Small Business Finance Tips USA 2026: A Complete Guide for Entrepreneurs

Introduction

Running a small business in the USA can feel like juggling a dozen balls at once. Between serving customers, marketing your products, and handling day-to-day operations, one thing often gets overlooked — finances.

Yet, financial health is the backbone of every successful business. Without smart money management, even the most creative ideas or passionate entrepreneurs can find themselves struggling.

That’s why today, we’re diving deep into small business finance tips USA — practical, simple, and proven strategies to help you stay on top of your money. Think of this as a friendly chat about managing business dollars so your company can thrive, not just survive.

Why Small Business Finance Matters in the USA

- High failure rate: According to the U.S. Small Business Administration, nearly 20% of small businesses fail in the first year, and poor financial management is a major reason.

- Cash flow struggles: Many businesses are profitable on paper but collapse because they run out of cash.

- Taxes & compliance: Staying compliant with IRS rules and state regulations is critical for avoiding penalties.

- Growth opportunities: Smart financial planning helps you reinvest profits and scale sustainably.

10 Essential Small Business Finance Tips USA Entrepreneurs Should Follow

1. Separate Personal and Business Finances

One of the first mistakes new entrepreneurs make is mixing personal and business accounts. Open a dedicated business bank account and credit card. This not only makes taxes easier but also builds business credit.

2. Master Cash Flow Management

Cash is king. Always know how much money is coming in and going out. Consider using a simple spreadsheet or tools like QuickBooks or Wave Accounting.

Pro tip: Keep at least 3–6 months of operating expenses as a cushion.

3. Create a Realistic Budget

Budgeting isn’t about restriction — it’s about direction. Estimate monthly income and plan expenses like:

- Rent/office costs

- Payroll

- Marketing

- Inventory

- Taxes

Real Example: A bakery in Chicago budgets $3,000/month for inventory and noticed they were overspending. By budgeting, they reduced waste and saved $500/month.

4. Keep Track of All Expenses

Every dollar matters. Save receipts, use expense-tracking apps, and categorize spending. This not only helps with taxes but also shows where you can cut costs.

5. Manage Debt Wisely

Debt isn’t always bad — many businesses use loans to grow. But avoid high-interest credit cards. Instead, consider SBA loans, business lines of credit, or equipment financing.

6. Stay on Top of Taxes

Hire a tax professional or use software to avoid IRS headaches. Set aside a portion of every dollar earned (usually 25–30%) for federal and state taxes.

7. Build an Emergency Fund

Unexpected repairs, slow seasons, or economic downturns can hurt cash flow. An emergency fund provides stability.

8. Consider Outsourcing Accounting

If numbers aren’t your thing, outsource to a bookkeeper or accountant. This can actually save money by preventing errors and missed deductions.

9. Invest in Financial Education

The more you understand money, the better decisions you’ll make. Listen to podcasts, attend workshops, or follow experts on small business finance.

10. Plan for Growth

Don’t just manage today — plan for tomorrow. Reinvest profits into marketing, new products, or hiring staff. Create a long-term financial roadmap.

Pros & Cons of Handling Finances Yourself

| Pros | Cons |

|---|---|

| Save money on accounting fees | Risk of errors |

| Full control over business money | Time-consuming |

| Learn valuable financial skills | May miss tax deductions |

| Immediate access to reports | Can be overwhelming |

Example — Pie Chart of Small Business Spending USA

👉 This data can be visualized as a pie chart, showing how small businesses typically allocate funds.

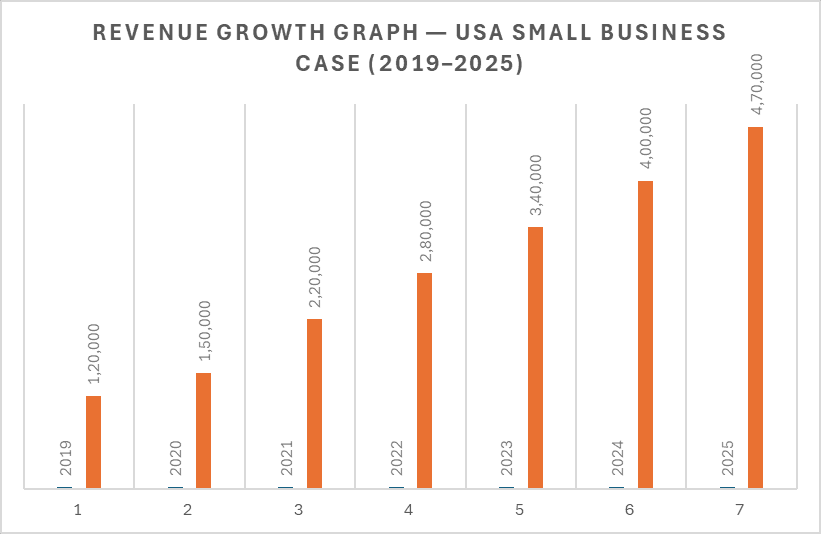

Example — Revenue Growth Graph (USA Small Business Case)

📈 You can turn this into a line graph showing steady revenue growth over time with proper financial planning.

Real-Life Success Story

Mark’s Landscaping Business (Texas):

Mark struggled with cash flow, often dipping into personal savings. After implementing a strict budget and separating business accounts, he:

- Cut unnecessary costs by 15%

- Built a $20,000 emergency fund in two years

- Qualified for a small business loan to expand his services

FAQs on Small Business Finance Tips USA

Q1: What’s the #1 finance mistake small businesses make in the USA?

👉 Mixing personal and business expenses — it complicates taxes and hides true profitability.

Q2: How much should a small business save for taxes?

👉 Set aside 25–30% of income to cover federal, state, and self-employment taxes.

Q3: Do I need an accountant if my business is small?

👉 Not always, but hiring one (even part-time) can save money by reducing errors and maximizing deductions.

Q4: How often should I review my budget?

👉 Monthly at minimum. Regular check-ins help catch problems early.

Q5: Can I run a business without taking on debt?

👉 Yes, but growth may be slower. Smart financing can actually help expand faster.

Conclusion — Take Control of Your Business Finances

Managing money may not be the most exciting part of being an entrepreneur, but it’s one of the most important. By following these small business finance tips USA, you’ll set your company up for stability, growth, and long-term success.

👉 Start small: separate your accounts, build a budget, and track expenses. Over time, these simple steps will create a rock-solid financial foundation for your business.