Debt Relief Options in USA 2026

Introduction

In 2026, millions of Americans are facing financial stress due to credit card debt, medical bills, student loans, and personal loans. According to the Federal Reserve, total household debt in the USA has crossed $17 trillion, with credit card debt hitting record highs.

When debt feels overwhelming, the good news is that you’re not alone — and there are solutions. This is where debt relief options in USA come into play.

In this guide — Debt Relief Options in USA 2026 — we’ll break down every major method of debt relief, from debt consolidation to settlement, management, forgiveness, and even bankruptcy. We’ll use real examples, pros & cons, expert tips, FAQs, and simple explanations so you can decide which option works best for you.

What is Debt Relief?

Debt relief refers to strategies, programs, or legal processes that help reduce, restructure, or eliminate debt. The goal is to make debt more manageable — either by lowering interest rates, negotiating balances, or creating a clear repayment plan.

💡 Example: Susan, a nurse from Texas, owed $18,000 in credit cards with 24% interest. Through debt relief, she joined a debt management program that cut her interest to 8%, reducing her monthly payments by $250 and helping her become debt-free in 4 years.

Major Debt Relief Options in USA

1. Debt Consolidation

Debt consolidation combines multiple debts into a single loan or credit line, ideally with a lower interest rate.

- How it works: You take a personal loan, credit card balance transfer, or home equity loan to pay off all existing debts. Then, you make one monthly payment instead of many.

- Best for: People with decent credit who want simpler payments.

Pros:

- Lower interest rates (if you qualify)

- Simplifies finances with one payment

- Helps improve credit if managed well

Cons:

- Requires good to excellent credit

- If mismanaged, debt grows again

💡 Example: James had 5 credit cards totaling $12,000 at 23% interest. He consolidated into a personal loan at 9% APR, saving over $5,000 in interest.

2. Debt Management Plans (DMPs)

Offered by nonprofit credit counseling agencies, debt management plans reduce your interest rates and fees but require full repayment of the principal.

- How it works: You make one payment to the agency each month. They distribute funds to your creditors at reduced interest rates.

- Best for: People with steady income who can repay their debts over 3–5 years.

Pros:

- Lower interest rates (often cut by 50%+)

- Structured path to debt freedom

- Less damage to credit score compared to settlement

Cons:

- Must repay full balance

- Monthly fees ($25–$50)

💡 Example: Maria owed $15,000 in credit cards. Her DMP lowered her rates from 25% to 7%, saving thousands in interest and helping her pay off the debt in 4 years.

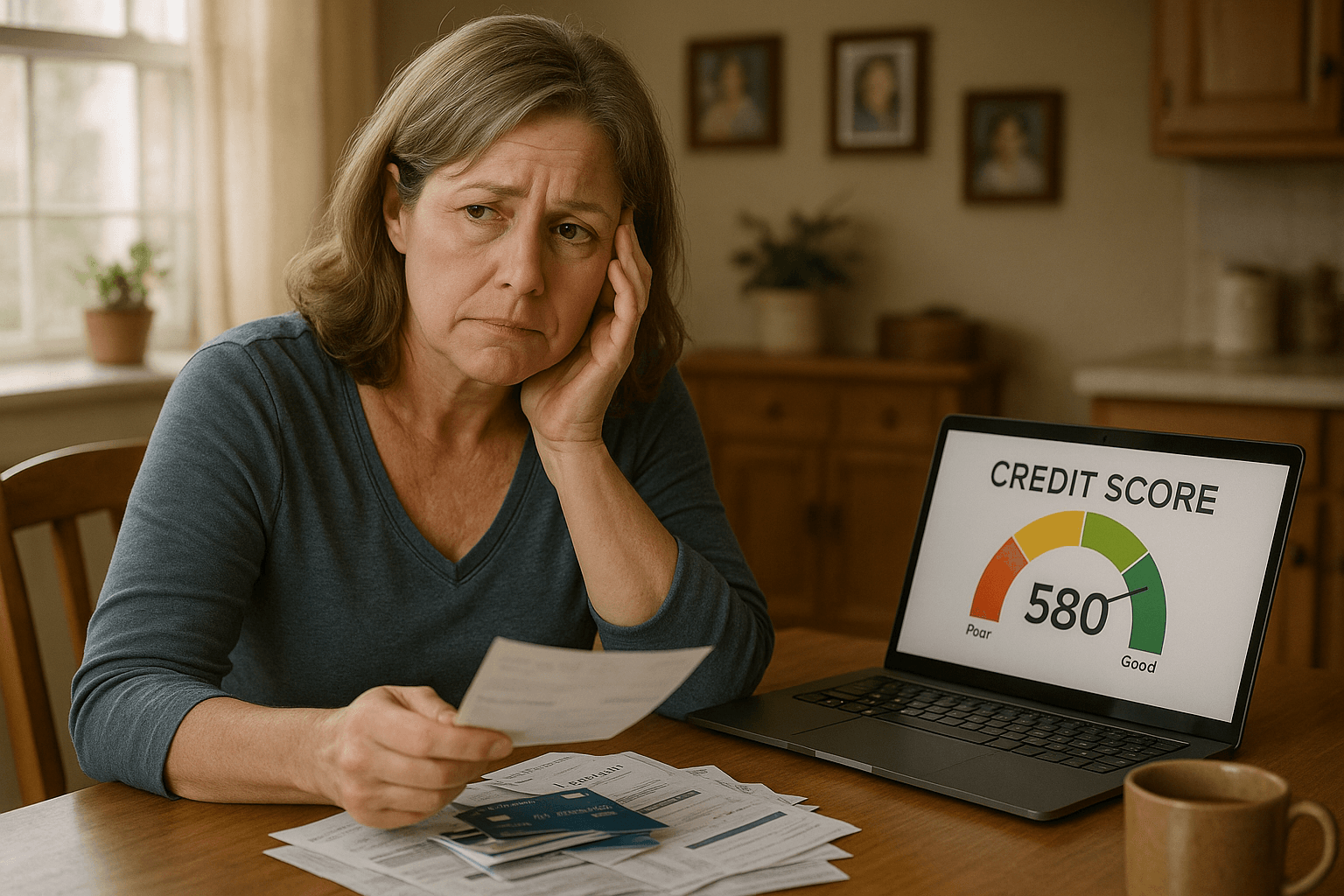

3. Debt Settlement

Debt settlement means negotiating with creditors to pay less than what you owe.

- How it works: You stop paying creditors directly and save money in a special account. Once enough builds up, the debt settlement company negotiates lump-sum payoffs.

- Best for: People struggling with high unsecured debt and considering bankruptcy.

Pros:

- Can significantly reduce total debt (30–60% off)

- Faster than paying in full

Cons:

- Credit score takes a major hit

- Forgiven debt is taxable

- Not guaranteed — creditors can refuse

💡 Example: Alex had $20,000 in debt. His creditors settled for $12,000, saving $8,000. However, his credit score dropped from 680 to 540.

4. Debt Forgiveness Programs

Some debts — like student loans or medical bills — may qualify for forgiveness programs.

- Federal student loan forgiveness: Certain borrowers (teachers, nurses, public service workers) can have part or all of their loans canceled.

- Medical debt forgiveness: Nonprofits and some hospitals forgive bills for low-income patients.

Pros:

- Debt wiped out without repayment

- Available for specific hardship cases

Cons:

- Strict eligibility requirements

- Not available for all types of debt

5. Bankruptcy

Bankruptcy is a legal process that eliminates or restructures debt under federal court supervision.

- Chapter 7 bankruptcy: Liquidates assets to erase most unsecured debt (credit cards, medical bills).

- Chapter 13 bankruptcy: Creates a 3–5 year repayment plan while protecting assets like your home.

Pros:

- Can erase most unsecured debt

- Fresh financial start

Cons:

- Stays on credit report for 7–10 years

- Some debts (student loans, taxes) not dischargeable

- Emotional and legal stress

💡 Example: Robert filed Chapter 7 and wiped out $40,000 in unsecured debt but lost his second car in the process.

Comparing Debt Relief Options in USA

| Option | Reduces Debt Owed | Credit Impact | Duration | Cost | Best For |

|---|---|---|---|---|---|

| Debt Consolidation | No (just lowers interest) | Minimal | 2–7 years | Interest + fees | People with good credit |

| Debt Management | No (repay in full) | Small dip, improves later | 3–5 years | Low fees | Steady income earners |

| Debt Settlement | Yes (pay less) | Major negative | 2–4 years | Fees + taxes | Struggling with high unsecured debt |

| Forgiveness | Yes (if eligible) | Varies | Varies | None | Students, medical hardship |

| Bankruptcy | Yes (wipes out most debt) | Severe negative | 3–5 years (Chapter 13) | Court fees | Extreme hardship |

Pros and Cons of Debt Relief in USA

Pros

- Provides hope and a path forward

- Can lower payments and interest

- May reduce or erase debt entirely

- Helps avoid endless late fees and collection calls

Cons

- Some options damage credit scores

- Risk of scams (especially in debt settlement)

- May involve fees or taxes

- Requires discipline and long-term planning

Choosing the Right Debt Relief Option

Ask yourself these questions:

- Do I have steady income? → Consider debt management.

- Is my credit still good? → Try debt consolidation.

- Am I already behind on payments? → Look into debt settlement.

- Am I facing extreme hardship? → Explore forgiveness or bankruptcy.

Expert Tips for USA Readers

- Check with Accredited Agencies – Always use certified nonprofit credit counseling agencies (look for NFCC accreditation).

- Beware of Scams – Avoid settlement companies that promise “guaranteed” results.

- Negotiate Directly – Sometimes calling your creditors yourself can result in lower rates.

- Budget First – No debt relief option works unless you adjust spending habits.

- Think Long-Term – Focus on rebuilding credit after debt relief.

FAQs — Debt Relief USA

1. Does debt relief ruin my credit?

👉 Some options (like settlement or bankruptcy) lower your score, while others (like consolidation or management) can improve it long-term.

2. Is debt settlement better than bankruptcy?

👉 Settlement hurts your credit but avoids court. Bankruptcy gives a fresh start but stays on your credit for 7–10 years.

3. Are debt relief programs legit in USA?

👉 Yes, but scams exist. Stick with accredited nonprofits and reputable lenders.

4. Can I negotiate debt myself?

👉 Yes. Many creditors prefer direct negotiation if you explain your hardship.

5. How long does debt relief take?

👉 Anywhere from 2 to 7 years, depending on the method.

Conclusion

Debt doesn’t have to control your life. With the right debt relief option in USA, you can reduce stress, regain financial stability, and plan for a brighter future.

To recap:

- Debt Consolidation: Good credit, lower rates.

- Debt Management: Full repayment, lower interest.

- Debt Settlement: Pay less, credit damage.

- Forgiveness: Great if you qualify.

- Bankruptcy: Last resort for extreme hardship.

👉 The best solution depends on your unique situation. Take time to explore your options, speak with certified credit counselors, and choose the path that helps you move forward with confidence.