Credit Counseling and Debt Management in USA 2026 — Your Complete Guide

Introduction: Dear Friend, Let’s Talk About Debt Honestly

If you’re reading this, chances are debt has been weighing on your mind. Maybe it’s credit card bills piling up, maybe it’s medical expenses, or maybe just life happening faster than your paycheck can keep up. First, let me say this: you are not alone. Millions of people across the United States deal with debt every single day.

The good news? There’s hope. And that’s where credit counseling and debt management in USA come into play. These tools can help you regain control, reduce stress, and build a clear path forward.

In this guide, I’m going to walk you through everything you need to know — from what credit counseling really is, to how a debt management plan (DMP) works, to practical tips for managing debt effectively. Think of it like a conversation with a friend who has done the homework for you.

Let’s dive in.

What is Credit Counseling?

At its core, credit counseling is professional guidance to help you understand your financial situation, explore debt relief options, and make a plan for repayment.

How It Works in the USA

In the United States, credit counseling services are typically provided by nonprofit organizations. These agencies have trained financial counselors who:

- Review your income, expenses, and debts.

- Provide budgeting advice.

- Explain your debt repayment options (including whether a debt management plan USA makes sense).

- Sometimes offer educational resources and workshops.

Think of it as financial coaching. You sit down with someone who isn’t there to judge, but to guide.

A Typical Credit Counseling Session

Imagine you call a credit counseling agency. The first session usually lasts 30–60 minutes. They’ll ask questions like:

- How much do you owe and to whom?

- What’s your monthly income?

- Where is your money going every month?

From there, they’ll help you see the “big picture” and suggest realistic steps.

👉 Example: Let’s say you have $15,000 in credit card debt across three cards. Each card charges 22–26% interest. A counselor might suggest a debt management plan where your interest rates could be reduced to 8–10%, making your monthly payment more affordable.

Debt Management in USA Explained

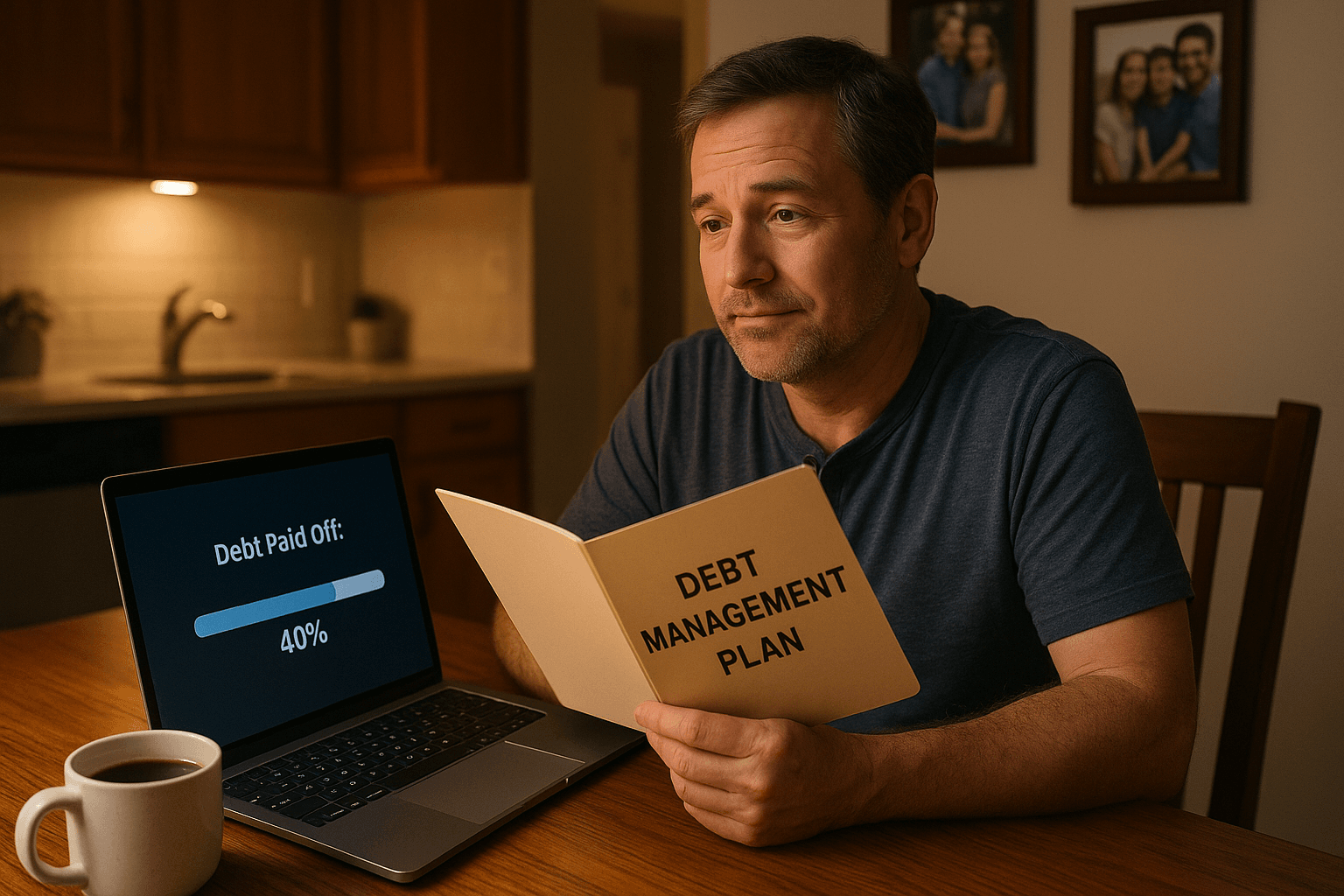

So, what exactly is a debt management plan (DMP)?

A DMP is a structured repayment program arranged through a credit counseling agency. Instead of paying multiple creditors separately, you make one monthly payment to the agency, and they distribute it to your creditors.

Key Features of a DMP:

- Single payment: You write one check or authorize one debit each month.

- Reduced interest rates: Creditors may agree to lower your rates.

- Waived fees: Late fees or penalties may be reduced.

- Timeline: Most DMPs take 3–5 years to complete.

How It Differs from Debt Settlement

Many people confuse debt management with debt settlement. But they’re very different:

- Debt management → You repay your debt in full, but with better terms (lower interest, structured plan).

- Debt settlement → You negotiate to pay less than what you owe, often with a big negative impact on your credit score.

👉 Real-Life Example:

John, a teacher from Ohio, had $20,000 in credit card debt. By enrolling in a DMP, his interest rates dropped from 24% to 9%. His monthly payment went from $650 to $380. Over four years, he became debt-free — without filing bankruptcy.

Benefits of Credit Counseling and Debt Management

Like anything in life, there are pros and cons. Let’s break them down.

Pros

- Lower interest rates: Saves you money over time.

- Simplified payments: One monthly bill instead of many.

- Faster payoff: Because less money goes toward interest, more goes toward principal.

- Credit education: Learn how to budget and manage money effectively.

- Peace of mind: No more juggling multiple creditors.

Cons

- Discipline required: You must stick to the plan every month.

- Limited credit card use: Most creditors will close or suspend your accounts while on a DMP.

- Possible fees: Some agencies charge small monthly fees.

- Credit score impact: Initially, your score may dip, though it often improves long term.

Steps to Start with Credit Counseling in USA

If you’re ready to explore this option, here’s a simple roadmap:

- Research Agencies

- Look for reputable nonprofit agencies.

- Check for certification from the National Foundation for Credit Counseling (NFCC).

- Schedule a Consultation

- Most agencies offer a free initial session.

- Gather your financial information ahead of time.

- Review Recommendations

- Your counselor will explain your options.

- If a DMP is suggested, ask about fees and how creditors typically respond.

- Enroll in a Plan

- Sign paperwork and agree to terms.

- Your counselor will contact creditors.

- Stay Committed

- Make payments consistently.

- Avoid taking on new debt while enrolled.

Debt Management Plan USA — How It Works

Let’s look closer at the mechanics of a DMP.

- Assessment: Counselor reviews your finances.

- Proposal: Agency negotiates with creditors.

- Approval: Creditors accept reduced interest or fees.

- Payments: You make one monthly payment to the agency.

- Distribution: Agency pays your creditors.

- Completion: After 3–5 years, your debt is fully repaid.

👉 Example:

Sarah had five credit cards totaling $25,000. Her monthly minimums added up to $800, which she couldn’t manage. On a DMP, her payment was reduced to $450. It took 55 months, but she became debt-free without filing bankruptcy.

Comparing Options — Is Credit Counseling Right for You?

Not everyone needs credit counseling. Let’s compare:

- DIY Budgeting: Best for small debts you can tackle on your own.

- Debt Consolidation Loan: Combines debts into one loan with fixed payments. Works if you qualify for good rates.

- Debt Settlement: Can reduce balance owed but damages credit.

- Bankruptcy: A last resort for unmanageable debt.

👉 Quick Tip: If you’re overwhelmed, missing payments, or only paying minimums, credit counseling is worth exploring.

Practical Tips for Managing Debt Effectively

Even with a counselor’s help, habits matter. Here are some practical steps:

- Build a Budget: Track every dollar in and out.

- Prioritize Needs vs Wants: Focus on essentials.

- Emergency Fund: Start small ($500–$1000).

- Cut Extra Costs: Cancel unused subscriptions, dine out less.

- Increase Income: Consider part-time work, freelancing, or selling unused items.

- Stay Motivated: Celebrate small wins as debts shrink.

FAQs about Credit Counseling and Debt Management in USA

Q1: Will credit counseling hurt my credit score?

👉 Initially, your score may dip if accounts are closed. But long term, many people see improvement.

Q2: How long does a debt management plan last?

👉 Typically 3–5 years.

Q3: Are credit counseling services USA free?

👉 Initial counseling is often free. DMPs may have small monthly fees ($25–$50).

Q4: Can I still use credit cards on a DMP?

👉 Usually no. Most accounts are closed or suspended to prevent new debt.

Q5: What happens if I miss a payment?

👉 Your plan could be canceled. Always communicate with your counselor if issues arise.

Real-Life Example: Meet Sarah

Sarah, a single mom in Texas, was juggling $18,000 in credit card debt while raising two kids. Every month, she felt crushed by bills.

She reached out to a credit counseling service USA. Together, they created a debt management plan. Her interest rates dropped, and her monthly payments became manageable. More importantly, she learned how to budget and save.

Three and a half years later, Sarah made her final payment. Today, she’s debt-free, building an emergency fund, and teaching her kids about money.

Her story is proof that with the right guidance, financial freedom is possible.

Final Thoughts — Taking Control of Your Financial Future

Dear Friend, if debt has been stressing you out, remember this: you don’t have to go through it alone. Credit counseling and debt management USA services exist to guide you toward stability, peace of mind, and a brighter future.

By exploring your options, taking small but steady steps, and committing to a plan, you can absolutely take control of your finances.

👉 If you’re ready, consider reaching out to a certified credit counseling agency in the USA. It might just be the first step toward the fresh start you deserve.