Importance of Finance in Business USA 2026 | Why Business Finance Is Crucial for Growth

Introduction: Why Finance Is the Lifeblood of Every Business

Every successful business — from a small startup in Austin to a Fortune 500 company in New York — runs on one essential element: finance.

Importance of Finance in Business USA 2026, Finance isn’t just about managing money. It’s about planning, allocating, and optimizing resources to achieve growth, stability, and sustainability. In the USA’s competitive market, where businesses must constantly adapt to technology, inflation, and global trade shifts, understanding the importance of finance in business is not optional — it’s vital.

This article explores how finance powers every stage of a business, from launching and scaling to managing risks and ensuring long-term success.

We’ll cover:

- Why finance is essential in business

- The main types of business finance

- The role of financial management in decision-making

- Tips and examples for American businesses

- FAQs and expert advice

What Is Business Finance?

Business finance refers to the process of obtaining, managing, and using funds to run a company efficiently. It includes budgeting, forecasting, investing, and decision-making related to cash flow, profits, and growth.

In simpler terms:

“Finance is the fuel that keeps your business engine running.”

Finance affects every part of a business — marketing, operations, HR, and even customer service. Without proper financial planning, even the best ideas can fail to survive.

The Importance of Finance in Business USA

In the United States, business finance plays a crucial role in driving the economy. With over 33 million small businesses contributing to job creation and innovation, understanding how to handle money effectively determines success or failure.

Here are the major reasons finance is important for businesses in the USA:

1. Helps in Starting and Growing a Business

Every business begins with an idea — but ideas need funding to turn into reality. From leasing office space to hiring employees, finance fuels every early-stage business activity.

Example:

A tech startup in Silicon Valley may need seed funding from angel investors or venture capital firms to launch its product. Proper financial management helps attract and use these funds wisely.

Key takeaway:

Finance ensures that a business has enough capital to operate, expand, and innovate.

2. Supports Strategic Decision-Making

Finance provides the data-driven foundation for business decisions.

When leaders decide whether to open a new branch, launch a new product, or invest in technology, they rely on financial analysis — including ROI (Return on Investment), cash flow, and cost-benefit studies.

Example:

A restaurant chain in Florida might use financial forecasts to decide if it can afford to open a new location in another state.

Why it matters:

Good financial management ensures that every business decision aligns with profitability and growth goals.

3. Ensures Smooth Operations and Cash Flow Management

Running out of cash is one of the top reasons businesses fail — even profitable ones.

Finance helps manage daily expenses, such as payroll, rent, inventory, and marketing. Companies need steady cash flow to stay operational during both good and tough times.

Example:

Retail stores in the USA often rely on short-term business loans to maintain inventory before the holiday season. Finance ensures cash flow stability during high-demand periods.

4. Helps in Risk Management

No business can avoid risks — but good financial planning can minimize them.

Finance helps identify, analyze, and manage risks like market fluctuations, credit issues, or unexpected costs.

Common Risk-Management Tools:

- Insurance policies

- Emergency funds

- Diversified investments

- Hedging strategies

Example:

A manufacturing company in Texas may use financial derivatives to protect itself from fluctuating raw material prices.

5. Enables Business Expansion

Once a business is stable, finance becomes the key to scaling. Expansion often requires loans, investor funding, or reinvested profits.

Example:

A successful e-commerce company may seek Series B funding to expand warehouses and logistics in other US states.

Without financial resources and a solid financial strategy, scaling operations would be impossible.

6. Builds Investor Confidence

Investors and lenders are more likely to support businesses with strong financial health.

Transparent accounting, clear balance sheets, and good credit scores attract more funding.

Tip:

Maintain up-to-date financial statements to show your company’s stability and growth potential.

7. Compliance and Legal Requirement

In the USA, every business must follow IRS tax laws, GAAP accounting standards, and other financial regulations.

Sound financial management ensures compliance, avoiding penalties or audits.

Example:

A California-based firm maintaining accurate records can easily handle audits or attract government contracts.

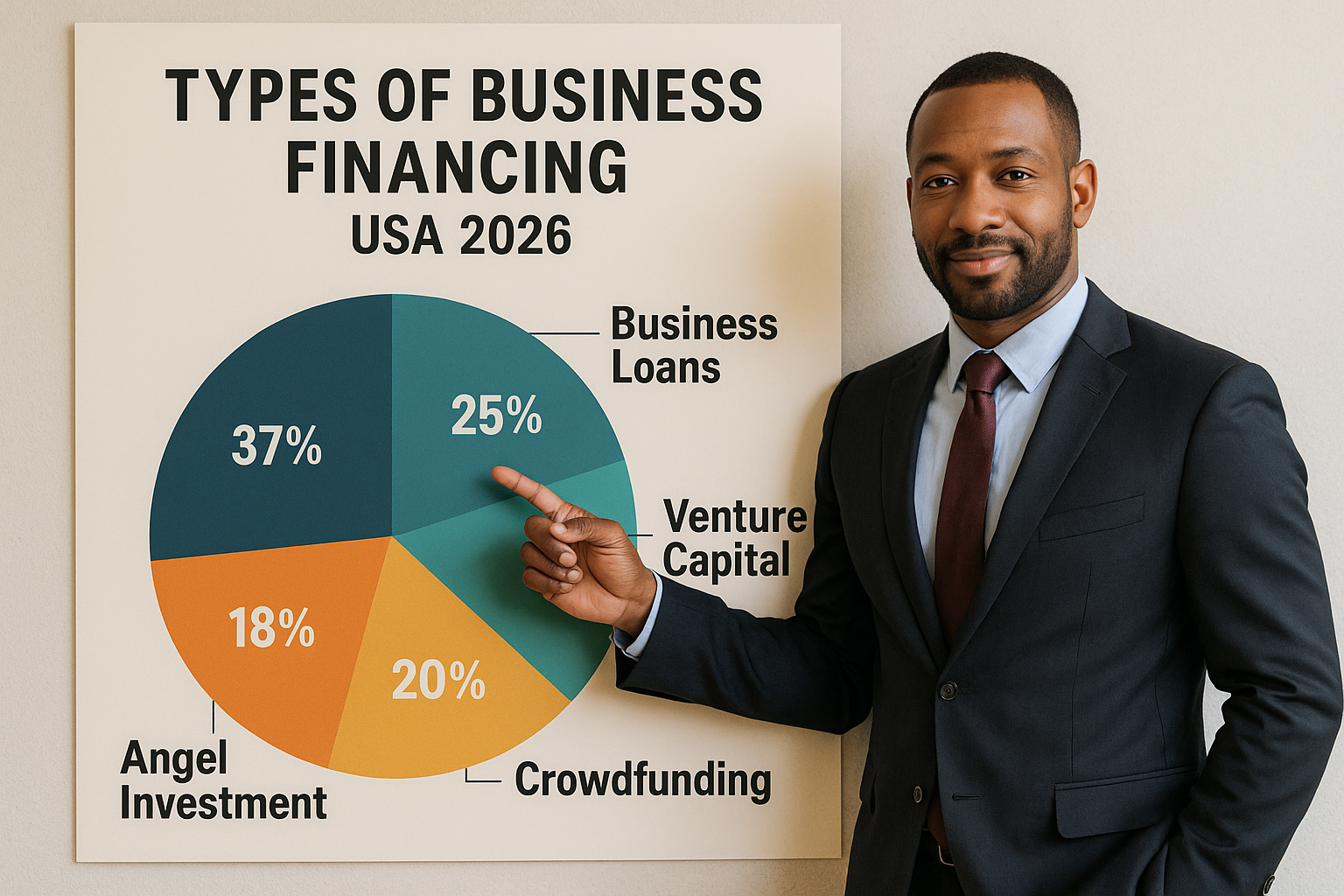

Types of Business Finance

There are mainly two types of business finance — each serving a different purpose:

1. Short-Term Finance

Used to meet immediate needs like payroll, bills, and working capital.

Examples:

- Bank overdrafts

- Short-term business loans

- Trade credit

2. Long-Term Finance

Used for larger investments and long-term projects.

Examples:

- Equity financing (selling company shares)

- Venture capital funding

- Long-term loans and bonds

The Role of Financial Management in US Businesses

Financial management means planning, organizing, and controlling financial activities. It ensures optimal use of funds and financial discipline.

Key Roles:

- Financial Planning: Creating short-term and long-term financial goals.

- Budgeting: Allocating funds effectively.

- Forecasting: Predicting future financial outcomes.

- Cost Control: Managing expenses efficiently.

- Investment Decisions: Selecting profitable opportunities.

Example:

A small coffee chain may use budgeting tools to control daily expenses and forecasting tools to plan for seasonal sales peaks.

Practical Examples of Finance in Real US Businesses

Example 1: Apple Inc. – Financial Strategy Drives Innovation

Apple invests billions in R&D, but also maintains massive cash reserves. This financial discipline allows it to fund innovation while staying stable.

Example 2: Small Businesses During Economic Downturns

During the COVID-19 pandemic, many small businesses in the USA survived due to sound financial management — using emergency loans, managing expenses, and adjusting budgets.

Example 3: Tesla – Balancing Risk and Growth

Tesla’s aggressive growth and expansion were possible because of strategic capital raising and financial forecasting.

Pros and Cons of Business Finance

| Pros | Cons |

|---|---|

| Enables growth and innovation | Can lead to debt if mismanaged |

| Improves decision-making | Complex to manage without expertise |

| Builds investor trust | Involves compliance costs |

| Helps in risk mitigation | Requires consistent monitoring |

Financial Planning Tips for US Businesses (2026 Edition)

- Use digital accounting tools like QuickBooks or Xero for better visibility.

- Set realistic budgets and adjust quarterly.

- Diversify revenue sources — avoid relying on one product or client.

- Plan taxes ahead to avoid last-minute stress.

- Keep an emergency fund for at least 6 months of expenses.

- Review financial reports monthly to catch early warning signs.

Financial Data Snapshot (2026 Overview – USA

| Category | Statistic |

|---|---|

| Small businesses contributing to GDP | 43% |

| Businesses with cash flow issues | 61% |

| Companies using financial software | 78% |

| Average small business loan approval rate | 48% |

| Venture capital invested in US startups (2025) | $180 billion |

These figures highlight how critical financial planning and access to capital are for American businesses.

The Government’s Role in US Business Finance

The US government supports businesses through various financial aid programs and loan initiatives, such as:

- SBA (Small Business Administration) loans

- Economic Injury Disaster Loans (EIDL)

- Grants for innovation and green businesses

Proper finance knowledge helps businesses take advantage of these opportunities effectively.

Common Financial Mistakes Businesses Make

- Ignoring cash flow forecasting

- Mixing personal and business finances

- Over-relying on credit without repayment planning

- Not having an emergency reserve

- Skipping regular financial audits

Tip: Avoid these pitfalls by hiring a qualified accountant or financial advisor.

FAQs: Importance of Finance in Business USA

1. Why is finance important in business?

Finance ensures businesses have the money and strategy needed for growth, operations, and sustainability.

2. How does finance help small businesses?

It helps manage cash flow, fund expansion, and navigate challenges like inflation or market dips.

3. What are the main sources of business finance in the USA?

Bank loans, venture capital, crowdfunding, angel investors, and retained earnings.

4. Is financial planning necessary for startups?

Yes, especially in the USA, where competition is high and investor transparency is essential.

5. How can I improve my business’s financial health?

Track expenses, reduce unnecessary costs, plan budgets, and use modern financial management tools.

Conclusion: Finance — The Backbone of Every American Business

The importance of finance in business USA cannot be overstated. Finance provides structure, vision, and the means to grow. Whether it’s a small bakery in Chicago or a large manufacturing firm in Detroit, every company relies on smart financial management to thrive.

Finance isn’t just about numbers — it’s about making strategic choices that shape your company’s future.

If you manage your finances well, you’re not just surviving — you’re setting up your business for sustainable success.

Call to Action

If you’re a US entrepreneur or business owner, take charge of your financial future today.

Start by reviewing your current finances, setting clear goals, and working with a trusted financial advisor.

Remember:

Strong finance equals strong business.