-

Top Benefits of Debt Management Program USA | Debt Relief & Credit Counseling

Introduction Top benefits of debt management program USA, Debt can feel like quicksand—you keep trying to get out, but the harder you struggle, the deeper you sink. For many Americans, this isn’t just a figure of speech. According to the Federal Reserve, the average U.S. household with credit card debt carries over $7,000 in revolving balances, often at interest rates above 20%. That’s where a debt management program (DMP) can make a life-changing difference. Instead of drowning in bills, you get a structured plan, lower interest rates, and the emotional relief of knowing you’re finally moving toward freedom. In this article, we’ll break down the Top benefits of debt management…

-

Credit Counseling and Debt Management in USA 2026 — Your Complete Guide

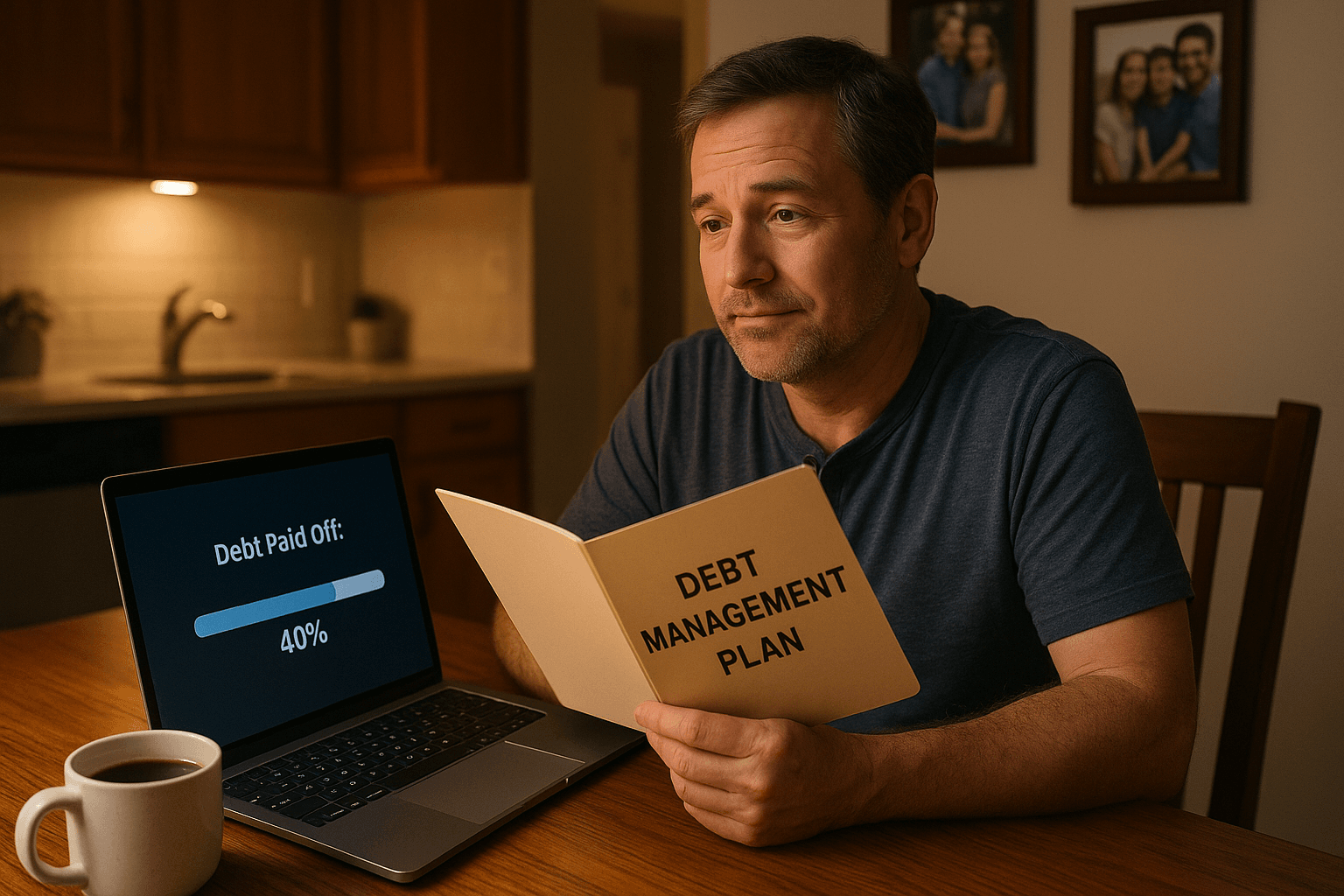

Introduction: Dear Friend, Let’s Talk About Debt Honestly If you’re reading this, chances are debt has been weighing on your mind. Maybe it’s credit card bills piling up, maybe it’s medical expenses, or maybe just life happening faster than your paycheck can keep up. First, let me say this: you are not alone. Millions of people across the United States deal with debt every single day. The good news? There’s hope. And that’s where credit counseling and debt management in USA come into play. These tools can help you regain control, reduce stress, and build a clear path forward. In this guide, I’m going to walk you through everything you…

-

Debt Management Good or Bad in USA 2026— The Truth You Need to Know

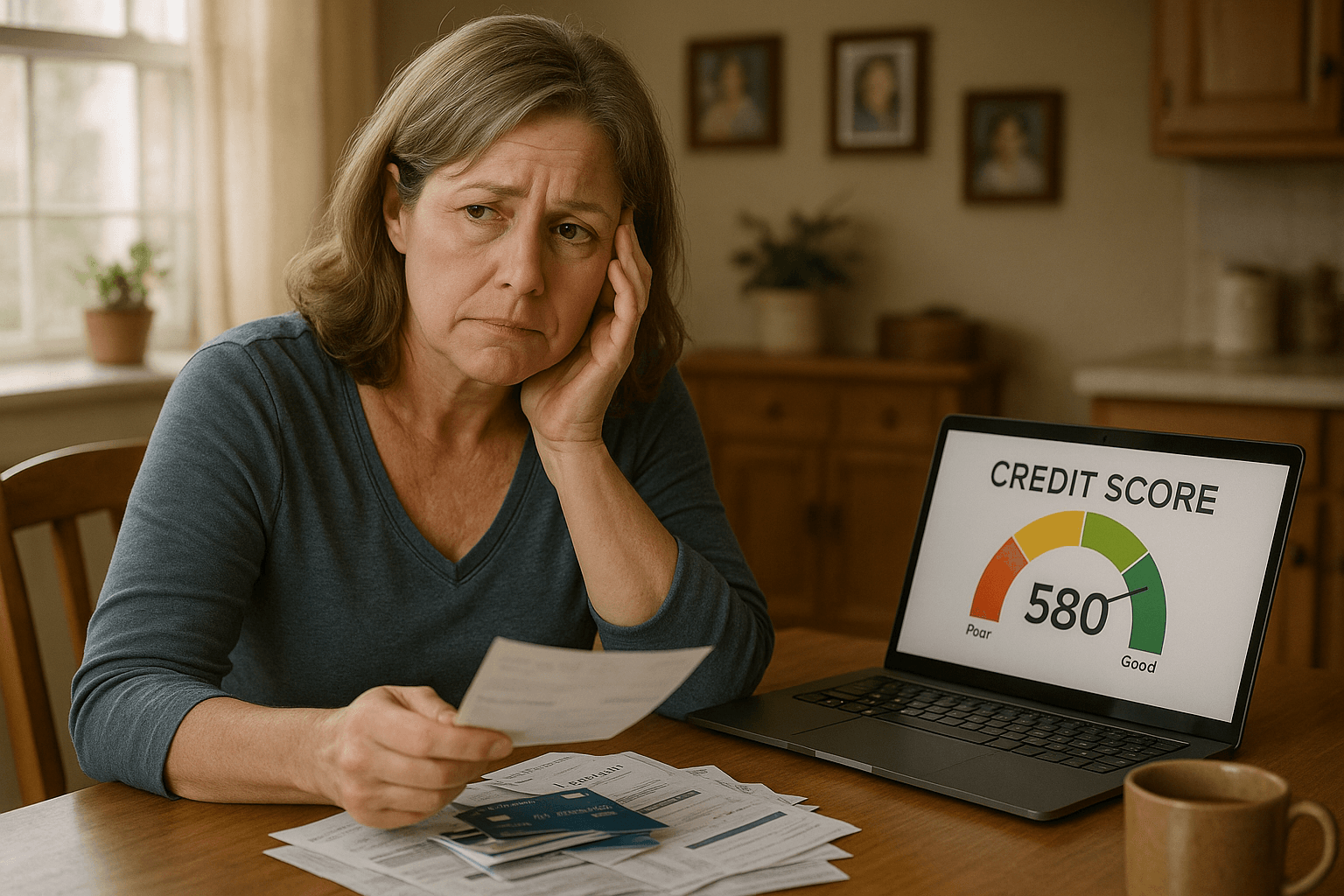

Introduction: Dear Friend, Let’s Talk About Debt If you’re reading this, you’re probably worried about debt. Maybe credit card bills keep piling up, maybe you’ve been juggling minimum payments, or maybe you’ve simply reached the point where you’re asking: “Debt Management Good or Bad in USA” First, let me reassure you: you are not alone. Millions of Americans struggle with debt every day. In fact, according to recent studies, the average U.S. household with credit card debt owes over $6,000. Add in car loans, medical bills, or student loans, and the burden can feel overwhelming. But here’s the good news — debt management programs exist to help you. They aren’t…

-

Debt Settlement vs Debt Management in USA 2026

Introduction In today’s USA economy, debt is part of everyday life. From credit cards to personal loans, mortgages to medical bills, many households struggle with monthly payments. When debt feels overwhelming, two common solutions come up: debt settlement and debt management. But what’s the difference between the two? Which one is better for you? And how do they impact your credit, monthly payments, and long-term financial health? This detailed guide — Debt Settlement vs Debt Management in USA 2026 — breaks everything down in plain English. We’ll explain what each method means, how they work, real-life examples, pros and cons, and practical tips to help you make the smartest decision…

-

Types of Debt Management Programs in USA 2025: Complete Beginner’s Guide

Introduction: Types of Debt Management Programs in USA 2025 Debt is something most Americans face today — from credit cards to student loans. If you’re struggling to keep up with payments, you’re not alone. The good news? There are several types of debt management programs in USA 2025 that can help you take control of your money. In this guide, we’ll break it down in simple, friendly language. No confusing terms — just clear explanations, examples, and practical tips to help you understand your options What Is a Debt Management Program? A debt management program (DMP) is a structured plan that helps you pay off debt in a manageable way.…