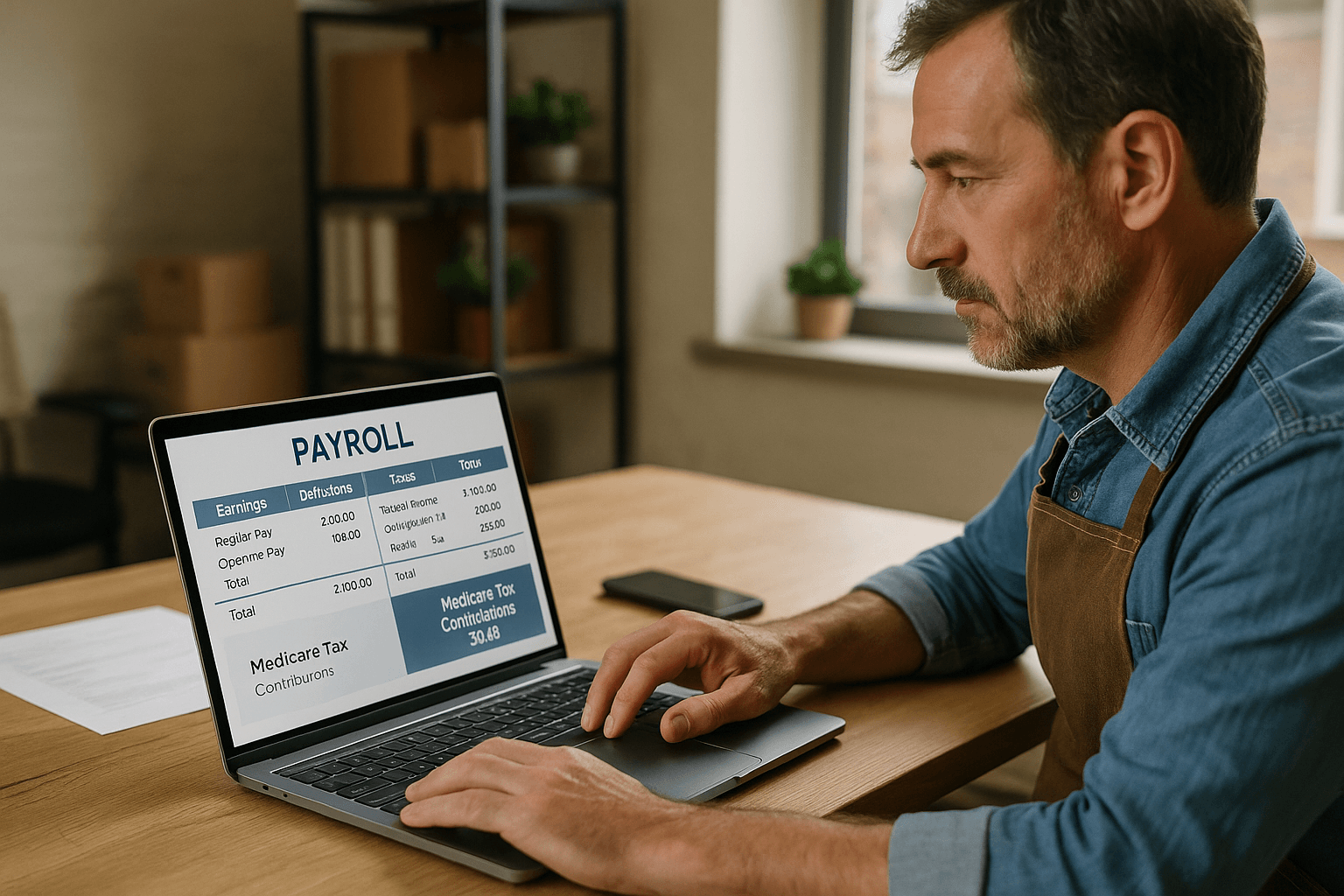

Example of Withholding Tax USA

John earns $1,200 weekly. Here’s his paycheck breakdown:

- $150 – federal withholding tax

- $60 – state withholding tax

- $92 – Social Security tax

- $21 – Medicare tax

👉 John’s take-home pay = $877

At year-end:

- Total withheld: $7,800

- Actual tax liability: $7,200

- John’s refund = $600

This is how millions of Americans end up with refunds every April.

IRS Forms You Should Know

- W-4 Form: Tells your employer how much to withhold.

- W-2 Form: Summarizes your annual income and withholding.

- Form 941: Filed by employers for payroll taxes.

Pros and Cons of Withholding Tax

✅ Pros

- Prevents big one-time tax bills.

- Makes budgeting easier.

- Guarantees government revenue.

❌ Cons

- Over-withholding = interest-free loan to IRS.

- Confusing for people with multiple jobs or gig income.

- Mistakes on W-4 can cause large refunds or tax bills.

Common Mistakes Employees Make

- Not updating W-4 after marriage, kids, or job changes.

- Assuming employer always gets it right.

- Forgetting about side hustle taxes.

- Confusing state and federal withholding.

How to Adjust Your Withholding

- Review your W-4.

- Use the IRS Withholding Estimator online.

- Update your W-4 with new info (dependents, filing status, extra withholding).

- Submit it to HR/payroll.

Tip: If you consistently get huge refunds, you may want to reduce your withholding so you keep more money throughout the year.

FAQs About Withholding Tax USA

Q1: What happens if too much is withheld?

👉 You get a refund. In 2023, the average was $2,812.

Q2: What if too little is withheld?

👉 You’ll owe the IRS and might face penalties.

Q3: Do all states have income tax withholding?

👉 No. States like Texas, Florida, and Washington don’t.

Q4: Can I avoid withholding?

👉 Only if you qualify as exempt, which is rare.

Q5: How do I know if it’s correct?

👉 Check your pay stubs or use the IRS calculator.

Conclusion

Withholding tax USA may look like money disappearing from your paycheck, but it’s really just taxes being prepaid.

The bottom line:

- It spreads out your tax payments.

- It keeps you from facing surprise bills.

- You can control it with your W-4 form.

- Most Americans get refunds thanks to over-withholding.

👉 Don’t leave it to chance. Review your withholding today, adjust your W-4 if needed, and make sure your money is working for you — not just sitting with the IRS.