Alternative Minimum Tax Explained USA | AMT Tax Brackets & Rules 2026

Introduction

Taxes in the United States are already complicated, and the Alternative Minimum Tax Explained USA, doesn’t make things easier. If you’ve ever wondered why your accountant mentions AMT even when you’ve already calculated regular taxes, you’re not alone.

The AMT was originally designed in 1969 to prevent very wealthy Americans from using excessive deductions and loopholes to avoid paying taxes. But over the years, millions of middle- and upper-middle-class taxpayers also got pulled in — until Congress passed reforms in 2017.

Today, fewer people pay AMT than in the past, but it’s still important to understand AMT tax USA rules, especially if you earn a higher income, have large deductions, or exercise stock options.

In this article, we’ll cover:

- What AMT is and why it exists

- How AMT is calculated (step by step)

- 202 AMT exemptions and brackets

- Who typically pays AMT in the USA

- Real-life examples

- Pros and cons of the AMT

- Planning tips to reduce AMT exposure

- FAQs that clear up common misconceptions

What is the Alternative Minimum Tax (AMT)?

The Alternative Minimum Tax (AMT) is a parallel tax system. Instead of calculating taxes only under the regular tax rules, certain taxpayers must also calculate them under the AMT system.

👉 You then pay whichever is higher — your regular tax or AMT.

The purpose: to make sure high-income taxpayers can’t reduce their tax bill too much using deductions, credits, or special tax breaks.

How Does AMT Work? (Step-by-Step Explanation)

Step 1 — Start with Your Regular Taxable Income

Begin with your income as calculated under standard IRS rules.

Step 2 — Add Back “Preference Items”

The IRS requires you to add back certain deductions and income exclusions that aren’t allowed under AMT, such as:

- State and local tax (SALT) deductions

- Miscellaneous itemized deductions

- Certain accelerated depreciation

- Incentive stock options (ISOs)

Step 3 — Subtract AMT Exemption

The IRS allows an AMT exemption that reduces taxable income — but it phases out for higher earners.

Step 4 — Apply AMT Tax Rates

There are only two AMT rates:

- 26% on the first portion of AMT income

- 28% on amounts above that threshold

H3: Step 5 — Compare with Regular Tax

You pay whichever is higher: regular tax or AMT.

AMT Exemptions USA (2026 Limits)

The AMT exemption is the amount of income shielded from AMT before tax applies.

👉 For tax year 2026 (IRS projected amounts, subject to adjustment for inflation):

- $88,300 for single filers

- $126,500 for married filing jointly

- $63,250 for married filing separately

These exemptions phase out at higher income levels:

- Single: phaseout begins at $609,350

- Married filing jointly: phaseout begins at $1,218,700

AMT Tax Brackets USA (2026)

Unlike regular tax brackets, AMT uses only two rates:

| Filing Status | AMT Rate 1 | AMT Rate 2 | Threshold for 28% |

|---|---|---|---|

| All Filers | 26% | 28% | $232,600 (2026) |

Who Pays AMT in the USA?

Not everyone pays AMT. Typically, you’re more likely to owe AMT if you:

- Have high income (over $500k+)

- Claim large state and local tax deductions (SALT)

- Exercise incentive stock options (ISOs)

- Claim high miscellaneous itemized deductions

- Have significant interest deductions from private activity bonds

👉 Statistic: According to IRS data, about 200,000 taxpayers paid AMT in 2022, compared to millions before the 2017 Tax Cuts and Jobs Act (TCJA).

Real-Life Examples of AMT Tax USA

Example 1: High SALT Deductions

Sarah, a single filer in California, earns $300,000 and pays $25,000 in state taxes. Since SALT deductions aren’t allowed under AMT, she may trigger AMT liability.

Example 2: Stock Options

Michael exercises incentive stock options worth $150,000. The IRS requires him to include the “spread” (the difference between market value and strike price) under AMT rules, pushing him into AMT.

Example 3: Typical Middle-Income Household

John and Emily earn $150,000 combined and take standard deductions. They’re not subject to AMT — proof that most middle-class families aren’t affected anymore.

Pros and Cons of the AMT

Pros

- Ensures high-income taxpayers pay a fair share

- Reduces reliance on excessive deductions and loopholes

- Simple rate structure (26% and 28%)

Cons

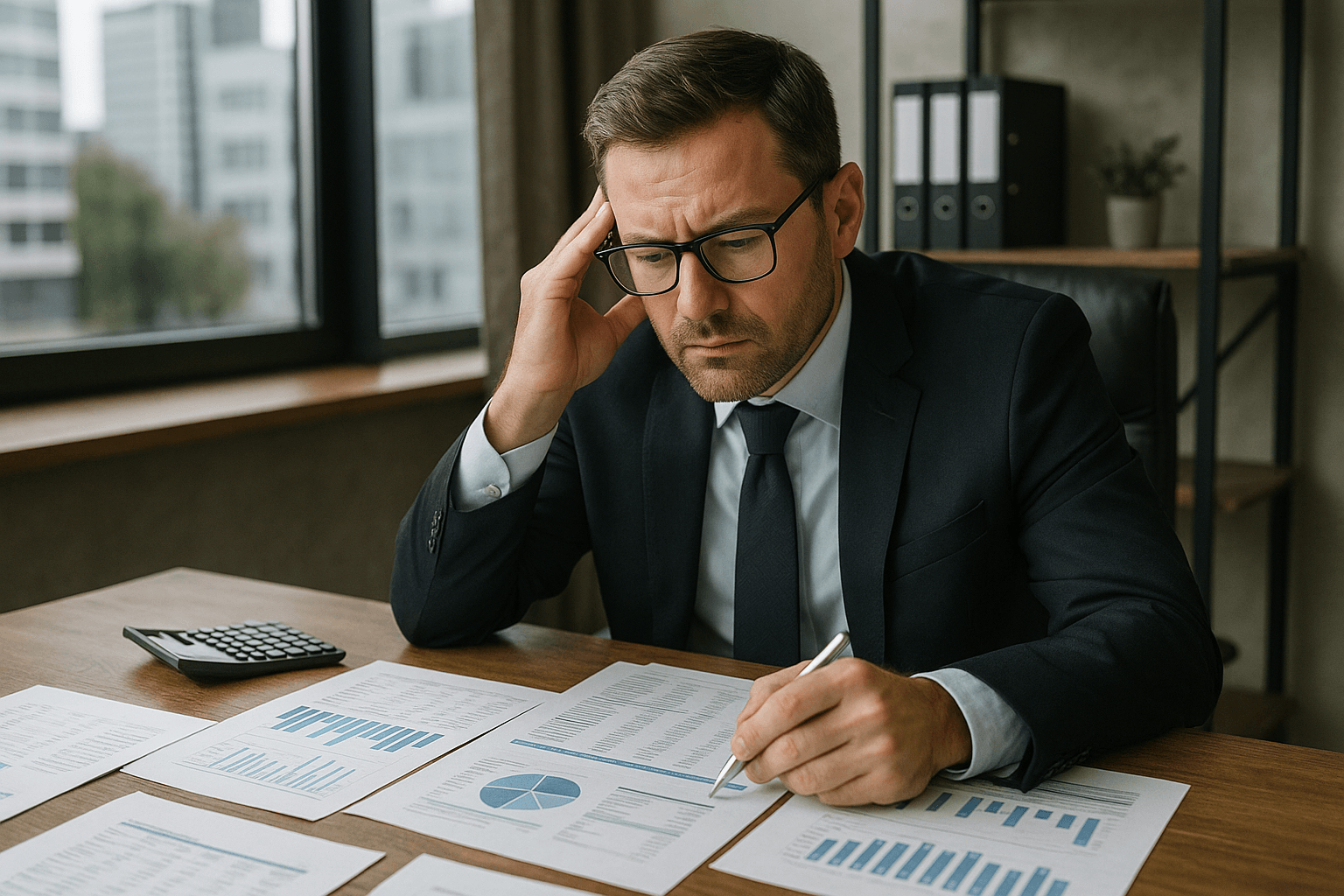

- Complex calculations for taxpayers and accountants

- Can unfairly impact residents in high-tax states

- Stock option holders may face surprise tax bills

- Creates uncertainty in financial planning

AMT Planning Tips USA

- Use tax software or a CPA: AMT calculations are tricky without professional help.

- Watch stock options: Exercise incentive stock options gradually to avoid a big AMT hit.

- Manage deductions: Be mindful of large state/local tax deductions.

- Charitable giving: Contributions remain deductible under AMT.

- Check annually: Even if you didn’t owe AMT last year, changes in income can trigger it.

FAQs — Alternative Minimum Tax Explained USA

Q1: Do all taxpayers need to calculate AMT?

👉 No. Only certain high-income individuals with specific deductions need to check AMT.

Q2: Can AMT be avoided completely?

👉 You can’t avoid it if triggered, but careful planning (e.g., spreading stock option exercises) helps reduce exposure.

Q3: Does AMT apply to corporations?

👉 Corporate AMT was repealed in 2017. A new 15% corporate minimum tax applies from 2023, but it’s different from individual AMT.

Q4: Can AMT create credits for future years?

👉 Yes. If you paid AMT due to incentive stock options, you may get a future Minimum Tax Credit (MTC).

Q5: How do I know if I owe AMT?

👉 IRS Form 6251 is used to calculate AMT. Most tax software does this automatically.

Conclusion

The Alternative Minimum Tax (AMT) in the USA is designed to make sure high-income taxpayers can’t completely avoid taxes. While the rules are complex, the good news is that most Americans no longer face AMT thanks to the 2017 reforms and high exemption levels.

Still, if you have high income, stock options, or large deductions, it’s worth checking your exposure each year. Planning ahead with a tax advisor can help you avoid surprises and even reduce your AMT liability.

👉 Bottom line: Don’t panic about AMT — but don’t ignore it either. For most, it’s just a calculation your tax software runs in the background. For a few, it can mean a significant tax bill.