Taxes

-

How to File Taxes Online in USA 2026 | Easy Step-by-Step Tax Filing Guide

Introduction: The Digital Way to File Taxes in the USA Tax season in the United States can feel overwhelming — deadlines, forms, deductions, and the fear of making mistakes. But the good news? Filing your taxes online has never been easier. With digital tools, secure IRS e-filing systems, and user-friendly tax software, How to File Taxes Online in USA 2026 has become the most convenient way for individuals and small businesses to stay compliant — and even get refunds faster. In this comprehensive guide, you’ll learn: Whether you’re a freelancer, employee, small business owner, or retiree, this 2026 guide will walk you through every detail in simple, easy-to-follow language. What…

-

Free Tax Filing Options in USA — A Complete Guide to File Taxes for Free

When tax season rolls around, the last thing anyone wants is to pay even more money just to file taxes. The good news? You don’t have to. In the United States, there are several free tax filing options that can help you file your taxes online safely, quickly, and at no cost — whether you’re a student, a freelancer, or a full-time employee. In this complete guide, we’ll explore the best free tax filing options in USA, explain how the IRS Free File program works, compare top free software, and share tips to help you file your taxes without spending a dime. What Does “Free Tax Filing” Mean? “Free tax…

-

Sales Tax by State in USA 2026 — Complete Guide to Sales Tax USA

Introduction: Why Sales Tax Matters in the USA Sales Tax by State in USA 2026, If you’ve ever walked into a store in the U.S. and noticed that the price on the tag isn’t the final amount you pay at the register, you’ve already encountered sales tax. Unlike some countries where taxes are included in the price tag, the United States adds sales tax at checkout. Here’s the catch: sales tax isn’t the same across the country. Each state sets its own rules, some even letting cities and counties add more on top. That’s why buying the same $100 item in one state can cost $106 while in another it…

-

Withholding Tax USA Explained 2026 | How Withholding Tax Works in the USA

Introduction If you’ve ever opened your paycheck and thought, “Why is my take-home pay less than what I earned?”, you’ve already met withholding Tax USA Explained 2026. For millions of Americans, withholding tax feels like a mystery. But here’s the truth: it’s not a punishment, and it’s not your employer pocketing extra money. It’s simply a pay-as-you-earn system where taxes are deducted throughout the year. In fact, the IRS reports that in 2023, the average refund was $2,812, and about 75% of taxpayers received a refund — proof that most people actually overpay taxes through withholding. In this guide, I’ll walk you through Withholding Tax USA Explained 2026 step by…

-

Alternative Minimum Tax Explained USA | AMT Tax Brackets & Rules 2026

Introduction Taxes in the United States are already complicated, and the Alternative Minimum Tax Explained USA, doesn’t make things easier. If you’ve ever wondered why your accountant mentions AMT even when you’ve already calculated regular taxes, you’re not alone. The AMT was originally designed in 1969 to prevent very wealthy Americans from using excessive deductions and loopholes to avoid paying taxes. But over the years, millions of middle- and upper-middle-class taxpayers also got pulled in — until Congress passed reforms in 2017. Today, fewer people pay AMT than in the past, but it’s still important to understand AMT tax USA rules, especially if you earn a higher income, have large…

-

Gift Tax Rules USA Explained | 2026 IRS Exemptions & Exclusions

Introduction Gifting money or property to loved ones should feel like a joyful moment — not a tax headache. Yet many Americans wonder: “If I give my child $50,000 for a house down payment, will the IRS tax it?” That’s where Gift Tax Rules USA Explained come in. The IRS has clear guidelines about when gifts are taxable, when they’re exempt, and who is responsible for paying. Here’s the surprising truth: Most people will never actually pay gift tax. Thanks to generous annual exclusions and a multi-million-dollar lifetime exemption, only a small fraction of wealthy families ever write a check to the IRS for gift taxes. In this guide, we’ll…

-

Estate Tax Laws USA Explained ||Exemptions, Rates & Planning 2026

Introduction Estate Tax Laws USA Explained, You’ve probably heard the phrase: “Nothing is certain except death and taxes.” The estate tax combines both. Often called the “death tax,” it applies when a person passes away and their estate (everything they owned — homes, bank accounts, stocks, etc.) is transferred to heirs. But here’s the truth: most Americans will never pay estate tax. Why? Because the exemption level is so high. In 2025, only estates worth over $12.92 million per person are subject to federal estate tax. In this article, we’ll break down: By the end, you’ll have a clear, easy-to-understand picture of how estate tax works in the USA and…

-

Property Taxes in USA — What Are Property Taxes in USA?

Introduction: If you own a house, land, or any piece of real estate in the United States, you’re paying more than just a mortgage. Alongside utilities, insurance, and upkeep, there’s another big cost that comes around every year: property taxes in USA.But what exactly are property taxes in USA? Why do we pay them? How are they calculated, and what do they fund? For many homeowners, property taxes can feel confusing — and sometimes even overwhelming. Yet they are one of the most important parts of how local communities function. Think of property taxes as your neighborhood’s membership fee. Unlike income tax, which is based on how much you earn,…

-

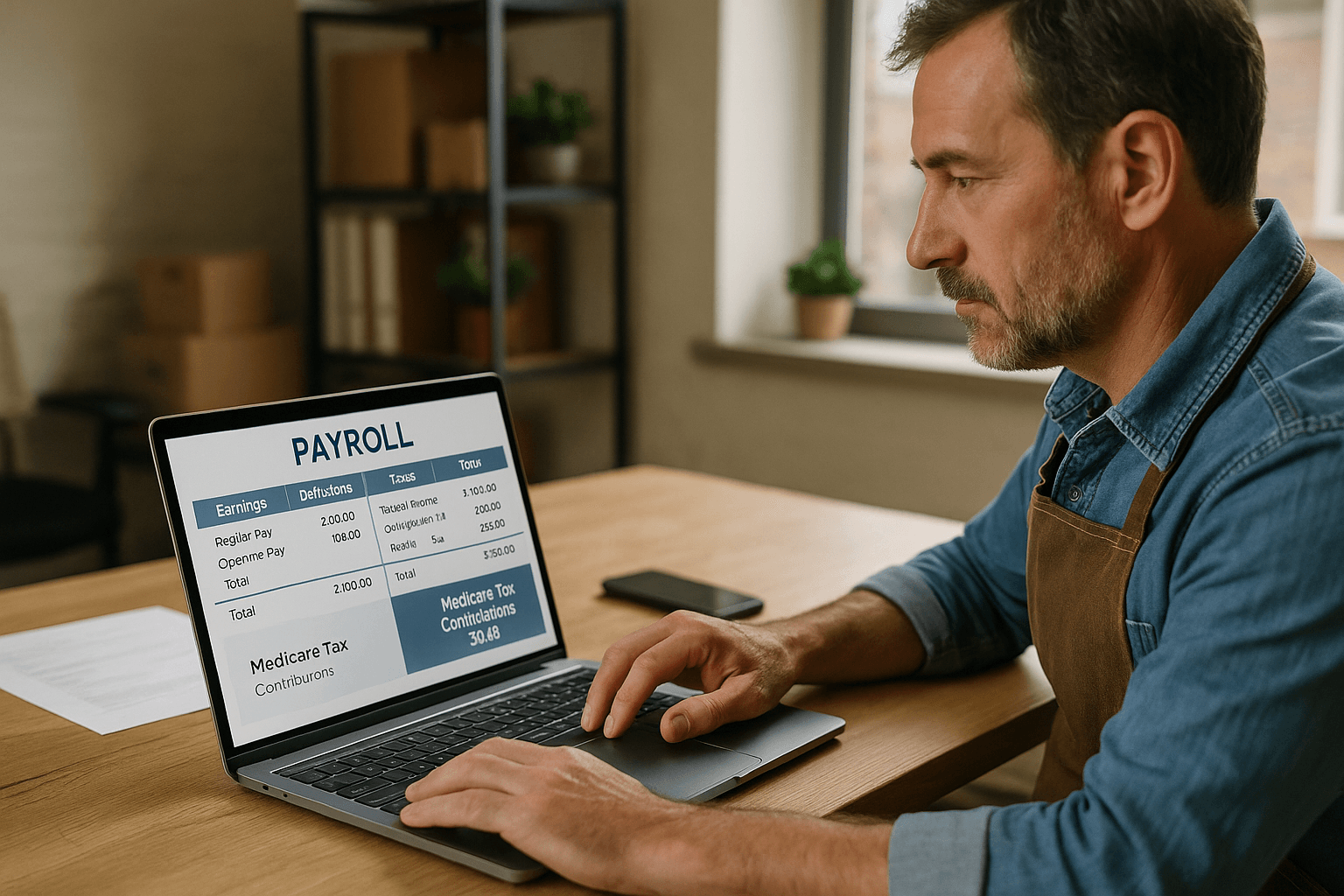

Medicare Tax Explained in USA 2026: What You Need to Know

Introduction Medicare Tax Explained in USA 2026,If you’ve ever checked your paycheck in the USA, you’ve probably noticed a line that says “Medicare Tax.” Many people know it’s something related to healthcare, but few understand exactly what it is or why it’s deducted from their pay. Here’s the short answer: Medicare tax is a payroll tax that funds healthcare for Americans aged 65 and older, as well as certain disabled individuals. In this article, I’ll walk you through Medicare Tax Explained in USA 2026 in plain English. You’ll learn: By the end, you’ll feel confident reading your pay stub and knowing exactly where your money is going. What is Medicare…

-

Social Security Tax Explained USA | Rates, Examples & Wage Base 2026

Introduction If you’ve ever looked closely at your paycheck, you’ve probably noticed a line that says “Social Security tax.” Many Americans see that deduction every pay period, but not everyone understands where it goes or how it works. Here’s the good news: that money isn’t disappearing into thin air. It’s helping fund one of the most important safety-net programs in the United States — Social Security. In this article, we’ll break down Social Security tax explained USA in simple terms. You’ll learn: By the end, you’ll have a crystal-clear understanding of Social Security tax in the USA — and maybe even a new appreciation for what it provides. What is…