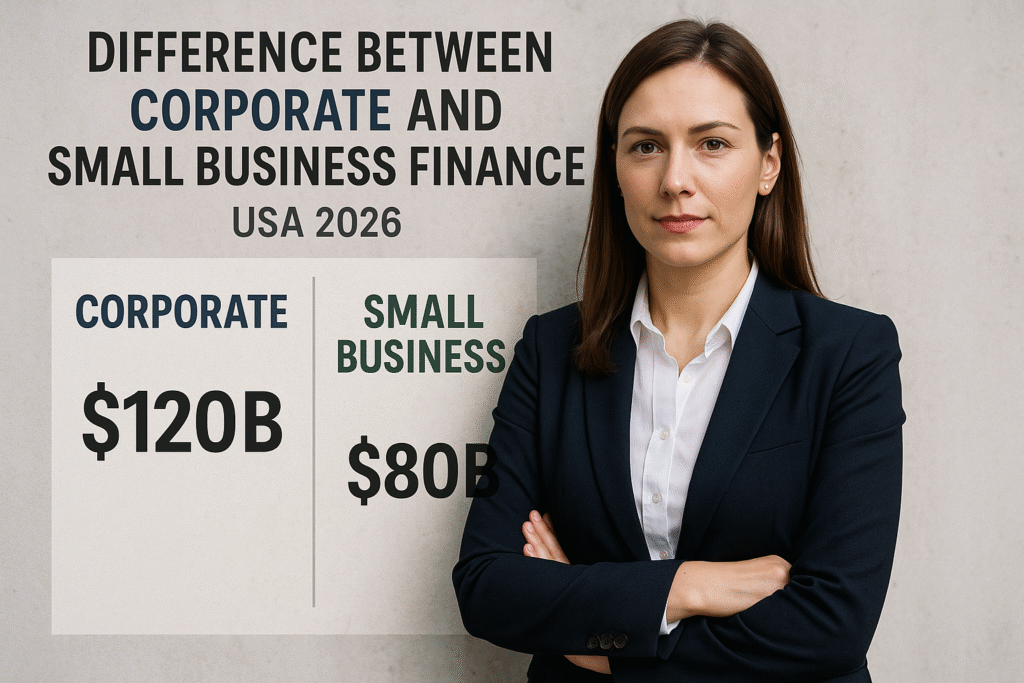

Difference Between Corporate and Small Business Finance USA 2026

Introduction: Why Finance Looks Different for Corporates and Small Businesses

Difference Between Corporate and Small Business Finance USA 2026,Finance is the heartbeat of every organization — it determines how companies grow, invest, and survive economic challenges. But finance isn’t one-size-fits-all.

The way a large corporation like Apple manages its money is entirely different from how a local bakery in Ohio handles its finances. Both need capital, both need budgeting, and both aim for profitability — but the scale, strategy, and complexity differ dramatically.

In this article, we’ll break down the difference between corporate and small business finance USA 2026 in a simple, easy-to-understand way. You’ll learn:

- What corporate finance and small business finance mean

- The main differences in funding, goals, structure, and risks

- Real-life examples from American companies

- Practical tips for managing finances at each level

- FAQs and expert insights

Let’s dive in!

What Is Business Finance?

Before we compare corporate and small business finance, let’s quickly understand what business finance actually means.

Business finance involves managing money and investments to support a company’s operations and growth. It includes:

- Raising capital (loans, investors, or retained earnings)

- Budgeting and financial planning

- Managing cash flow and expenses

- Making investment decisions

- Ensuring profitability and long-term sustainability

Whether you run a large corporation or a small business, finance is what keeps the wheels turning.

What Is Corporate Finance?

Corporate finance refers to the financial management of large organizations or publicly traded companies.

Its primary focus is maximizing shareholder value through strategic investment and funding decisions. Corporate finance deals with massive sums of money, complex structures, and international operations.

Key Features of Corporate Finance:

- Focuses on capital structure and investment decisions

- Involves mergers, acquisitions, and stock issuance

- Uses financial modeling and risk management tools

- Managed by professional finance departments or CFOs

- Complies with SEC and corporate governance standards

Example:

A company like Amazon uses corporate finance to decide whether to issue new bonds, repurchase shares, or acquire a tech startup to enhance its logistics network.

What Is Small Business Finance?

Small business finance refers to the financial management practices of privately owned businesses with limited employees and revenue.

Unlike corporations, small businesses often rely on personal savings, bank loans, or small investors to operate.

Key Features of Small Business Finance:

- Focused on cash flow management and day-to-day operations

- Uses simple accounting and budgeting systems

- Financing often through SBA loans, personal funds, or credit lines

- Managed directly by the owner or a small finance team

- Less regulatory complexity than corporate finance

Example:

A bakery in California uses a small business line of credit to purchase ingredients and cover seasonal expenses.

Corporate vs Small Business Finance — The Core Differences

Let’s break down the main differences between corporate and small business finance USA in detail.

| Aspect | Corporate Finance | Small Business Finance |

|---|---|---|

| Scale | Large-scale operations and international markets | Local or regional operations |

| Funding Sources | Stock issuance, corporate bonds, institutional investors | Bank loans, SBA loans, credit cards, personal savings |

| Financial Management | Managed by CFOs and financial departments | Managed by owners or small finance teams |

| Regulation | Subject to SEC, GAAP, and corporate laws | Basic accounting and tax compliance |

| Risk Management | Complex risk models, diversification, and hedging | Limited tools, focus on cash flow and debt control |

| Financial Goals | Maximize shareholder value and growth | Maintain profitability and stability |

| Decision Speed | Slower, multiple approvals and board oversight | Faster, owner-driven decisions |

| Transparency | High—must report to shareholders | Private reporting, minimal public disclosure |

1. Funding and Capital Structure

One of the biggest differences between corporate and small business finance USA lies in how they raise capital.

Corporate Financing Sources:

- Equity financing: Issuing shares to the public

- Debt financing: Corporate bonds or large institutional loans

- Retained earnings: Profits reinvested into the company

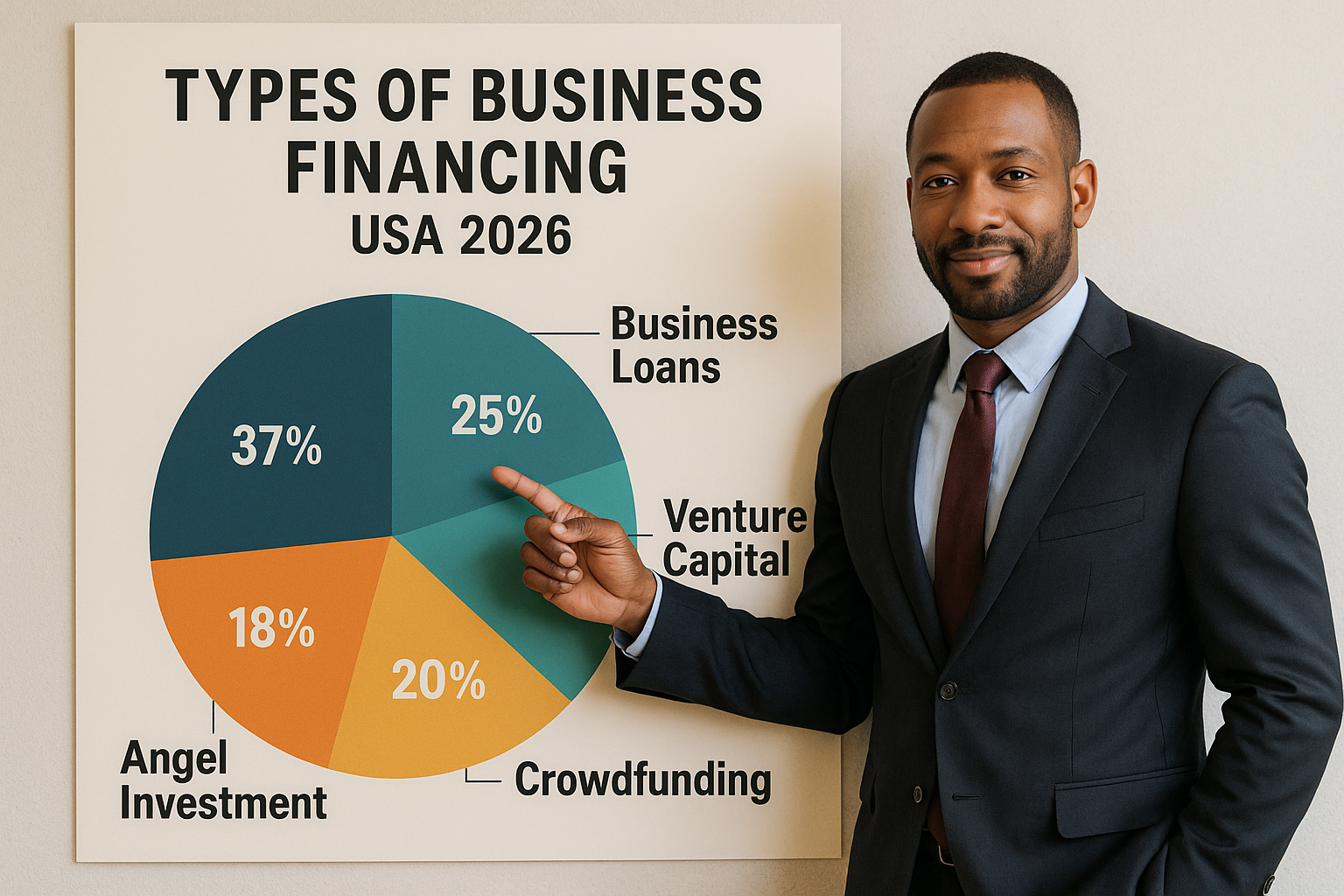

Small Business Financing Sources:

- Personal savings and family funds

- SBA and microloans

- Crowdfunding or angel investors

- Business credit lines

Example:

- Apple raised billions by issuing corporate bonds to expand Apple Pay.

- A small IT startup in Austin might rely on a $50,000 SBA loan to buy equipment.

2. Financial Planning and Strategy

Corporate Finance:

Corporate financial planning is data-driven and long-term. It involves forecasting global markets, managing multiple subsidiaries, and making strategic investment decisions.

Tools used:

- Financial modeling (DCF, NPV, IRR)

- Risk diversification

- Scenario analysis

Small Business Finance:

Small businesses plan based on immediate cash flow needs and local market conditions.

Focus areas:

- Budgeting and expense control

- Short-term financial planning

- Maintaining liquidity for daily operations

3. Management and Decision-Making

Corporate:

- Finance decisions go through boards, CFOs, and executive committees.

- Each financial move is supported by detailed reports and market analysis.

- Priorities: investor returns, market share, and sustainability.

Small Business:

- The owner or manager often makes financial decisions quickly.

- Flexibility is higher, but strategic resources are limited.

- Priorities: survival, local growth, and cash management.

Example:

A corporate CFO might take months analyzing a merger deal, while a café owner might decide overnight to add a new product to attract customers.

4. Accounting and Financial Reporting

Corporate Finance:

- Must follow GAAP or IFRS accounting standards.

- Requires audited financial statements and annual reports.

- Reports to shareholders, investors, and regulators.

Small Business Finance:

- Simpler bookkeeping with tools like QuickBooks or Wave.

- Focuses on profit and loss statements and tax records.

- Fewer reporting obligations.

5. Risk and Financial Stability

Corporate Finance:

Corporations have access to risk management departments, insurance, and derivatives to hedge against financial loss.

They spread risks across products, markets, and countries.

Small Business Finance:

Small businesses face higher risk exposure due to limited cash reserves and fewer diversification opportunities.

- A single bad season or late payment can severely impact cash flow.

- They rely more on personal guarantees and local lenders.

6. Regulation and Compliance

Corporate Finance:

Heavily regulated by:

- SEC (Securities and Exchange Commission)

- Federal Reserve and IRS

- Corporate governance laws

Compliance costs are high, but transparency ensures investor confidence.

Small Business Finance:

- Regulated mainly for taxes and licensing.

- Easier compliance, but still requires attention to payroll, insurance, and local laws.

7. Financial Goals and Metrics

| Goal Type | Corporate Finance | Small Business Finance |

|---|---|---|

| Primary Goal | Shareholder value & expansion | Profitability & stability |

| Performance Metrics | EPS, ROI, EBITDA, market capitalization | Cash flow, gross profit margin, revenue growth |

| Investment Focus | Global expansion, mergers, acquisitions | Local marketing, inventory, and operations |

Real-Life Examples

Example 1: Corporate Finance (Microsoft)

Microsoft invests billions in AI acquisitions, cloud infrastructure, and stock buybacks to maximize shareholder value. This is strategic corporate finance at scale.

Example 2: Small Business Finance (Local Coffee Chain)

A small café in Florida uses a local credit union loan and credit card payments to buy new equipment and hire staff. The goal is short-term cash flow stability, not market dominance.

Pros and Cons: Corporate vs Small Business Finance

| Type | Pros | Cons |

|---|---|---|

| Corporate Finance | Large funding access, professional management, diversification | Bureaucracy, slower decisions, regulatory burden |

| Small Business Finance | Flexibility, faster decisions, personal control | Limited funding, higher risk exposure, less support |

Key Similarities Between Corporate and Small Business Finance

Even with so many differences, both systems share some fundamentals:

- Both require budgeting and cash flow control.

- Both depend on financial forecasting for sustainability.

- Both seek to maximize returns on investments.

- Both face economic risks, such as inflation or recession.

Practical Tips for Managing Business Finance in the USA

- Maintain accurate records – Use accounting software for transparency.

- Separate personal and business finances.

- Build an emergency fund – At least 3–6 months of operating expenses.

- Monitor cash flow weekly – Don’t wait until tax season.

- Seek expert advice – Consult financial planners or CPAs.

- Use credit wisely – Leverage credit lines but avoid overborrowing.

Table: Snapshot Summary

| Category | Corporate Finance | Small Business Finance |

|---|---|---|

| Scale | Large, multi-country | Local or regional |

| Funding Source | Bonds, investors, stock market | SBA loans, personal credit |

| Goal | Shareholder wealth | Profit stability |

| Decision Speed | Slow and strategic | Fast and practical |

| Risk Management | Diversified and analytical | Limited and reactive |

| Regulation | SEC, GAAP | Local/state laws |

FAQs: Corporate vs Small Business Finance USA

Q1. What’s the biggest difference between corporate and small business finance?

The biggest difference is scale and funding. Corporate finance involves large investments, global operations, and complex structures, while small business finance focuses on managing limited capital and daily operations.

Q2. Which is more flexible: corporate or small business finance?

Small business finance is more flexible since owners make decisions quickly without board approval.

Q3. Do small businesses follow corporate accounting standards?

No. Small businesses use simpler accounting systems, while corporations follow GAAP or IFRS.

Q4. Can small businesses become corporates one day?

Yes! Many large corporations — including Amazon and Apple — started as small businesses. Strategic financial planning helped them grow.

Q5. Which is riskier — corporate or small business finance?

Small business finance carries higher risk due to limited capital and fewer diversification options.

Conclusion: Two Different Paths, One Financial Goal

Both corporate and small business finance are vital to the U.S. economy — they just operate at different levels.

- Corporations drive global innovation and investment.

- Small businesses fuel local economies, create jobs, and serve communities.

While corporate finance focuses on shareholder value, small business finance emphasizes survival, growth, and independence.

No matter the size, sound financial management is the foundation of success. Whether you’re managing billions or just starting out, the principles of smart finance remain the same — plan wisely, manage risks, and invest for the future.

Call-to-Action

If you’re running a business — big or small — now is the perfect time to review your financial strategy.

Explore your funding options, strengthen your cash flow, and seek professional guidance to scale smartly.

“Good finance isn’t just about numbers — it’s about building the future you envision.”