Types of Business Financing USA 2026 | Top Financing Options for Small Businesses

Introduction: Why Business Financing Is the Key to Growth

Whether you’re launching a startup in California or expanding a family business in Texas, one thing matters more than anything — funding.

Every business, big or small, runs on capital. You need money to buy equipment, pay employees, market your brand, and sustain operations. But where does that money come from? That’s where business financing comes in.

The Types of Business Financing USA 2026 have evolved dramatically in recent years. Today, entrepreneurs can choose from traditional loans, venture capital, crowdfunding, grants, and even AI-based funding platforms.

This guide breaks down the best business financing options USA entrepreneurs can explore in 2026 — explaining how each works, when to use them, their pros and cons, and real-world examples.

What Is Business Financing?

Business financing refers to the methods and sources of funds used by companies to start, operate, or expand. In simple terms, it’s how businesses get the money they need to grow.

Finance helps you:

- Buy equipment or inventory

- Pay salaries and rent

- Fund marketing and R&D

- Manage cash flow

- Expand into new markets

The right financing option depends on your business stage, credit profile, and growth goals.

The Importance of Business Financing in the USA

In the USA, access to funding is one of the biggest factors that determines a company’s success.

- Over 43% of small businesses cite lack of capital as their top challenge (SBA Report, 2025).

- More than 60% of startups rely on external financing in their first three years.

- The average small business loan size in the US is $633,000 (Federal Reserve Data, 2025).

Finance gives businesses the freedom to innovate, compete, and grow sustainably.

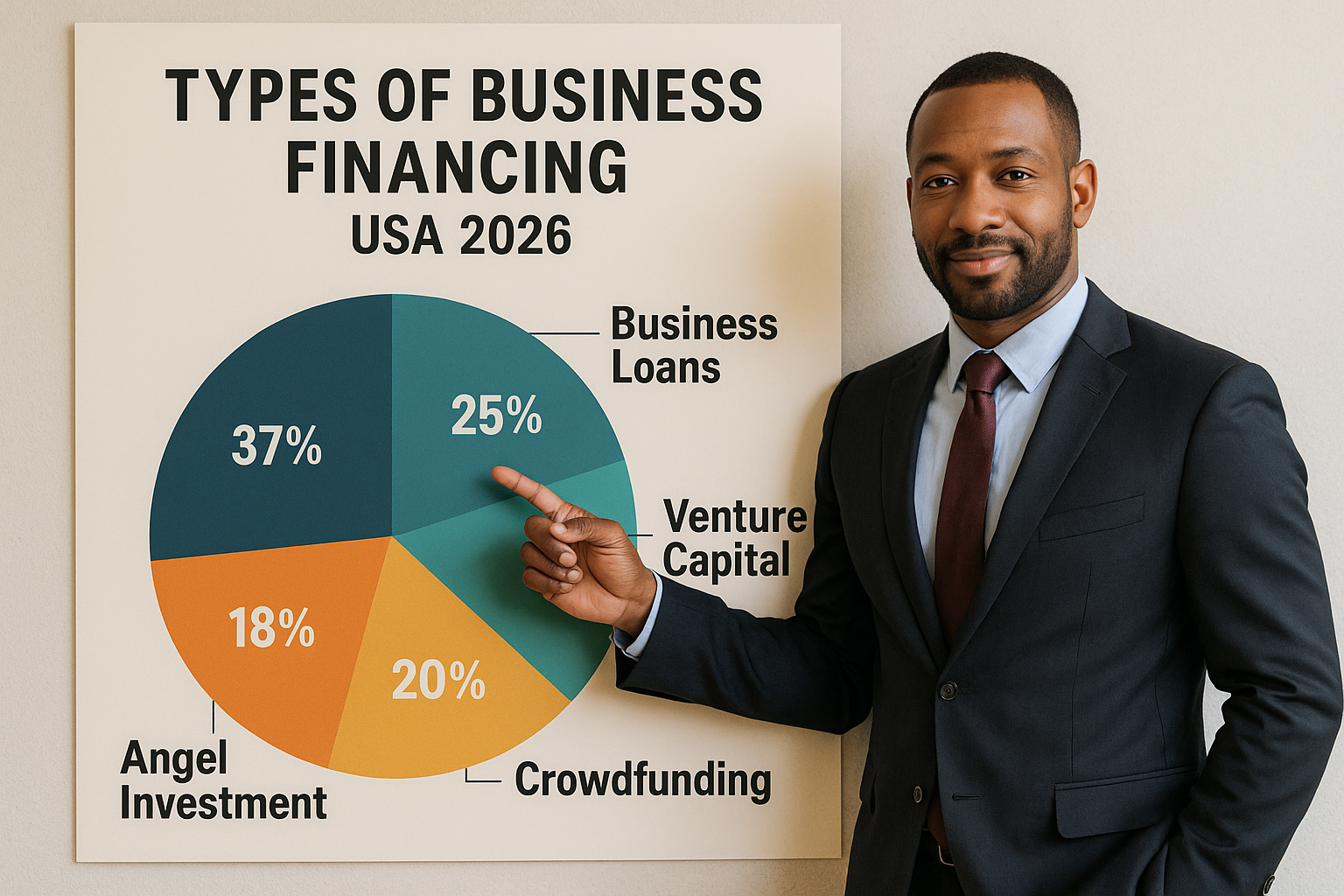

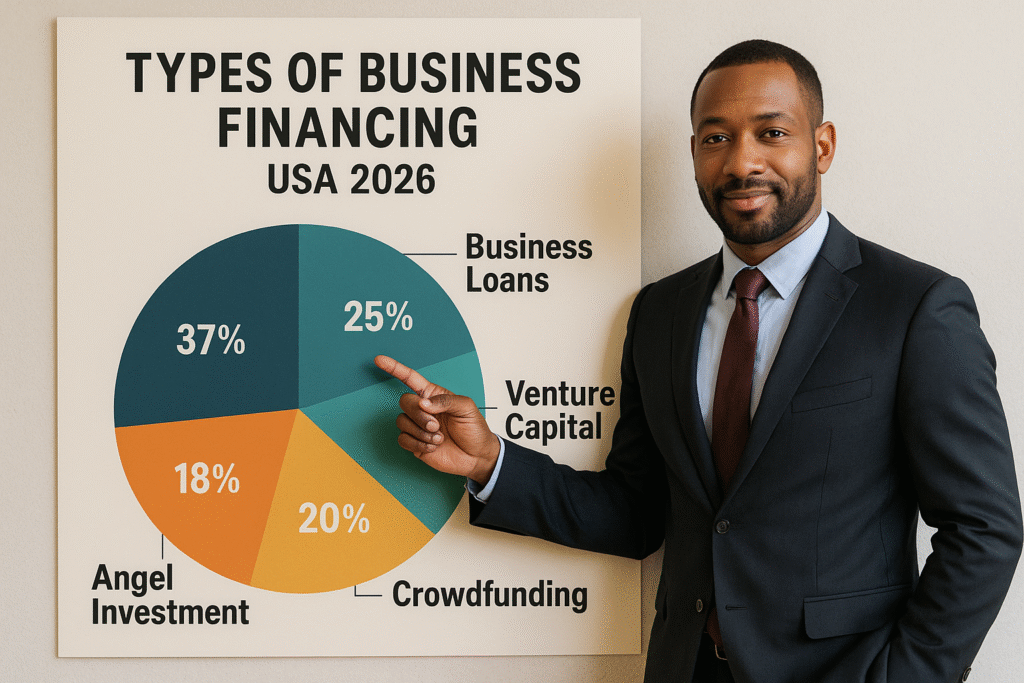

Main Types of Business Financing in the USA

Business financing in the USA falls broadly into two categories:

- Debt Financing — Borrowing money that must be repaid with interest.

- Equity Financing — Raising capital by selling ownership or shares of your company.

Let’s dive deeper into the most popular business financing options USA entrepreneurs use in 2026.

1. Traditional Bank Loans

Overview:

Bank loans are one of the most common forms of business financing in the USA. Banks offer both short-term and long-term loans depending on the company’s needs.

How It Works:

You borrow a lump sum and repay it over time with interest. The bank may require collateral or a strong credit score.

Pros:

- Predictable monthly payments

- Builds business credit

- Competitive interest rates for strong borrowers

Cons:

- Requires excellent credit and documentation

- Lengthy approval process

Example:

A restaurant in Chicago borrows $250,000 from Chase Bank to open a second location, repaid over 5 years at 6% interest.

2. SBA Loans (Small Business Administration)

Overview:

SBA loans are backed by the U.S. Small Business Administration, making them one of the most popular funding options for small businesses in the USA.

Types of SBA Loans:

- SBA 7(a) — General-purpose business loans

- SBA 504 — For equipment and real estate

- SBA Microloans — Up to $50,000 for startups

Pros:

- Low-interest rates

- Longer repayment terms

- Backed by federal guarantees

Cons:

- Slow approval process

- Requires detailed paperwork

Example:

A small construction firm in Texas uses an SBA 504 loan to buy heavy equipment worth $400,000.

3. Business Lines of Credit

Overview:

A business line of credit (LOC) gives you flexible access to funds up to a limit — similar to a credit card. You only pay interest on the amount you use.

Pros:

- Flexible borrowing

- Ideal for managing cash flow

- Quick access to funds

Cons:

- May have annual fees

- Interest rates can vary

Example:

A retailer uses a $100,000 line of credit to buy extra inventory before the holiday season and repays it after sales.

4. Equipment Financing

Overview:

This type of loan helps businesses purchase machinery, vehicles, or technology. The equipment itself acts as collateral.

Pros:

- Easier approval (collateral-backed)

- Tax-deductible interest

- Keeps working capital free

Cons:

- Only for equipment purchases

- Possible depreciation risk

Example:

A manufacturing company in Ohio uses equipment financing to buy a new production line worth $1 million.

5. Commercial Real Estate Loans

Overview:

Used to buy, build, or renovate property for business use.

Types:

- Term loans

- Construction loans

- SBA 504 real estate financing

Pros:

- Builds business equity

- Long repayment terms

Cons:

- Requires strong financial history

- High initial down payment

Example:

A law firm in New York purchases an office building using a 15-year commercial real estate loan.

6. Venture Capital (VC)

Overview:

Venture capital is equity financing provided by investors in exchange for ownership stakes. It’s best suited for high-growth startups.

Pros:

- Access to large funding amounts

- Strategic mentorship and networking

- No repayment obligation

Cons:

- You give up equity Investors influence company decisions

Example:

A biotech startup in Boston raises $10 million from Sequoia Capital for product development.

7. Angel Investors

Overview:

Angel investors are wealthy individuals who invest in early-stage startups in exchange for equity or convertible debt.

Pros:

- Quick funding with fewer formalities

- Mentorship and guidance

- Ideal for early-stage businesses

Cons:

- Equity dilution

- Not suitable for all industries

Example:

An e-commerce startup in Seattle raises $250,000 from an angel investor to develop its website and hire staff.

8. Crowdfunding

Overview:

Crowdfunding allows businesses to raise small amounts of money from many people online through platforms like Kickstarter, Indiegogo, and GoFundMe.

Types:

- Donation-based

- Reward-based

- Equity-based

Pros:

- Great for product validation

- No credit checks

- Builds brand awareness

Cons:

- Time-consuming campaigns

- All-or-nothing funding on some platforms

Example:

A smartwatch startup raises $1 million through Kickstarter pre-orders.

Overview:

Businesses sell their unpaid invoices to a lender to get immediate cash instead of waiting for clients to pay.

Pros:

- Improves cash flow

- No collateral required

- Fast approval

Cons:

- High fees

- Risk of customer relationship issues

Example:

A logistics firm in Florida sells $100,000 worth of invoices to cover operating costs during a slow month.

10. Merchant Cash Advances (MCA)

Overview:

An MCA provides upfront cash in exchange for a percentage of future sales.

Pros:

- Quick funding

- Easy qualification

Cons:

- High fees and interest rates

- Daily repayments reduce cash flow

Example:

A coffee shop uses a $30,000 MCA to upgrade its equipment, repaid through daily card sales.

11. Business Credit Cards

Overview:

These provide revolving credit for small purchases or emergencies. Many US cards offer cashback and travel rewards.

Pros:

- Builds credit score

- Offers flexibility and perks

Cons:

- High interest rates if unpaid

- Risk of overspending

Example:

A marketing agency uses a business credit card to cover travel expenses for client meetings.

12. Government Grants & Economic Programs

Overview:

Government grants provide non-repayable funding for specific business activities like research, technology, or sustainability.

Popular US Grants:

- Small Business Innovation Research (SBIR)

- Economic Development Administration (EDA) grants

- Minority Business Development Agency (MBDA)

Pros:

- Free capital (no repayment)

- Supports innovation and community growth

Cons:

- Competitive and time-consuming

- Strict eligibility criteria

Example:

A clean-energy startup in Colorado wins an SBIR grant to develop eco-friendly battery technology.

Comparing Business Financing Options in the USA

| Financing Type | Best For | Repayment Required? | Equity Dilution? |

|---|---|---|---|

| Bank Loans | Established businesses | ✅ Yes | ❌ No |

| SBA Loans | Small businesses | ✅ Yes | ❌ No |

| Venture Capital | Startups | ❌ No | ✅ Yes |

| Crowdfunding | New product launches | ❌ Depends | ✅/❌ |

| Equipment Financing | Manufacturers | ✅ Yes | ❌ No |

| Angel Investors | Early-stage startups | ❌ No | ✅ Yes |

| Invoice Financing | Businesses with invoices | ✅ Yes | ❌ No |

How to Choose the Right Business Financing Option

- Evaluate Your Stage:

- Startup → Angel investors or crowdfunding.

- Established → Bank or SBA loans.

- Check Your Credit Score:

- High credit → Bank loans.

- Low credit → Invoice financing or grants.

- Determine Funding Purpose:

- Growth → Venture capital or SBA loans.

- Cash flow → Lines of credit or invoice factoring.

- Understand Repayment Terms:

Always compare APRs, fees, and repayment periods before choosing.

Pros and Cons of Business Financing

| Pros | Cons |

|---|---|

| Access to capital for growth | Potential debt or dilution |

| Enhances credibility | Can affect ownership control |

| Enables innovation | Risk of over-leverage |

| Helps manage cash flow | Requires documentation and compliance |

Tips for Getting Approved for Business Financing

- Build a strong credit profile.

- Prepare a detailed business plan.

- Show clear revenue and projections.

- Keep tax and financial statements updated.

- Compare lenders and negotiate rates.

FAQs: Business Financing Options USA 2026

1. What is the best financing option for small businesses in the USA?

SBA loans and lines of credit are the most reliable options for small US businesses.

2. How can startups get funding?

Startups can raise money through angel investors, venture capital, or crowdfunding platforms.

3. Are government grants available for businesses?

Yes, the US government offers grants for research, innovation, minority-owned, and green businesses.

4. What is the easiest business financing option to get approved for?

Business credit cards and merchant cash advances usually have easier approval requirements.

5. Do I need collateral for business loans?

Some loans (like secured bank loans) require collateral, while SBA or credit lines may not.

Conclusion: Choosing the Right Financing Path

In 2026, businesses in the USA have more financing options than ever before. Whether you’re launching a startup or expanding nationwide, there’s a funding model that fits your vision.

The key is to choose wisely — consider your goals, repayment capacity, and risk tolerance.

Finance isn’t just about getting money; it’s about using it strategically to fuel growth, stability, and innovation.

Call to Action

If you’re ready to grow your business, start exploring your business financing options USA today.

Review your finances, prepare your business plan, and apply for the funding type that aligns with your goals.

Strong financial planning is the first step toward lasting success.