-

Property Taxes in USA — What Are Property Taxes in USA?

Introduction: If you own a house, land, or any piece of real estate in the United States, you’re paying more than just a mortgage. Alongside utilities, insurance, and upkeep, there’s another big cost that comes around every year: property taxes in USA.But what exactly are property taxes in USA? Why do we pay them? How are they calculated, and what do they fund? For many homeowners, property taxes can feel confusing — and sometimes even overwhelming. Yet they are one of the most important parts of how local communities function. Think of property taxes as your neighborhood’s membership fee. Unlike income tax, which is based on how much you earn,…

-

Medicare Tax Explained in USA 2026: What You Need to Know

Introduction Medicare Tax Explained in USA 2026,If you’ve ever checked your paycheck in the USA, you’ve probably noticed a line that says “Medicare Tax.” Many people know it’s something related to healthcare, but few understand exactly what it is or why it’s deducted from their pay. Here’s the short answer: Medicare tax is a payroll tax that funds healthcare for Americans aged 65 and older, as well as certain disabled individuals. In this article, I’ll walk you through Medicare Tax Explained in USA 2026 in plain English. You’ll learn: By the end, you’ll feel confident reading your pay stub and knowing exactly where your money is going. What is Medicare…

-

Social Security Tax Explained USA | Rates, Examples & Wage Base 2026

Introduction If you’ve ever looked closely at your paycheck, you’ve probably noticed a line that says “Social Security tax.” Many Americans see that deduction every pay period, but not everyone understands where it goes or how it works. Here’s the good news: that money isn’t disappearing into thin air. It’s helping fund one of the most important safety-net programs in the United States — Social Security. In this article, we’ll break down Social Security tax explained USA in simple terms. You’ll learn: By the end, you’ll have a crystal-clear understanding of Social Security tax in the USA — and maybe even a new appreciation for what it provides. What is…

-

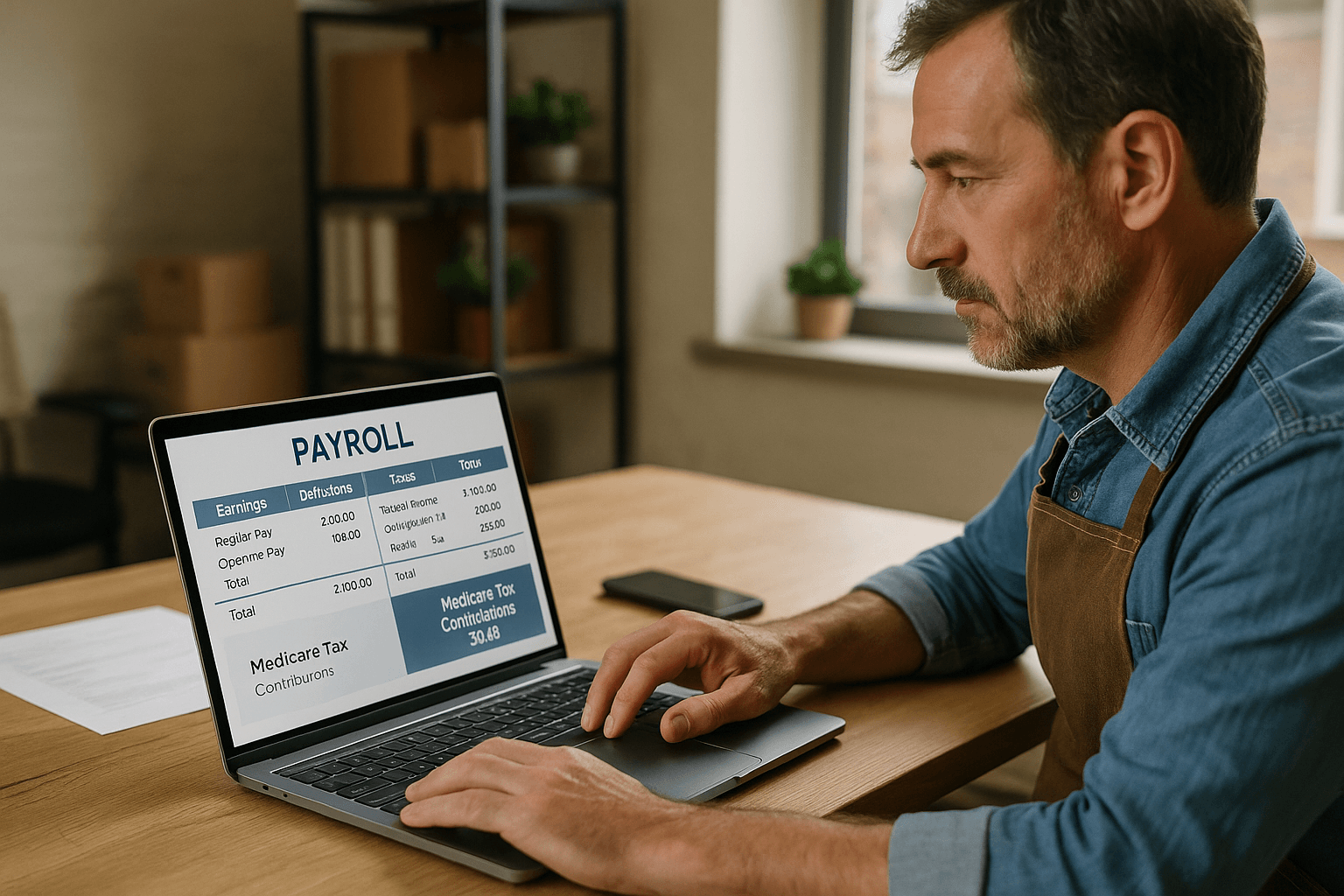

What is Payroll Tax USA? Payroll Tax Explained for Employers & Employees

Introduction What is payroll tax USA, If you’ve ever received a paycheck in the USA, you’ve probably noticed that the amount you take home is smaller than your gross salary. That difference often comes down to payroll taxes. But what exactly are payroll taxes? Who pays them? How are they calculated? And why do they matter so much? In this guide, we’ll break down what is payroll tax USA, explain it in plain English, and give you real-world examples so it all makes sense. Whether you’re an employee trying to understand your paycheck or an employer making sure you follow the law, this article will give you the clarity you…

-

Top Benefits of Debt Management Program USA | Debt Relief & Credit Counseling

Introduction Top benefits of debt management program USA, Debt can feel like quicksand—you keep trying to get out, but the harder you struggle, the deeper you sink. For many Americans, this isn’t just a figure of speech. According to the Federal Reserve, the average U.S. household with credit card debt carries over $7,000 in revolving balances, often at interest rates above 20%. That’s where a debt management program (DMP) can make a life-changing difference. Instead of drowning in bills, you get a structured plan, lower interest rates, and the emotional relief of knowing you’re finally moving toward freedom. In this article, we’ll break down the Top benefits of debt management…

-

Debt Management Process in USA 2026

Introduction: Why Talk About Debt Management? Debt Management Process in USA, Debt can feel like quicksand. The harder you struggle to get out, the deeper you seem to sink. If you’ve ever sat staring at a pile of bills, wondering how you’ll ever dig your way out — you’re not alone. In fact, studies show that the average American household carries over $100,000 in total debt (including mortgages, credit cards, and loans). For many families, debt isn’t just numbers — it’s stress, sleepless nights, arguments at home, and dreams put on hold. The good news? There is a way forward. One of the most effective methods people use is a…

-

How Debt Management Affects Credit Score in USA 2026

Introduction: Let’s Talk Honestly About Debt Let’s be real for a second: debt is stressful.If you’ve ever opened your mailbox and felt your stomach drop seeing another credit card bill, or if your phone rings and you’re scared it’s a collector — you’re not alone. How Debt Management Affects Credit Score in USA, Millions of Americans are in the same boat. In fact, the average household carries tens of thousands of dollars in debt. And when you’re buried under it, one question keeps haunting you: 👉 “If I join a debt management plan, what will happen to my credit score?” I get it — because your credit score feels like…

-

Credit Counseling and Debt Management in USA 2026 — Your Complete Guide

Introduction: Dear Friend, Let’s Talk About Debt Honestly If you’re reading this, chances are debt has been weighing on your mind. Maybe it’s credit card bills piling up, maybe it’s medical expenses, or maybe just life happening faster than your paycheck can keep up. First, let me say this: you are not alone. Millions of people across the United States deal with debt every single day. The good news? There’s hope. And that’s where credit counseling and debt management in USA come into play. These tools can help you regain control, reduce stress, and build a clear path forward. In this guide, I’m going to walk you through everything you…

-

Debt Management Good or Bad in USA 2026— The Truth You Need to Know

Introduction: Dear Friend, Let’s Talk About Debt If you’re reading this, you’re probably worried about debt. Maybe credit card bills keep piling up, maybe you’ve been juggling minimum payments, or maybe you’ve simply reached the point where you’re asking: “Debt Management Good or Bad in USA” First, let me reassure you: you are not alone. Millions of Americans struggle with debt every day. In fact, according to recent studies, the average U.S. household with credit card debt owes over $6,000. Add in car loans, medical bills, or student loans, and the burden can feel overwhelming. But here’s the good news — debt management programs exist to help you. They aren’t…

-

Debt Relief Options in USA 2026

Introduction In 2026, millions of Americans are facing financial stress due to credit card debt, medical bills, student loans, and personal loans. According to the Federal Reserve, total household debt in the USA has crossed $17 trillion, with credit card debt hitting record highs. When debt feels overwhelming, the good news is that you’re not alone — and there are solutions. This is where debt relief options in USA come into play. In this guide — Debt Relief Options in USA 2026 — we’ll break down every major method of debt relief, from debt consolidation to settlement, management, forgiveness, and even bankruptcy. We’ll use real examples, pros & cons, expert…