Weekly Budget Planner USA (2025 Complete Guide)

Introduction: Why Weekly Budgeting Works Better for Many Americans

Most people in the USA think about budgeting monthly—but here’s the catch: bills, groceries, and daily expenses often happen weekly. That’s why a weekly budget planner USA style works so well.

It breaks your money into smaller chunks, making it easier to control spending, track habits, and avoid overspending mid-month.

Think of it like portion control for your wallet—if you know exactly how much you can spend this week, you won’t blow through your whole paycheck before the month ends.

In this guide, we’ll cover:

- Why a weekly budget planner is effective in the USA

- How to set one up step by step

- Real-life examples and templates

- Tips, pros & cons, and money-saving hacks

- FAQs to clear common doubts

By the end, you’ll have a practical system to manage your money week by week.

What is a Weekly Budget Planner?

A weekly budget planner USA is simply a tool that:

- Breaks your income into weekly amounts

- Tracks weekly expenses (groceries, gas, entertainment, etc.)

- Helps avoid overspending early in the month

- Encourages consistent savings

Instead of managing $4,000 for a month, you might manage $1,000 per week. This makes spending easier to control.

Why Use a Weekly Budget Planner in the USA?

1. Matches Pay Schedules

Many Americans are paid weekly or bi-weekly. Planning weekly makes income and expenses align perfectly.

2. Prevents Overspending

Ever spent too much in week one and struggled later? Weekly budgeting fixes this.

3. Easier Tracking

Shorter time frames = less chance of “losing track” of money.

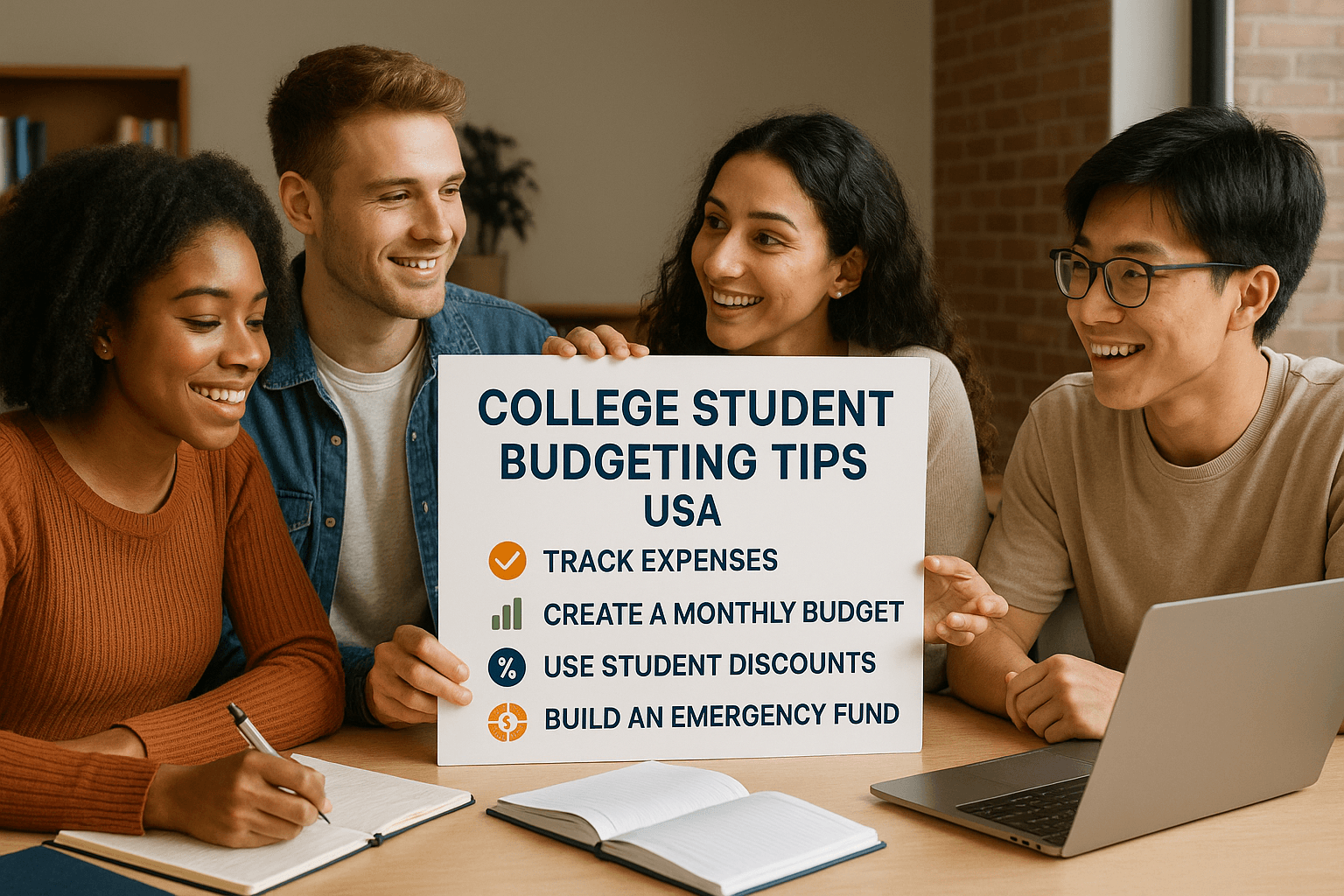

4. Great for Beginners

College students, families, or anyone new to budgeting find weekly planning simpler than monthly.

How to Create a Weekly Budget Planner USA

Here’s a step-by-step breakdown:

Step 1 – Know Your Weekly Income

- If paid weekly: use that number directly.

- If paid monthly: divide by 4 (or 4.3 for accuracy).

Example: Monthly $4,000 ÷ 4 = $1,000 per week.

Step 2 – List Weekly Essentials

- Rent (divide monthly by 4)

- Utilities (gas, water, electricity)

- Groceries

- Transportation

Step 3 – Add Flexible Expenses

- Dining out

- Entertainment

- Shopping

Step 4 – Plan Weekly Savings

Even $25–$50 per week adds up:

- $25 × 52 weeks = $1,300 per year

- $50 × 52 weeks = $2,600 per year

Step 5 – Track & Adjust Weekly

Review every Sunday night—what worked, what didn’t?

Weekly Budget Planner USA (Template Example)

Here’s a simple weekly budget table you can copy into Excel, Google Sheets, or print:

| Category | Budgeted | Actual | Difference |

|---|---|---|---|

| Income | $1,000 | ||

| Expenses | |||

| Housing (¼ rent) | $375 | ||

| Utilities (avg) | $60 | ||

| Groceries | $120 | ||

| Transportation | $80 | ||

| Dining Out | $50 | ||

| Entertainment | $40 | ||

| Miscellaneous | $25 | ||

| Savings | $100 |

Weekly Budgeting Methods Popular in the USA

1. The 50/30/20 Rule (Weekly Version)

- 50% needs

- 30% wants

- 20% savings/debt

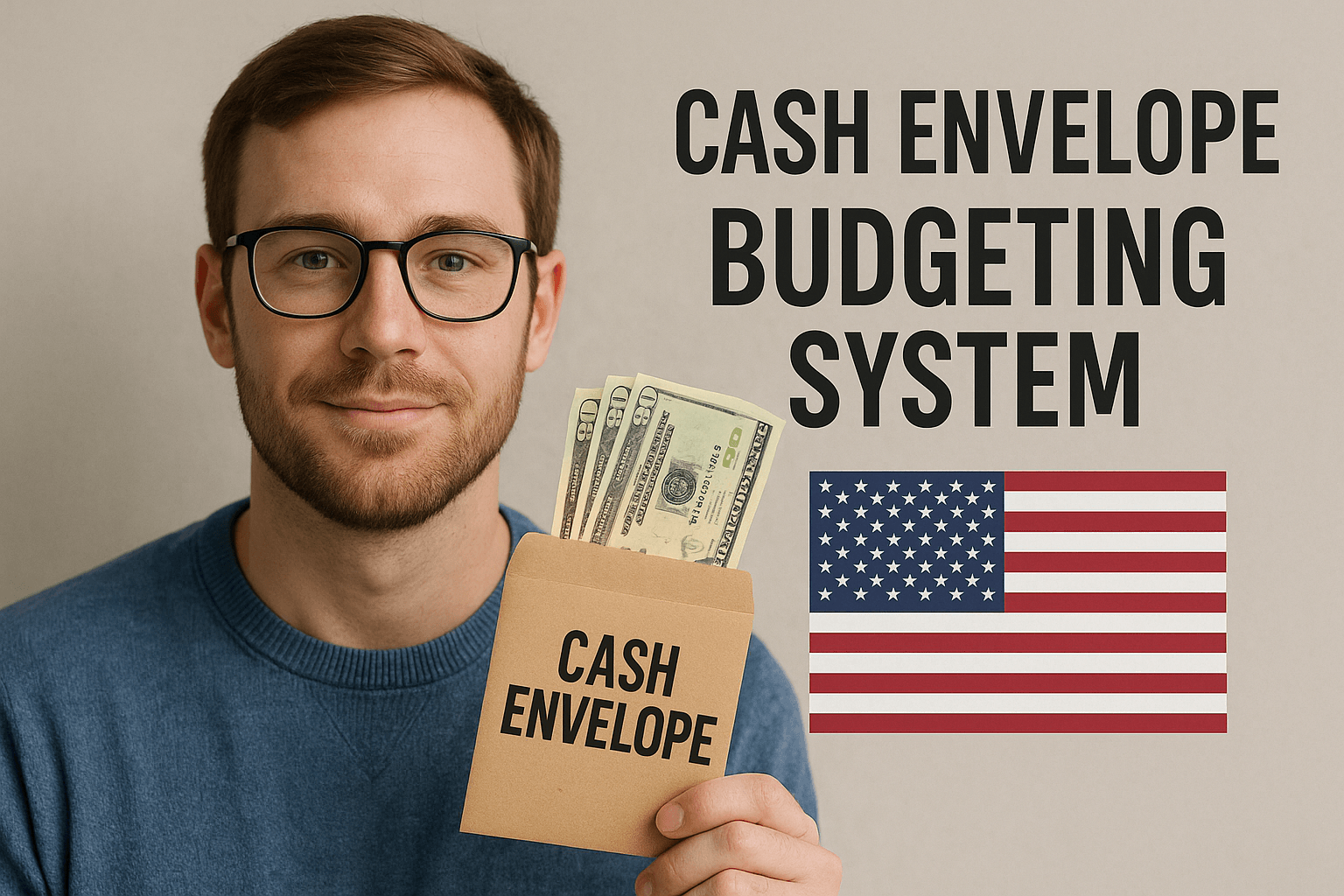

2. Envelope Cash Method

Put weekly cash into envelopes: groceries, gas, entertainment.

H3: 3. Digital Expense Trackers

- Mint

- YNAB

- EveryDollar

4. Zero-Based Budgeting

Every dollar has a purpose—income minus expenses = zero.

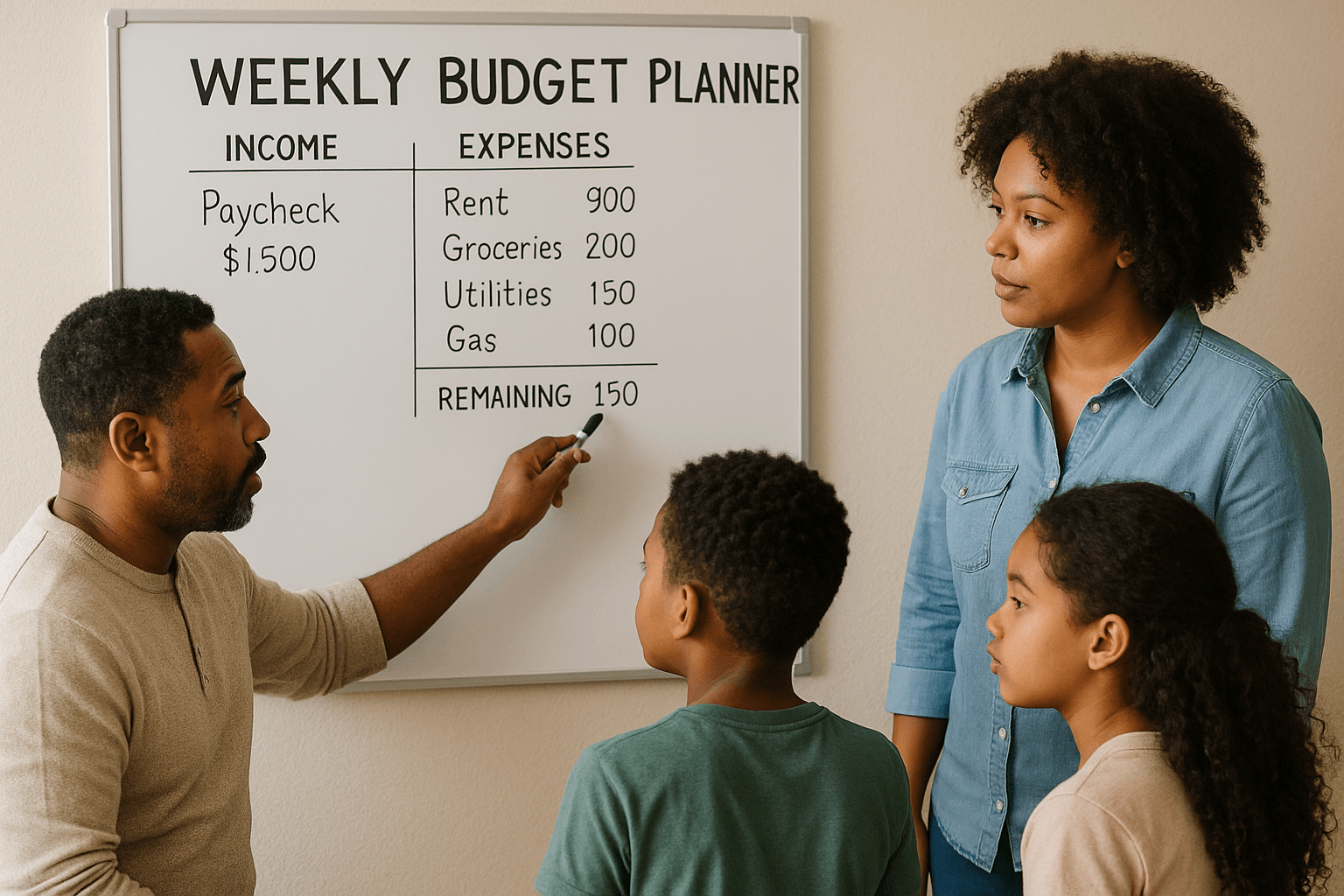

Real-Life Example – Sarah’s Weekly Budget

Sarah, a college student in New York, earns $600 weekly from a part-time job. She struggled with money until switching to a weekly budget planner USA:

- Rent (¼ of $1,200): $300

- Utilities: $50

- Groceries: $80

- Transportation: $40

- Savings: $50

- Entertainment & Misc: $80

By sticking to her weekly plan, Sarah now saves $200/month and no longer runs out of cash mid-week.

Pros & Cons of Weekly Budgeting

Pros:

- Matches weekly/bi-weekly income schedules

- Prevents mid-month overspending

- Easier to track & adjust

- Helps build savings consistently

Cons:

- Can feel repetitive

- Requires discipline to track weekly

- Some bills don’t split evenly into weeks

Tips to Succeed with a Weekly Budget Planner USA

- Automate savings: Transfer money weekly into savings.

- Use a spending tracker app: Helps stay accountable.

- Plan meals ahead: Cuts grocery overspending.

- Review Sundays: A quick weekly check keeps you on track.

- Be flexible: Adjust categories when needed.

Extra Money-Saving Tips for Weekly Budgeting

- Buy in bulk for groceries but divide cost into weekly portions.

- Use cashback/reward cards for gas & groceries.

- Cut unused subscriptions.

- Share streaming services with family/roommates.

- Take advantage of student or employee discounts.

FAQs on Weekly Budget Planner USA

Q1: Is a weekly budget better than monthly?

👉 For beginners and weekly-paid workers, yes—it provides better control.

Q2: How much should I save weekly in the USA?

👉 Start with 10–20% of your income, even if it’s small.

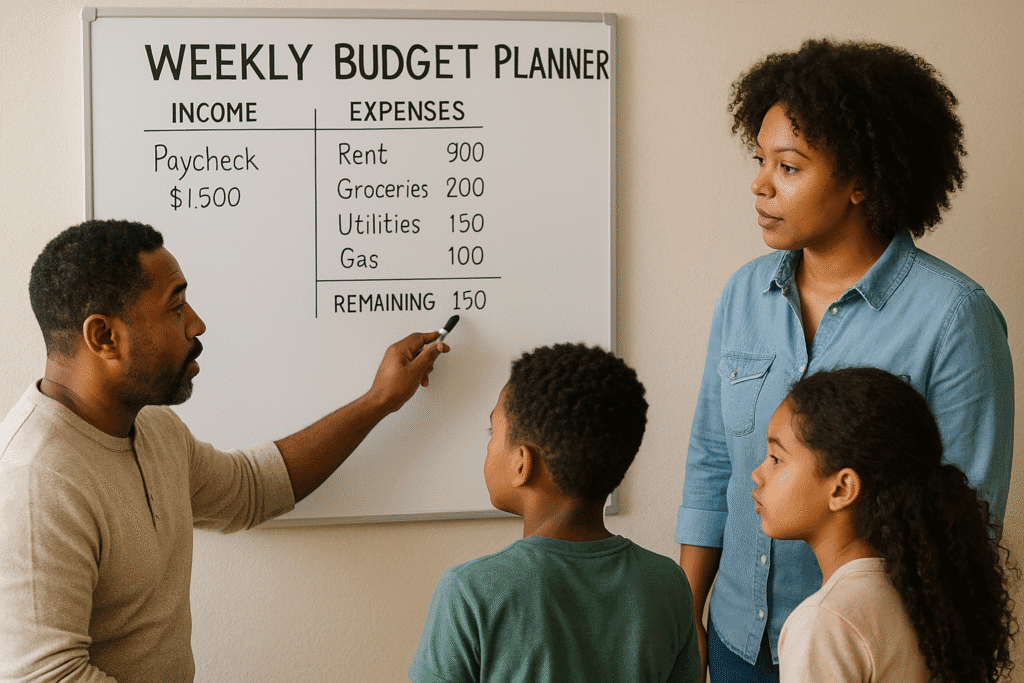

Q3: Can families use weekly budgets?

👉 Yes, especially for grocery and household spending.

Q4: What’s the best free weekly budget planner?

👉 Google Sheets + free printable templates work great. Apps like Mint and YNAB are also helpful.

Q5: How do I handle irregular income weekly?

👉 Base your budget on your average income. Keep an extra emergency buffer.

Conclusion: Start Small, Stay Consistent

A weekly budget planner USA gives you more control, clarity, and peace of mind. Whether you’re a student, working professional, or family, breaking down your finances weekly helps you:

- Match income with expenses

- Avoid overspending

- Build consistent savings

- Stay financially confident

👉 Start with a simple template today—track one week, adjust, and repeat. Within a month, you’ll notice less stress and more savings.