Business Finance Management USA: A Complete Guide for Entrepreneurs and Small Businesses

Introduction

Running a business in the United States is both exciting and challenging. Whether you’re a new entrepreneur launching a startup or an experienced business owner managing a growing company, one thing remains constant: Business finance management USA.

Think of business finance as the “heartbeat” of your company. Without proper financial management, even the best products or services can fail. The way you handle money—budgeting, forecasting, managing cash flow, and planning for growth—can make or break your success.

In this article, we’ll break down business finance management USA in simple terms, with practical examples, tips, and strategies you can use right away. By the end, you’ll have a clear roadmap to strengthen your company’s financial health.

What Is Business Finance Management?

At its core, business finance management is about planning, organizing, controlling, and monitoring financial resources to achieve your business goals.

In the USA, where competition is high and the cost of doing business can be significant, strong financial management helps businesses:

- Stay profitable

- Improve cash flow

- Reduce risks

- Plan for long-term sustainability

Key Elements of Business Finance Management

- Budgeting – Setting up income and expense plans.

- Cash Flow Management – Ensuring money is available for day-to-day operations.

- Financial Forecasting – Predicting future financial outcomes.

- Debt & Credit Management – Handling loans, credit lines, and repayments wisely.

- Tax & Compliance – Staying aligned with U.S. tax laws and regulations.

Why Business Finance Management Matters in the USA

The U.S. is home to over 33 million small businesses (according to SBA.gov). But studies show that nearly 20% fail in their first year, and 50% fail within five years. The most common reason? Poor financial management.

Benefits of Proper Financial Management

✅ Better decision-making

✅ Reduced debt risk

✅ Stronger investor confidence

✅ Easier access to funding

✅ Increased profitability

Common Challenges Businesses Face in the USA

Before diving into solutions, let’s explore the financial challenges many U.S. business owners encounter:

- High Startup Costs – Rent, licensing, payroll, marketing, and technology.

- Tax Complexity – Federal, state, and local taxes vary by industry and location.

- Cash Flow Gaps – Late payments from clients can hurt operations.

- Credit Dependency – Relying too much on loans or credit cards.

- Economic Uncertainty – Inflation, interest rates, and global markets affect small businesses.

Practical Tips for Business Finance Management in the USA

Here are real-world strategies to manage your business finances effectively:

1. Build a Strong Budget

- List all income sources (sales, services, investments).

- Track fixed expenses (rent, salaries) and variable expenses (marketing, supplies).

- Adjust monthly based on performance.

👉 Example: A café owner in New York sets a budget that allocates 30% of revenue to food supplies, 25% to salaries, 20% to rent, and the rest to marketing and emergency funds.

2. Master Cash Flow Management

- Invoice clients promptly.

- Offer early payment discounts.

- Use accounting software like QuickBooks or FreshBooks.

👉 Example: A digital marketing agency avoids cash shortages by setting payment terms at Net-15 instead of Net-30.

3. Separate Personal and Business Finances

Open a dedicated business bank account and credit card. This not only simplifies bookkeeping but also helps during tax season.

4. Monitor Key Financial Metrics

Track:

- Gross profit margin

- Operating cash flow

- Accounts receivable turnover

- Debt-to-equity ratio

5. Use Technology & Accounting Software

Cloud-based tools make it easier to automate expenses, track invoices, and generate reports.

6. Plan for Taxes Early

Work with a certified accountant to understand U.S. tax obligations:

- Federal income tax

- State and local taxes

- Payroll taxes

- Sales tax

7. Build an Emergency Fund

Set aside at least 3–6 months of operating expenses in case of downturns.

Financial Planning for Entrepreneurs in the USA

If you’re just starting your business, here are tailored steps:

- Start Lean – Don’t overspend on unnecessary office space or luxury tools.

- Secure Funding Wisely – Explore SBA loans, angel investors, or crowdfunding.

- Know Your Break-Even Point – The moment your revenue covers all expenses.

- Invest in Professional Advice – A CPA (Certified Public Accountant) can save you money in the long run.

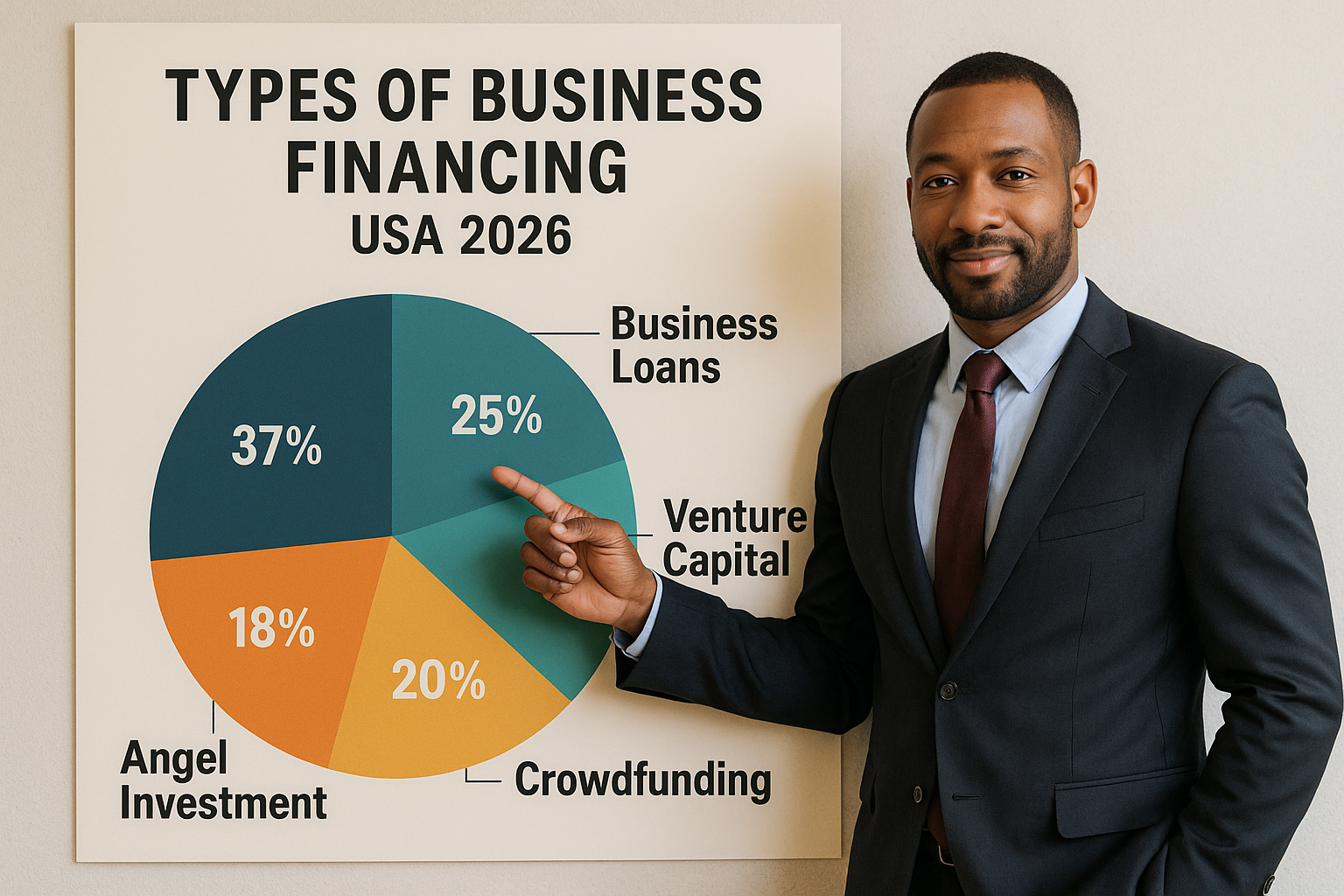

Pros and Cons of Different Financing Options

| Financing Option | Pros | Cons |

|---|---|---|

| Bank Loans | Lower interest rates, structured repayment | Harder approval, requires collateral |

| Credit Cards | Quick access, flexible | High interest, risky for long-term use |

| Angel Investors | Guidance + capital | Loss of some ownership |

| Crowdfunding | No repayment, builds community | Time-consuming, not guaranteed |

Managing Business Cash Flow in the USA

Cash flow is the lifeline of your business.

Tips to Improve Cash Flow:

- Require deposits for large projects.

- Negotiate better payment terms with suppliers.

- Lease instead of buying expensive equipment.

- Use cash flow forecasting tools.

Business Accounting Strategies

Accounting is more than just bookkeeping. Smart strategies help you stay compliant and maximize profits.

Smart Accounting Practices

- Use accrual accounting instead of cash accounting for a clearer financial picture.

- Reconcile bank accounts monthly.

- Track expenses by category (marketing, payroll, utilities).

- Schedule quarterly financial reviews.

FAQs on Business Finance Management USA

Q1: What’s the biggest financial mistake small businesses make?

👉 Mixing personal and business finances, leading to tax and cash flow issues.

Q2: Do I need a CPA for my small business?

👉 Not always, but hiring one can save you from costly tax mistakes.

Q3: How much should I save for emergencies?

👉 Aim for at least 3–6 months of operating costs.

Q4: What’s the best software for business finance management in the USA?

👉 QuickBooks, Xero, and FreshBooks are popular among small businesses.

Q5: How do U.S. businesses usually fund growth?

👉 Through bank loans, SBA programs, investors, or reinvested profits.

Conclusion

Managing business finances in the USA doesn’t have to feel overwhelming. With the right strategies—budgeting, cash flow management, smart accounting, and tax planning—you can create a financially healthy business that thrives even in uncertain times.

Remember, financial management is not a one-time task. It’s an ongoing process that requires attention, adaptability, and discipline.

👉 Whether you’re running a small startup or managing a growing company, take small steps every day to strengthen your financial systems. Over time, those efforts will build the foundation for long-term success.