Cryptocurrency Market Trends USA (2026) | Crypto Trends & Insights for US Investors

Introduction: How the US Crypto Market Is Shaping 2026

Cryptocurrency Market Trends USA (2026): The cryptocurrency landscape in the United States has never been more exciting or dynamic. As we enter 2026, the market continues to evolve rapidly, influenced by regulatory developments, technological innovations, and institutional adoption.

From Bitcoin ETFs gaining traction to AI-powered blockchain analytics, the cryptocurrency market trends in the USA show that digital assets are no longer a niche topic — they’re becoming a core part of the country’s financial ecosystem.

In this comprehensive guide, we’ll explore:

- The latest crypto trends in the USA (2026)

- Market performance and adoption data

- Government regulations and their impact

- The rise of institutional and retail participation

- Predictions for the next 3–5 years

Whether you’re an investor, trader, or simply crypto-curious, this article will help you understand what’s driving the US crypto market — and how to make the most of it.

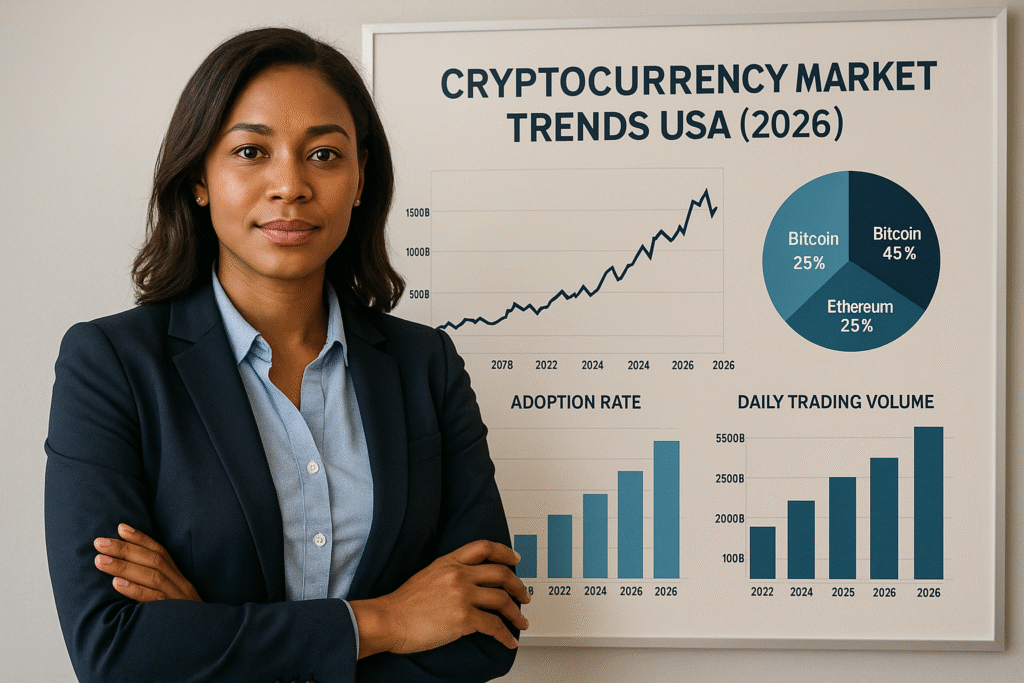

The US Cryptocurrency Market at a Glance

The United States remains one of the largest crypto markets globally, with millions of active users, hundreds of blockchain startups, and increasing mainstream acceptance.

Quick Stats (as of early 2026):

- Over 52 million Americans hold some form of cryptocurrency.

- Bitcoin ETFs now manage over $50 billion in assets.

- The total US crypto market cap surpasses $1.2 trillion.

- AI and DeFi projects lead the innovation curve.

The American crypto market has matured significantly since the speculative boom of 2021–2022. Today, it’s a blend of long-term investors, regulated exchanges, and blockchain-based financial products.

Top Cryptocurrency Market Trends in USA (2026)

Let’s break down the most important crypto trends USA investors and businesses should watch this year.

1. Mainstream Institutional Adoption Continues

One of the strongest cryptocurrency market trends in the USA is the continued institutional adoption of digital assets.

Banks, hedge funds, and publicly traded companies now treat crypto as a legitimate asset class.

Examples:

- Major asset managers like BlackRock and Fidelity have expanded their Bitcoin ETF offerings.

- Large corporations are integrating blockchain for supply chain transparency.

- Payment processors like PayPal and Stripe now support direct crypto transactions.

Why It Matters: Institutional participation improves market stability, liquidity, and credibility, attracting more everyday investors.

2. AI Meets Crypto: The Rise of Smart Trading and Blockchain Automation

AI-driven crypto analytics are transforming how Americans trade and manage their portfolios.

AI + Crypto Trends Include:

- Predictive price modeling using machine learning.

- Automated portfolio rebalancing.

- Smart contract auditing powered by AI.

This integration helps both retail and institutional investors make smarter, data-backed decisions while reducing risks.

3. Growth of DeFi (Decentralized Finance)

DeFi remains a major driver of innovation in the USA. It allows users to borrow, lend, trade, and earn interest without intermediaries.

Top US-based DeFi projects in 2026:

- Aave v4 — offering multi-chain lending.

- UniswapX — advanced liquidity protocol.

- Compound DAO — growing institutional liquidity pools.

Benefits:

- High transparency

- Low fees

- Passive income opportunities

However, DeFi regulation is expected to tighten, focusing on anti-money laundering (AML) compliance and investor protection.

4. Regulatory Clarity and Compliance Improvements

After years of uncertainty, US crypto regulations are finally becoming clearer.

Key Developments (2025–2026):

- The Digital Asset Framework Act sets new standards for exchanges and custodians.

- Stablecoin legislation requires 1:1 USD reserves.

- IRS has refined tax reporting for crypto earnings.

This regulatory maturity gives investors greater confidence, making the US one of the safest environments for legitimate crypto activity.

Pro Tip: Always choose FINRA or FinCEN-registered exchanges for compliance assurance.

5. Bitcoin ETFs and Institutional Products Take Center Stage

The approval of multiple Bitcoin ETFs in 2025 marked a turning point. In 2026, Ethereum and Solana ETFs are also under review.

Impact:

- Easier access for traditional investors.

- Increased liquidity in US crypto markets.

- Reduced volatility due to broader participation.

Example:

A typical investor can now buy exposure to Bitcoin through their 401(k) or IRA, bridging the gap between crypto and traditional finance.

6. Stablecoins Drive Payment Innovation

Stablecoins like USDC, PayPal USD (PYUSD), and Tether (USDT) are revolutionizing cross-border payments.

Why Americans Love Stablecoins:

- Fast and cheap transactions

- Price stability

- Integration with digital wallets and DeFi

In 2026, the USDC network processes over $500 billion in transactions per month, making it one of the most used digital dollar systems.

7. Environmental Focus and Green Crypto Initiatives

Sustainability is no longer optional. The US government and private firms are supporting eco-friendly blockchain networks that use Proof-of-Stake (PoS) instead of energy-heavy Proof-of-Work (PoW).

Trending Green Projects:

- Cardano (ADA)

- Algorand (ALGO)

- Ethereum (ETH) after its full PoS transition

These projects appeal to environmentally conscious investors and align with corporate ESG goals.

Emerging Technologies Impacting the US Crypto Market

The cryptocurrency ecosystem is now intertwined with several other tech sectors:

- Artificial Intelligence (AI): Predictive analytics and automated trading.

- Internet of Things (IoT): Smart contracts for connected devices.

- Web3: Decentralized apps and identity solutions.

- Metaverse: Blockchain-backed virtual economies.

These intersections are driving innovation and creating new business opportunities across finance, entertainment, and logistics.

US Crypto Adoption by Sector

| Sector | Adoption Level (2026) | Use Case |

|---|---|---|

| Banking & Finance | High | Crypto-backed loans, ETFs, custody |

| Retail & E-commerce | Moderate | Crypto payments, loyalty rewards |

| Gaming | High | Play-to-earn, NFTs |

| Real Estate | Growing | Tokenized property investments |

| Healthcare | Emerging | Secure data sharing on blockchain |

This diversification proves that cryptocurrency in the USA is no longer just about trading — it’s about transforming industries.

Market Outlook: What to Expect in 2027–2030

Experts predict that by 2030, crypto will be integrated into everyday American life — from payroll systems to government-backed digital currencies (CBDCs).

Forecast Highlights:

- Bitcoin could stabilize above $100,000 per BTC.

- Stablecoins will dominate digital payments.

- Web3 job demand to rise by 40%.

- Traditional banks will offer direct crypto custody services.

Takeaway: Crypto isn’t going anywhere — it’s becoming the foundation of future finance.

Pros and Cons of the US Crypto Market in 2026

| Pros | Cons |

|---|---|

| Clearer regulations and safer trading environment | Some compliance hurdles for startups |

| Institutional trust and adoption growing fast | Volatility still a challenge |

| Technological innovation (AI, DeFi, Web3) | Complex taxation policies |

| Better infrastructure and education | Entry barriers for small investors |

Tips for Crypto Investors in the USA (2026)

- Stay informed — follow official SEC and CFTC updates.

- Diversify portfolios — don’t stick to just Bitcoin or Ethereum.

- Use regulated exchanges — Coinbase, Kraken, and Gemini remain trusted.

- Watch emerging altcoins tied to AI and DeFi.

- Plan taxes early — report all transactions accurately.

FAQs: Cryptocurrency Market Trends USA 2026

1. What’s driving crypto growth in the USA in 2026?

Institutional adoption, AI integration, and regulatory clarity are the main drivers.

2. Is it legal to invest in cryptocurrency in the USA?

Yes, it’s legal — as long as you use registered and compliant exchanges.

3. Which cryptocurrencies are trending in 2026?

Bitcoin, Ethereum, Solana, Cardano, and AI-based tokens are leading the market.

4. Will the US launch its own digital dollar (CBDC)?

Discussions are ongoing, and pilot projects may roll out by 2027.

5. Are crypto taxes mandatory?

Yes. Crypto is considered property by the IRS — gains must be reported on your tax return.

Conclusion: The Future of Crypto in the USA Looks Bright

The cryptocurrency market trends in the USA (2026) show a strong move toward regulation, innovation, and mainstream adoption. Crypto is no longer the “wild west” — it’s becoming a cornerstone of modern finance.

Whether you’re a first-time investor or a blockchain professional, this is the right time to learn, explore, and participate responsibly.

As the market matures, remember: success in crypto depends not just on timing, but on knowledge, discipline, and security.

Call to Action

Ready to explore the world of cryptocurrency?

Start by opening an account on a trusted US crypto exchange, invest small, and stay updated on market trends.

Your financial future could be built on the blockchain — start today!