-

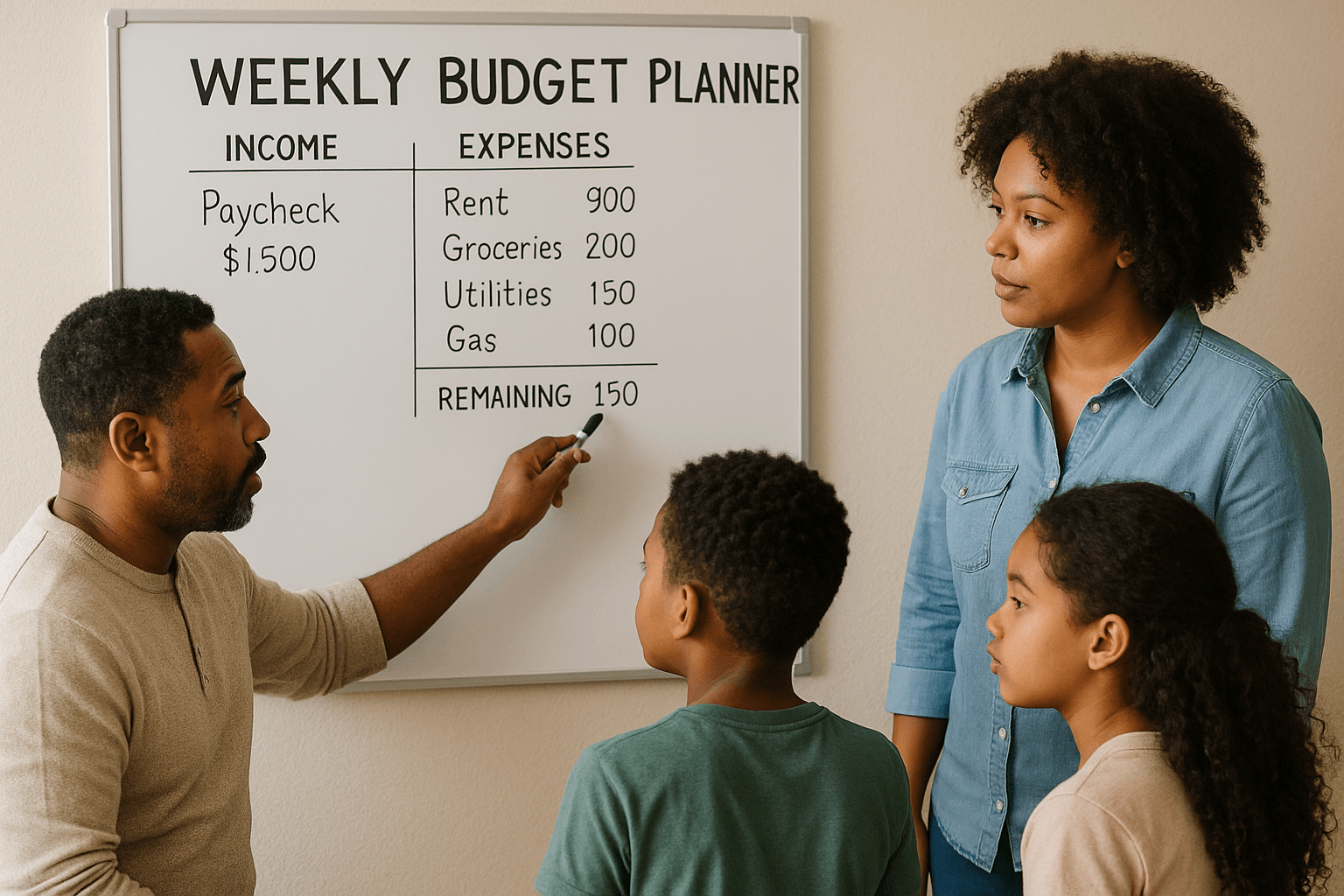

Weekly Budget Planner USA (2025 Complete Guide)

Introduction: Why Weekly Budgeting Works Better for Many Americans Most people in the USA think about budgeting monthly—but here’s the catch: bills, groceries, and daily expenses often happen weekly. That’s why a weekly budget planner USA style works so well. It breaks your money into smaller chunks, making it easier to control spending, track habits, and avoid overspending mid-month. Think of it like portion control for your wallet—if you know exactly how much you can spend this week, you won’t blow through your whole paycheck before the month ends. In this guide, we’ll cover: By the end, you’ll have a practical system to manage your money week by week. What…

-

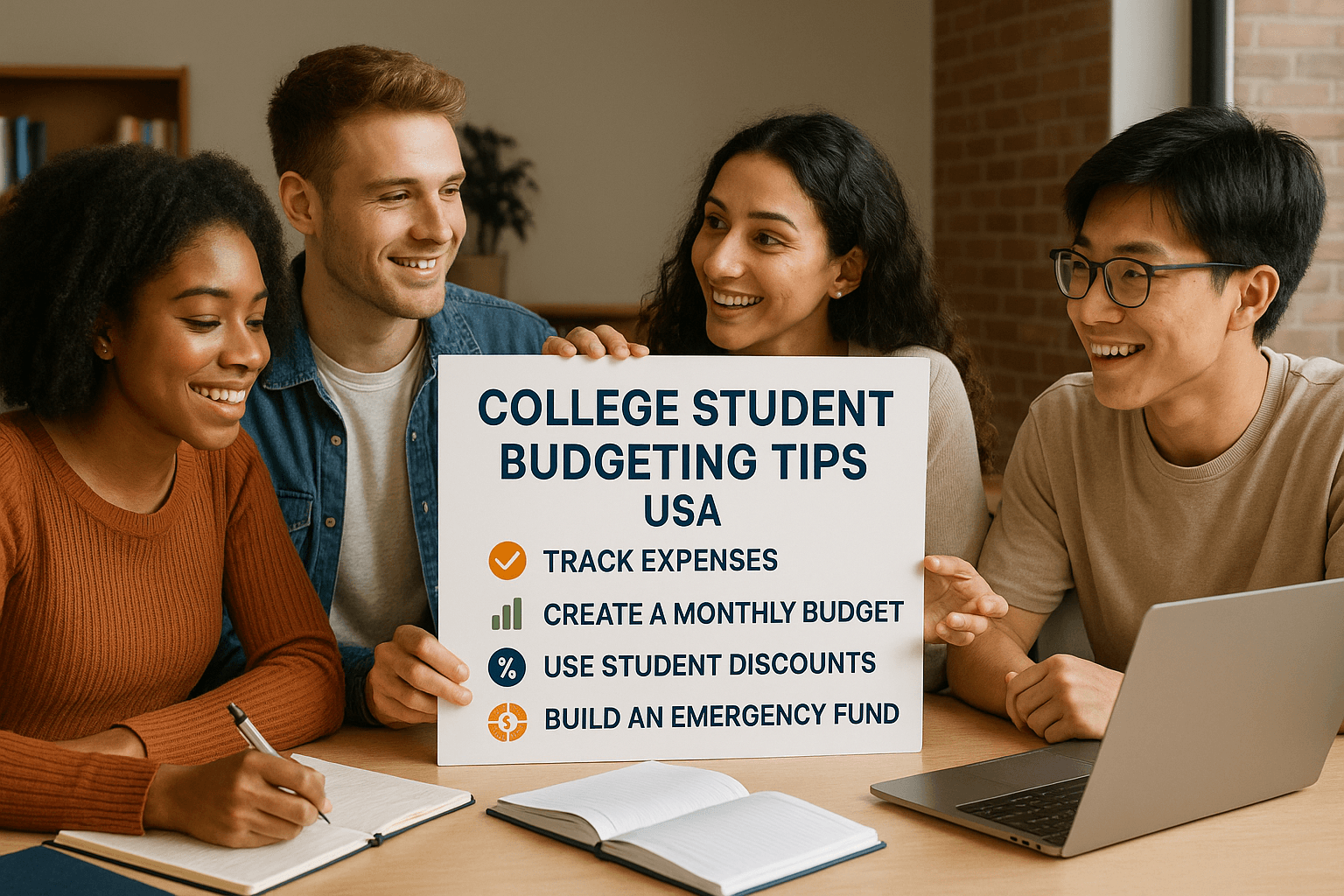

College Student Budgeting Tips USA 2026 || Explained

Introduction: Why Budgeting Matters for College Students College life in the USA is exciting—freedom, new friends, and opportunities everywhere. But it also comes with one big challenge: money management. Between tuition, rent, food, books, and social life, it’s easy for students to overspend and fall into debt. The good news? With the right approach, you can enjoy college without constantly stressing about money. That’s where college student budgeting tips USA come in. In this guide, we’ll cover: By the end, you’ll have a step-by-step plan to take control of your money—so you can focus on studying and enjoying college life. Why Budgeting is Essential for College Students in the USA…

-

Simple Family Budget Template USA 2026 || Complete Guide

Introduction: Why Every American Family Needs a Budget Managing money in a household isn’t always easy. Between mortgage or rent, groceries, healthcare, kids’ expenses, and saving for the future, it’s easy to feel like your paycheck disappears too quickly. That’s where a simple family budget template USA comes in. It’s like a roadmap for your money: showing where it goes, how much is left, and how you can reach your goals without stress. In this guide, we’ll explore: By the end, you’ll be able to create a personalized family budget USA style that works for you. What is a Family Budget and Why Does it Matter? A family budget is…

-

Best Investment Options in USA 2026 || Complete Guide

Introduction: Why 2026 is a Great Year to Invest If you’re living in the USA and want to grow your wealth, you might be asking: What are the best investment options in USA 2026? Best Investment Options in USA 2026, The good news: 2026 offers more opportunities than ever before. From traditional choices like stocks and bonds to modern trends like real estate crowdfunding, ETFs, and even crypto ETFs, investors in America have countless ways to grow their money. But here’s the catch — not all investments are created equal. Some are high-risk but high-reward, while others are safe but slower. That’s why I wrote this guide: to break down…

-

How to Start Investing in USA for Beginners || Step-by-Step Guide 2026

Introduction: Why Investing Matters for Beginners in the USA If you’re living in the United States and want to grow your money, investing is one of the smartest decisions you can make. Sure, it might sound intimidating at first — stocks, bonds, ETFs, brokers, retirement accounts — but the truth is, you don’t need a finance degree to get started. Thanks to modern apps and beginner-friendly platforms, you can begin investing with as little as $5–$50. This guide is designed to show you, step by step, how to start investing in USA for beginners. I’ll break it down in plain English, share real examples, highlight mistakes to avoid, and help…

-

Sales Tax by State in USA 2026 — Complete Guide to Sales Tax USA

Introduction: Why Sales Tax Matters in the USA Sales Tax by State in USA 2026, If you’ve ever walked into a store in the U.S. and noticed that the price on the tag isn’t the final amount you pay at the register, you’ve already encountered sales tax. Unlike some countries where taxes are included in the price tag, the United States adds sales tax at checkout. Here’s the catch: sales tax isn’t the same across the country. Each state sets its own rules, some even letting cities and counties add more on top. That’s why buying the same $100 item in one state can cost $106 while in another it…

-

Withholding Tax USA Explained 2026 | How Withholding Tax Works in the USA

Introduction If you’ve ever opened your paycheck and thought, “Why is my take-home pay less than what I earned?”, you’ve already met withholding Tax USA Explained 2026. For millions of Americans, withholding tax feels like a mystery. But here’s the truth: it’s not a punishment, and it’s not your employer pocketing extra money. It’s simply a pay-as-you-earn system where taxes are deducted throughout the year. In fact, the IRS reports that in 2023, the average refund was $2,812, and about 75% of taxpayers received a refund — proof that most people actually overpay taxes through withholding. In this guide, I’ll walk you through Withholding Tax USA Explained 2026 step by…

-

Alternative Minimum Tax Explained USA | AMT Tax Brackets & Rules 2026

Introduction Taxes in the United States are already complicated, and the Alternative Minimum Tax Explained USA, doesn’t make things easier. If you’ve ever wondered why your accountant mentions AMT even when you’ve already calculated regular taxes, you’re not alone. The AMT was originally designed in 1969 to prevent very wealthy Americans from using excessive deductions and loopholes to avoid paying taxes. But over the years, millions of middle- and upper-middle-class taxpayers also got pulled in — until Congress passed reforms in 2017. Today, fewer people pay AMT than in the past, but it’s still important to understand AMT tax USA rules, especially if you earn a higher income, have large…

-

Gift Tax Rules USA Explained | 2026 IRS Exemptions & Exclusions

Introduction Gifting money or property to loved ones should feel like a joyful moment — not a tax headache. Yet many Americans wonder: “If I give my child $50,000 for a house down payment, will the IRS tax it?” That’s where Gift Tax Rules USA Explained come in. The IRS has clear guidelines about when gifts are taxable, when they’re exempt, and who is responsible for paying. Here’s the surprising truth: Most people will never actually pay gift tax. Thanks to generous annual exclusions and a multi-million-dollar lifetime exemption, only a small fraction of wealthy families ever write a check to the IRS for gift taxes. In this guide, we’ll…

-

Estate Tax Laws USA Explained ||Exemptions, Rates & Planning 2026

Introduction Estate Tax Laws USA Explained, You’ve probably heard the phrase: “Nothing is certain except death and taxes.” The estate tax combines both. Often called the “death tax,” it applies when a person passes away and their estate (everything they owned — homes, bank accounts, stocks, etc.) is transferred to heirs. But here’s the truth: most Americans will never pay estate tax. Why? Because the exemption level is so high. In 2025, only estates worth over $12.92 million per person are subject to federal estate tax. In this article, we’ll break down: By the end, you’ll have a clear, easy-to-understand picture of how estate tax works in the USA and…