Cash Envelope Budgeting System USA 2026: How to Take Back Control of Your Money

Introduction

Do you ever feel like your paycheck disappears the moment it hits your account? You plan to save, but somehow the money just isn’t there when you need it. If that sounds familiar, you’re not alone. Many Americans struggle with overspending, rising costs of living, and managing their finances.

That’s where the Cash Envelope Budgeting System USA comes in. It’s an old-school yet highly effective way to control your money — using nothing more than cash, envelopes, and a little discipline. It might sound simple, but this system has helped countless families and individuals finally break free from living paycheck to paycheck.

In this guide, we’ll break down how the cash envelope system works, why it’s so powerful, and how you can start using it in your own life today.

What is the Cash Envelope Budgeting System?

The Cash Envelope Budgeting System USA is a money management method where you allocate cash into separate envelopes, each representing a spending category.

For example:

- Groceries: $400/month

- Gas: $200/month

- Entertainment: $100/month

- Eating Out: $150/month

When the money in the envelope is gone, you stop spending in that category. Simple, clear, and powerful.

This system helps you stay accountable, because unlike swiping a card, handing over cash makes you feel the money leaving your hands.

Why Use the Cash Envelope Budgeting System in the USA?

Here are a few reasons why this method is so effective in today’s world:

- Helps avoid credit card debt: With rising credit card interest rates in the USA, paying in cash can keep you from falling into debt.

- Improves spending awareness: You instantly see where your money is going.

- Keeps budgets realistic: No more wondering, “Where did all my money go?”

- Reduces impulse purchases: If the envelope is empty, the decision is already made for you.

Step-by-Step Guide to Start the Cash Envelope Budget USA

Step 1: Identify Your Spending Categories

Write down all your monthly expenses. Split them into:

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (groceries, eating out, entertainment)

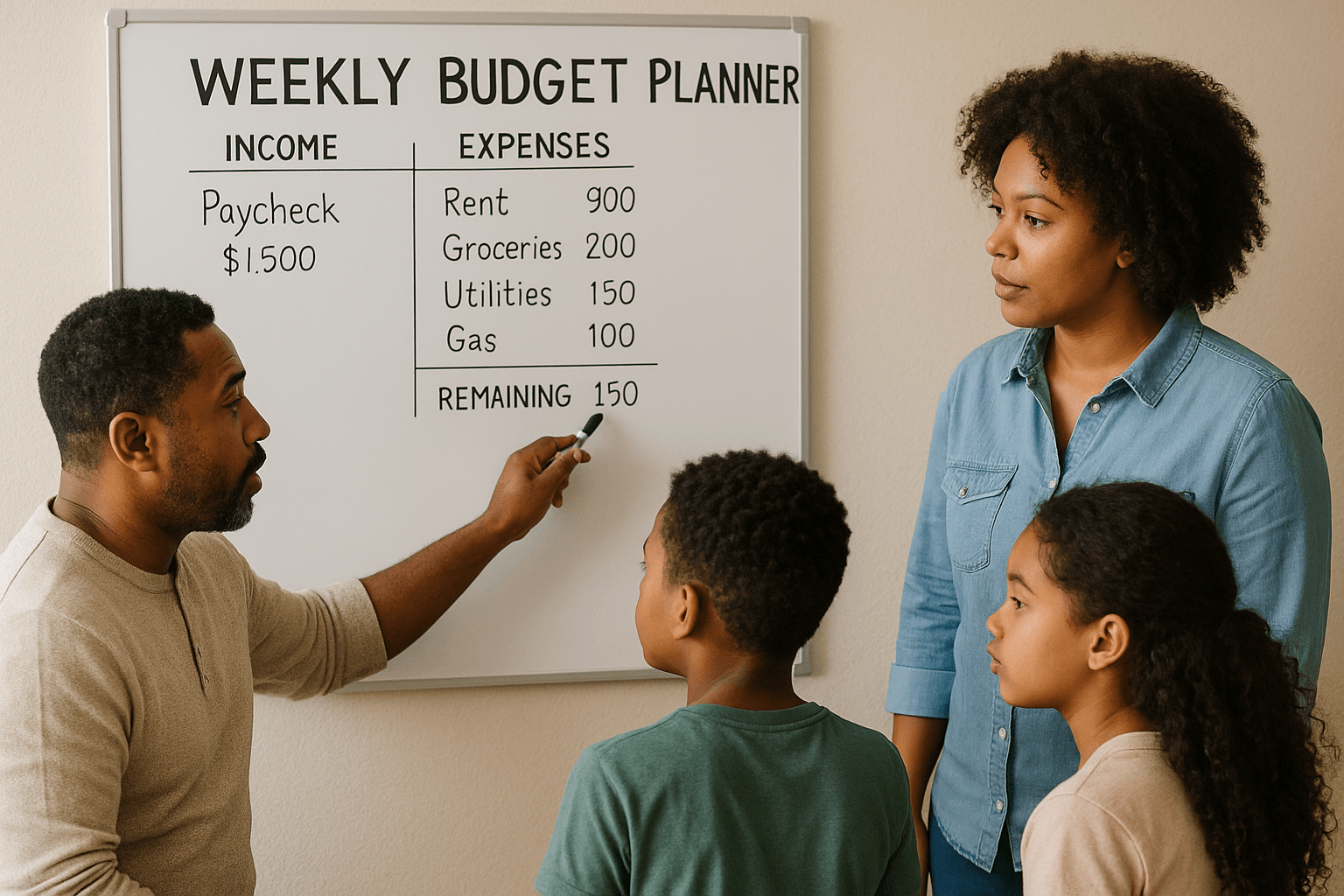

Step 2: Decide the Cash Amount for Each Category

Look at your monthly income and allocate realistic amounts. Example for a $3,000 income:

- Rent & Bills: $1,200 (not in envelopes since they’re paid online)

- Groceries: $400

- Gas: $200

- Entertainment: $100

- Eating Out: $150

- Miscellaneous: $100

Step 3: Create Your Envelopes

Label each envelope clearly. Some people use regular paper envelopes, while others buy durable reusable ones.

Step 4: Use Only Cash from the Envelopes

When you buy groceries, you take money from the grocery envelope. If it’s empty, no more grocery spending until the next month.

Step 5: Track and Adjust

At the end of the month, review your envelopes. Did you overspend in some areas? Did you have leftover cash? Adjust for the next month.

Real-Life Example: Sarah’s Story

Sarah, a 29-year-old from Ohio, was tired of swiping her debit card and overdrafting every month. She started using the cash envelope budget USA method with just three categories: groceries, gas, and eating out.

Within three months:

- She saved $600 she used to waste on takeout.

- She cut her grocery bill by 20% because she became more mindful.

- She stopped overdrafting and paying bank fees.

This simple system gave her peace of mind and helped her build her first emergency fund.

Pros and Cons of the Cash Envelope System

✅ Pros

- Easy to understand and implement

- No need for apps or complicated spreadsheets

- Physically limits overspending

- Builds financial discipline

- Can be adapted to any income level

❌ Cons

- Not convenient in a digital world

- Carrying cash may feel unsafe for some people

- Doesn’t work as well for online purchases

- Requires self-discipline

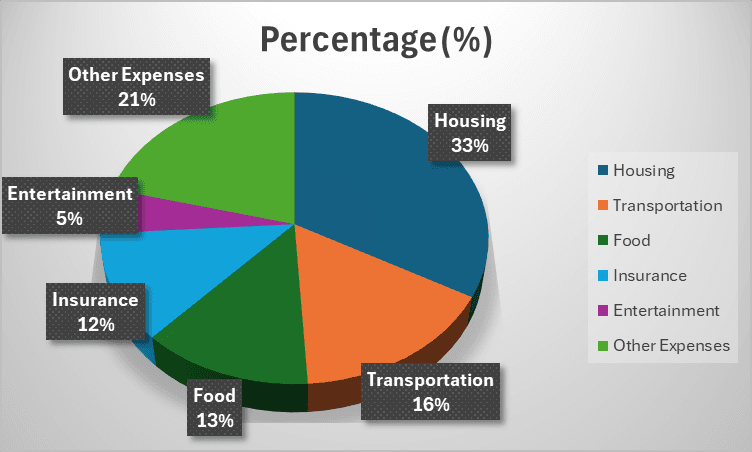

Visual: How the Average American Spends Their Budget

You can use this chart to compare your own spending habits with the average American household.

Who Should Try the Cash Envelope Budget?

- People who overspend on food, shopping, or entertainment

- Families wanting to save for a house or vacation

- Anyone in credit card debt

- College students learning money management

Tips to Make the Envelope Method Work in the USA

- Use smaller bills to make it easier to spend wisely.

- Combine envelopes with a budgeting app for bills paid online.

- Store envelopes in a safe place — not all in your wallet.

- Allow a small “fun money” envelope so you don’t feel restricted.

- Review your system every 2–3 months to see what’s working.

FAQs about Cash Envelope Budgeting in the USA

Q1: Can I use this system if I pay most bills online?

👉 Yes! Keep fixed bills online, but use envelopes for flexible spending like groceries, gas, and entertainment.

Q2: Is the cash envelope budget safe in the USA?

👉 Yes, if you only carry the envelope you need and keep the rest at home in a safe place.

Q3: How much money should I start with?

👉 Start small — maybe just 3 envelopes like groceries, gas, and eating out. Expand later as you get used to the system.

Q4: Can I use digital envelopes instead?

👉 Some apps mimic the envelope system. But the traditional method with cash is more effective because you physically see the money leave your hand.

Conclusion: Take Back Control of Your Money

The Cash Envelope Budgeting System USA is proof that sometimes the simplest methods are the most powerful. By going back to cash and envelopes, you gain control, reduce debt, and finally tell your money where to go instead of wondering where it went.

If you’re ready to stop living paycheck to paycheck, give the cash envelope budget a try. Start with just a few categories, track your progress, and see how quickly your mindset (and your bank account) changes.

👉 Why not grab a few envelopes tonight and set up your first budget? Your future self will thank you.