-

Top Benefits of Debt Management Program USA | Debt Relief & Credit Counseling

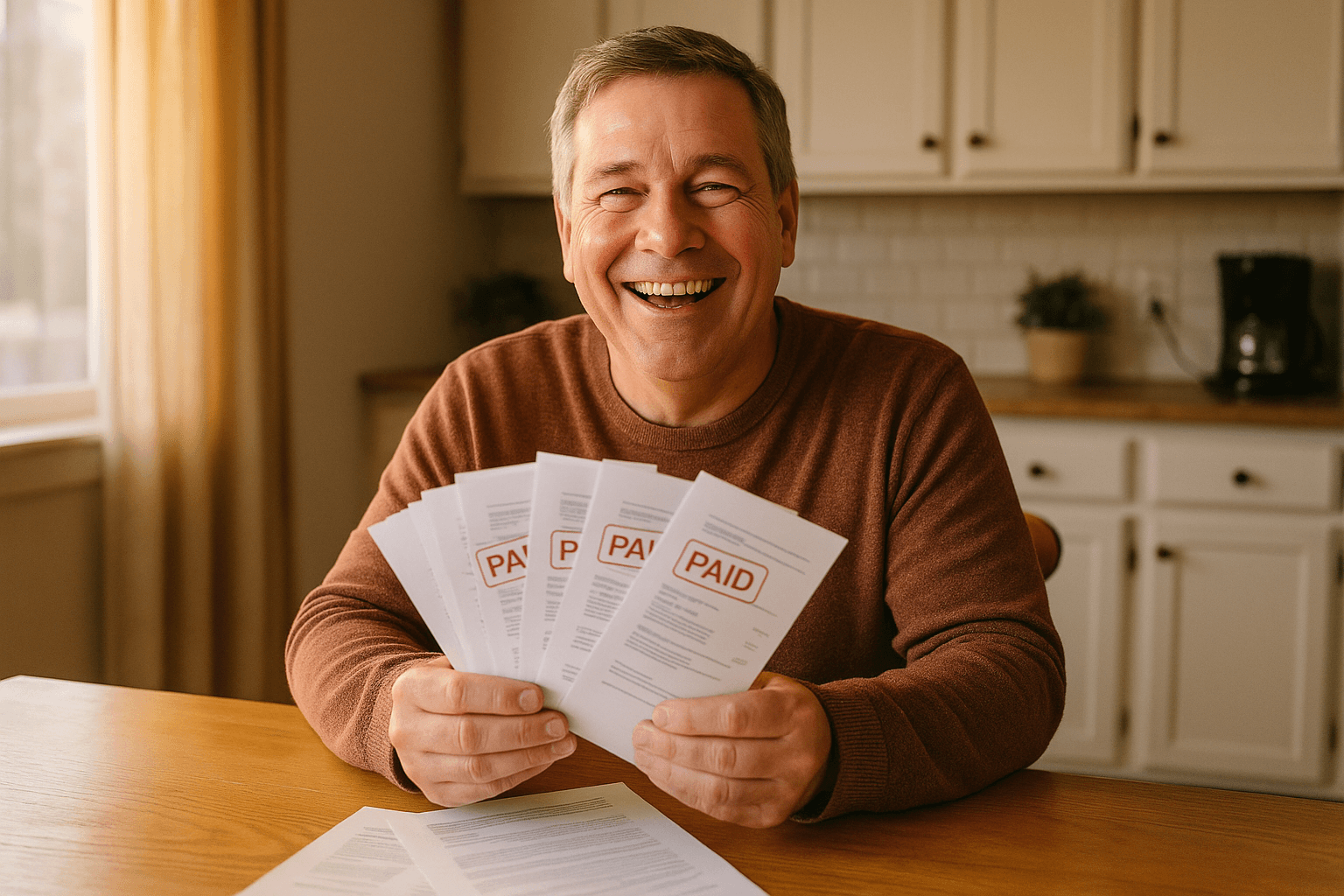

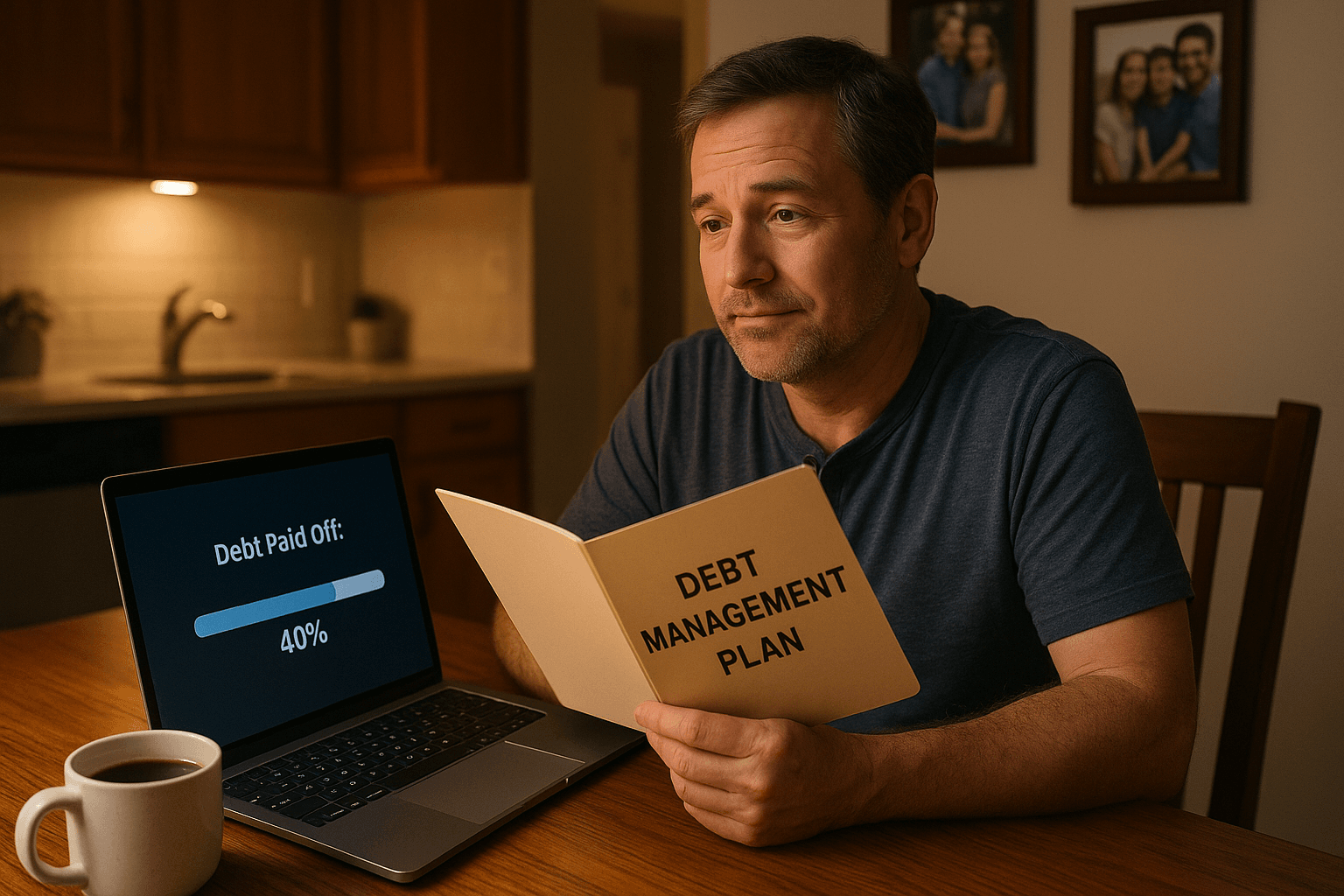

Introduction Top benefits of debt management program USA, Debt can feel like quicksand—you keep trying to get out, but the harder you struggle, the deeper you sink. For many Americans, this isn’t just a figure of speech. According to the Federal Reserve, the average U.S. household with credit card debt carries over $7,000 in revolving balances, often at interest rates above 20%. That’s where a debt management program (DMP) can make a life-changing difference. Instead of drowning in bills, you get a structured plan, lower interest rates, and the emotional relief of knowing you’re finally moving toward freedom. In this article, we’ll break down the Top benefits of debt management…

-

Debt Relief Options in USA 2026

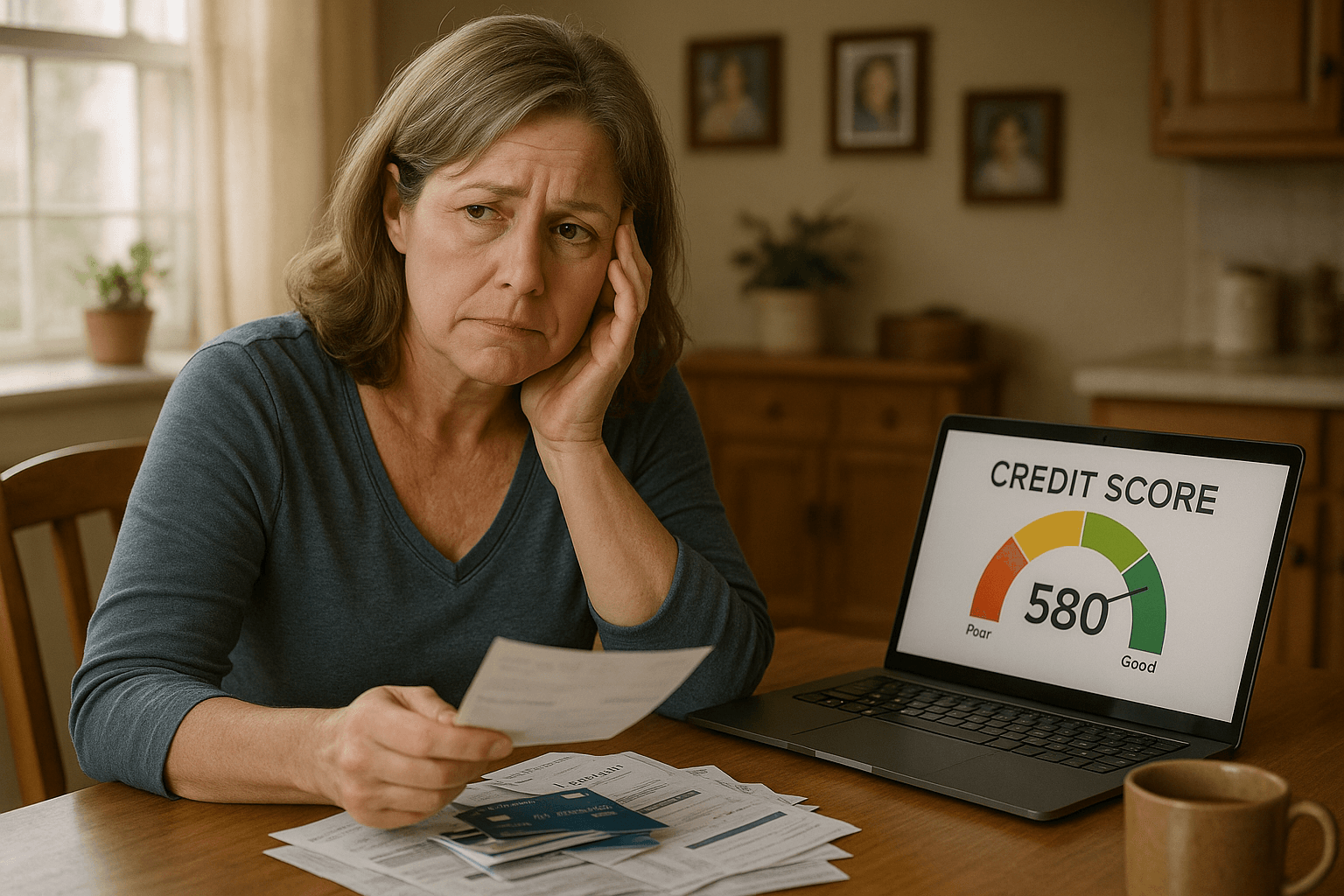

Introduction In 2026, millions of Americans are facing financial stress due to credit card debt, medical bills, student loans, and personal loans. According to the Federal Reserve, total household debt in the USA has crossed $17 trillion, with credit card debt hitting record highs. When debt feels overwhelming, the good news is that you’re not alone — and there are solutions. This is where debt relief options in USA come into play. In this guide — Debt Relief Options in USA 2026 — we’ll break down every major method of debt relief, from debt consolidation to settlement, management, forgiveness, and even bankruptcy. We’ll use real examples, pros & cons, expert…