-

Personal Loans – Types of Personal Loans Available in USA 2026 | Complete Guide to Personal Loan Types

Personal loans continue to be one of the most flexible financial tools for Americans in 2026. Whether you need extra cash for medical bills, debt consolidation, home repairs, or a big life event, there’s likely a personal loan tailored for you. But with so many types of personal loans available in the USA, choosing the right one can feel overwhelming. This guide breaks down every major type of personal loan available in 2026, explaining how they work, their benefits and drawbacks, and practical tips for picking the best option. Why Personal Loans Are So Popular in 2026 The U.S. economy in 2026 has seen rising living costs and changing interest…

-

Home Equity Loan: The Complete 2026 Guide for U.S. Homeowners

Introduction: What Exactly Is a Home Equity Loan? If you’re a homeowner in the U.S., you’re sitting on one of the most powerful financial tools available: home equity loan. A Home Equity Loan lets you borrow money using the value you’ve built in your home. Think of it as turning your home’s equity into cash — without selling your house. And in 2026, with home values still historically high across the U.S., many homeowners are using home equity loans for reasons like: This guide breaks everything down in a simple, friendly way — like talking to a financially smart friend — so you understand how home equity loans work, how…

-

Best Debt Consolidation Companies – Expert Reviews & Smart Debt Relief Options 2026

Introduction: Taking Back Control of Your Finance Debt can feel like a heavy backpack you can’t take off. Between credit cards, personal loans, medical bills, and other financial obligations, many Americans find themselves buried under multiple payments every month. But there’s hope — Best Debt Consolidation Companies. This strategy allows you to combine multiple debts into one manageable payment, often with a lower interest rate. It can simplify your finances, reduce stress, and help you work toward financial freedom faster. In this 2026 guide, we’ll explore the best debt consolidation companies, how they work, what to look for, and how to choose the right one for your situation. What Is…

-

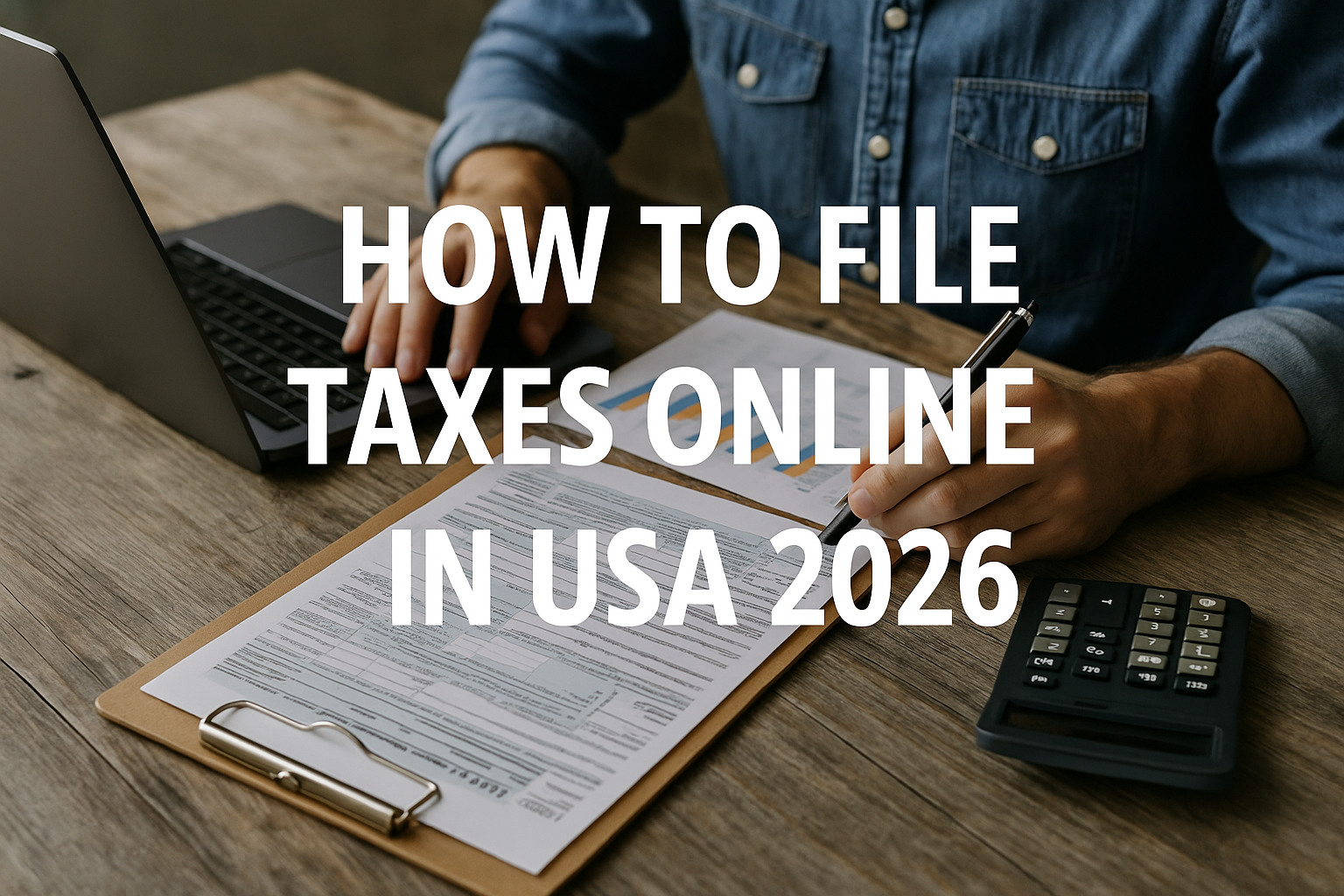

How to File Taxes Online in USA 2026 | Easy Step-by-Step Tax Filing Guide

Introduction: The Digital Way to File Taxes in the USA Tax season in the United States can feel overwhelming — deadlines, forms, deductions, and the fear of making mistakes. But the good news? Filing your taxes online has never been easier. With digital tools, secure IRS e-filing systems, and user-friendly tax software, How to File Taxes Online in USA 2026 has become the most convenient way for individuals and small businesses to stay compliant — and even get refunds faster. In this comprehensive guide, you’ll learn: Whether you’re a freelancer, employee, small business owner, or retiree, this 2026 guide will walk you through every detail in simple, easy-to-follow language. What…

-

How to Manage Business Cash Flow USA 2026 — Business Cash Flow USA

Introduction: Why Cash Flow Is the Lifeline of Every Business If profit is the “heartbeat” of a business, cash flow is the blood that keeps it alive.Many profitable companies in the USA have gone bankrupt — not because they weren’t making money, but because they ran out of cash when they needed it most. Managing How to Manage Business Cash Flow USA 2026 isn’t just about tracking income and expenses — it’s about making sure there’s always enough cash available to pay bills, invest, and grow. Whether you’re running a startup in Austin, a coffee shop in Seattle, or a mid-sized company in New York, understanding and managing cash flow…

-

Difference Between Corporate and Small Business Finance USA 2026

Introduction: Why Finance Looks Different for Corporates and Small Businesses Difference Between Corporate and Small Business Finance USA 2026,Finance is the heartbeat of every organization — it determines how companies grow, invest, and survive economic challenges. But finance isn’t one-size-fits-all. The way a large corporation like Apple manages its money is entirely different from how a local bakery in Ohio handles its finances. Both need capital, both need budgeting, and both aim for profitability — but the scale, strategy, and complexity differ dramatically. In this article, we’ll break down the difference between corporate and small business finance USA 2026 in a simple, easy-to-understand way. You’ll learn: Let’s dive in! What…

-

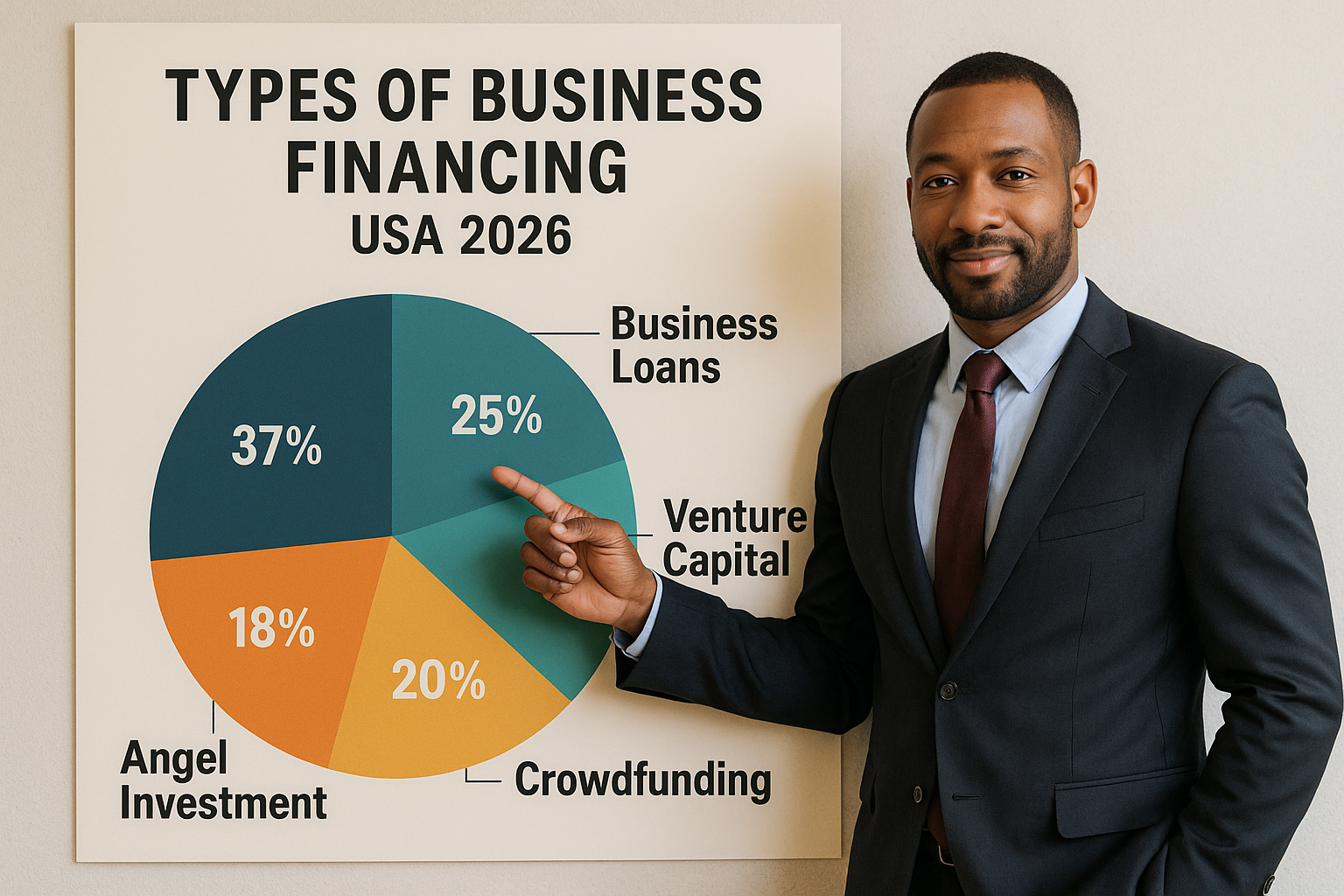

Types of Business Financing USA 2026 | Top Financing Options for Small Businesses

Introduction: Why Business Financing Is the Key to Growth Whether you’re launching a startup in California or expanding a family business in Texas, one thing matters more than anything — funding. Every business, big or small, runs on capital. You need money to buy equipment, pay employees, market your brand, and sustain operations. But where does that money come from? That’s where business financing comes in. The Types of Business Financing USA 2026 have evolved dramatically in recent years. Today, entrepreneurs can choose from traditional loans, venture capital, crowdfunding, grants, and even AI-based funding platforms. This guide breaks down the best business financing options USA entrepreneurs can explore in 2026…

-

Importance of Finance in Business USA 2026 | Why Business Finance Is Crucial for Growth

Introduction: Why Finance Is the Lifeblood of Every Business Every successful business — from a small startup in Austin to a Fortune 500 company in New York — runs on one essential element: finance. Importance of Finance in Business USA 2026, Finance isn’t just about managing money. It’s about planning, allocating, and optimizing resources to achieve growth, stability, and sustainability. In the USA’s competitive market, where businesses must constantly adapt to technology, inflation, and global trade shifts, understanding the importance of finance in business is not optional — it’s vital. This article explores how finance powers every stage of a business, from launching and scaling to managing risks and ensuring…

-

Cryptocurrency Market Trends USA (2026) | Crypto Trends & Insights for US Investors

Introduction: How the US Crypto Market Is Shaping 2026 Cryptocurrency Market Trends USA (2026): The cryptocurrency landscape in the United States has never been more exciting or dynamic. As we enter 2026, the market continues to evolve rapidly, influenced by regulatory developments, technological innovations, and institutional adoption. From Bitcoin ETFs gaining traction to AI-powered blockchain analytics, the cryptocurrency market trends in the USA show that digital assets are no longer a niche topic — they’re becoming a core part of the country’s financial ecosystem. In this comprehensive guide, we’ll explore: Whether you’re an investor, trader, or simply crypto-curious, this article will help you understand what’s driving the US crypto market…

-

Cryptocurrency vs Digital Money USA | Key Differences Explained

Introduction Money has come a long way — from coins and paper bills to mobile wallets and digital coins. The debate between cryptocurrency and digital money is hotter than ever in the United States. You use digital dollars daily through Venmo or PayPal, while your friend might invest in Bitcoin or Ethereum on Coinbase. But what’s the actual difference between Cryptocurrency vs Digital Money USA, Are they the same thing with different names, or do they represent completely different financial systems? This detailed guide breaks it all down — the meaning, key differences, examples, pros and cons, and what the future of money in the USA looks like. Let’s start…