College Student Budgeting Tips USA 2026 || Explained

Introduction: Why Budgeting Matters for College Students

College life in the USA is exciting—freedom, new friends, and opportunities everywhere. But it also comes with one big challenge: money management. Between tuition, rent, food, books, and social life, it’s easy for students to overspend and fall into debt.

The good news? With the right approach, you can enjoy college without constantly stressing about money. That’s where college student budgeting tips USA come in.

In this guide, we’ll cover:

- Why every student in America needs a budget

- How to create a simple student budget USA style

- Real examples of student budgets

- Smart money-saving tips

- FAQs, pros & cons, and practical advice

By the end, you’ll have a step-by-step plan to take control of your money—so you can focus on studying and enjoying college life.

Why Budgeting is Essential for College Students in the USA

Let’s be real—college is expensive. According to 2025 estimates, the average cost of tuition, housing, and fees at a US public university is around $27,000 per year (and much higher at private schools).

Without a plan, many students rely too heavily on credit cards or student loans, leading to financial stress after graduation. A budget helps you:

- Stretch your money further

- Avoid unnecessary debt

- Balance needs vs. wants

- Save for emergencies or future goals

How to Create a Simple Student Budget USA

Step 1 – Track Your Income

For most students, income may include:

- Financial aid refunds

- Part-time job wages

- Scholarships/grants

- Parental support

- Side hustles (tutoring, freelancing, delivery apps)

Step 2 – List Your Fixed Expenses

- Tuition & fees (if paid monthly/semester)

- Rent or dorm costs

- Utilities (Wi-Fi, electricity, water)

- Insurance (health, car)

Step 3 – Track Your Variable Expenses

- Food (groceries + dining out)

- Transportation (gas, bus pass, Uber/Lyft)

- Books & supplies

- Entertainment/social activities

Step 4 – Plan Savings (Even Small)

Even $20–$50/month matters. Start building:

- Emergency fund

- Travel savings

- Debt repayment fund

Step 5 – Review Weekly/Monthly

Budgets are flexible. If you overspend on food this week, cut back on entertainment next week.

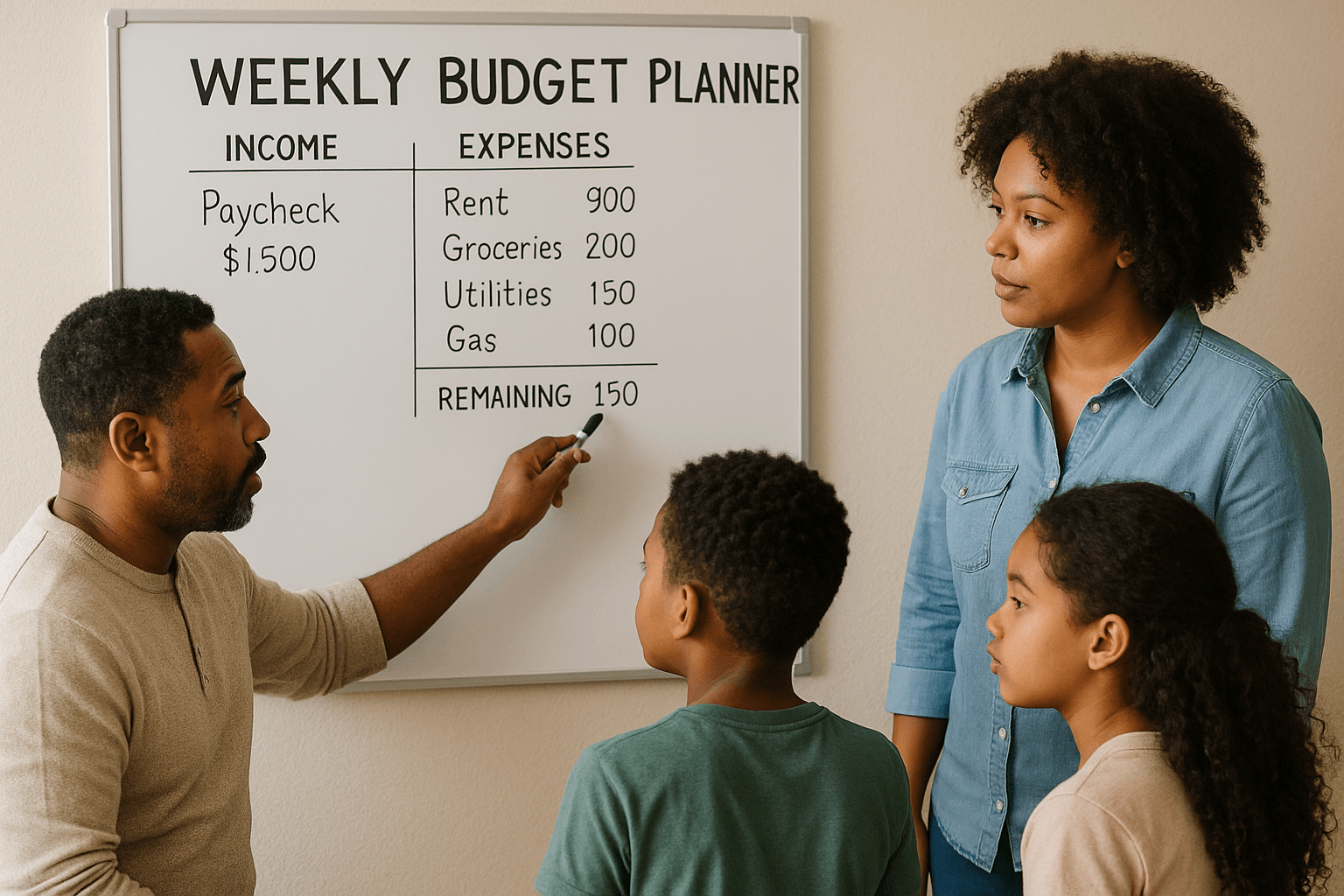

Example of a Student Budget USA

Here’s a real monthly student budget example for Emily, a sophomore in California earning $1,200/month from a part-time job + financial aid:

| Category | Amount Budgeted | Notes |

|---|---|---|

| Rent (shared apt) | $500 | Split with 2 roommates |

| Utilities/Wi-Fi | $100 | Average monthly |

| Groceries | $200 | Meal prepping saves money |

| Dining Out/Coffee | $100 | Limit to weekends |

| Transportation | $120 | Gas + bus pass |

| Books/Supplies | $80 | Buy used or rent |

| Entertainment | $60 | Movies, streaming |

| Savings/Emergency | $40 | Small but consistent |

Takeaway: By tracking, Emily avoids debt and even saves a little each month.

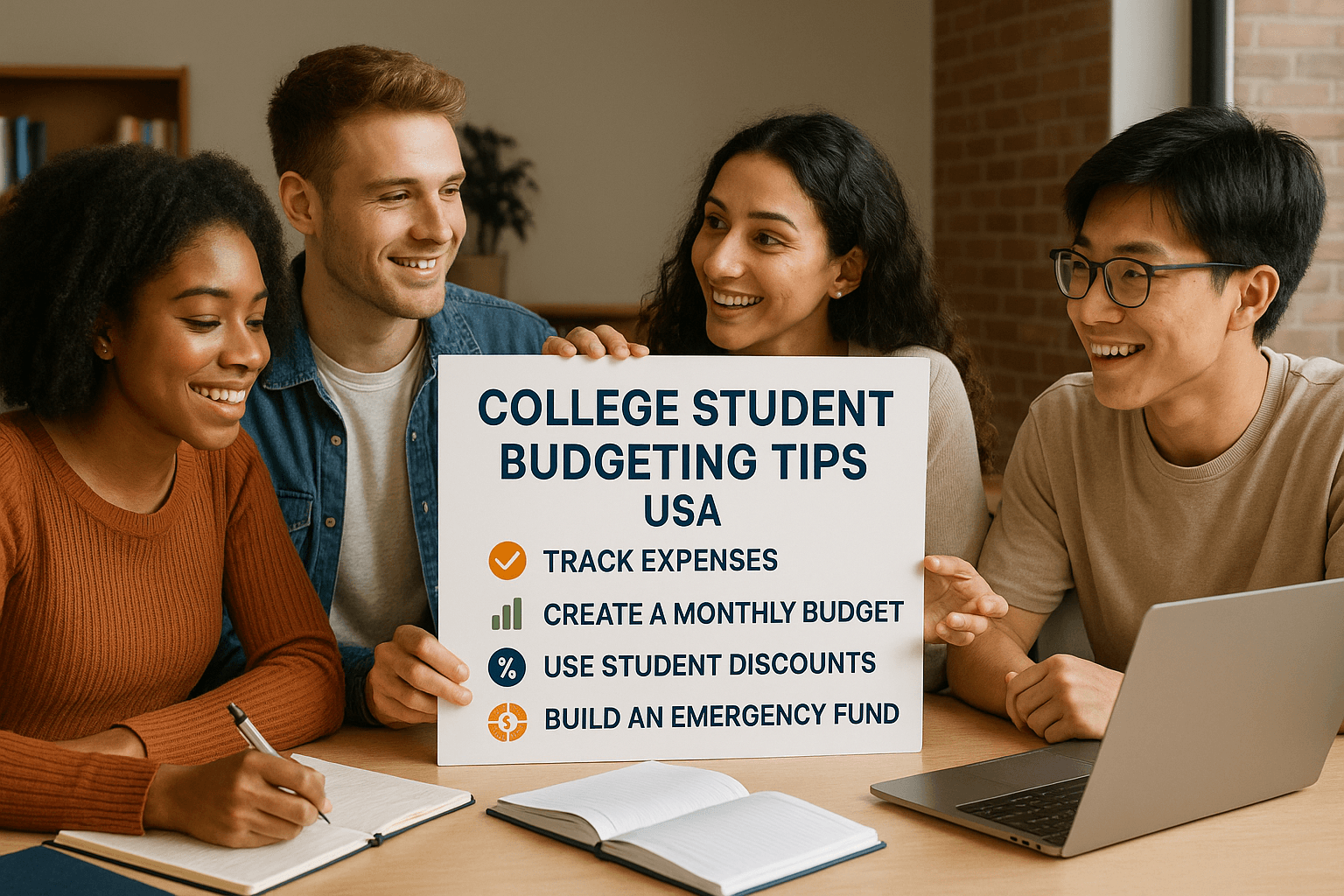

Top College Student Budgeting Tips USA

1. Use Free Budgeting Apps

- Mint (great for beginners)

- YNAB (You Need A Budget)

- PocketGuard (tracks overspending)

2. Cook More, Eat Out Less

- Average college student spends $3,500+ per year eating out.

- Cooking 3 meals at home weekly saves hundreds.

3. Buy or Rent Used Textbooks

Websites like Chegg, Amazon, or campus exchange groups save up to 70%.

4. Use Student Discounts Everywhere

- Spotify, Apple, Adobe, and Amazon Prime all offer student pricing.

- Local restaurants and movie theaters also give discounts.

5. Share Costs with Roommates

Split Wi-Fi, groceries, or streaming services.

6. Limit Credit Card Use

Use credit cards only for emergencies or planned purchases. Avoid carrying a balance.

7. Build an Emergency Fund

Even $500 makes a difference when your laptop breaks or you face unexpected costs.

Pros & Cons of Budgeting in College

Pros:

- Reduces financial stress

- Builds lifelong money habits

- Helps avoid student debt traps

- Allows guilt-free spending when planned

Cons:

- Requires discipline and tracking

- Unexpected expenses may disrupt budget

- May feel restrictive at first

Extra Money-Saving Hacks for Students in the USA

- Use cashback apps like Rakuten or Ibotta

- Take advantage of campus resources (free gym, events, tutoring)

- Opt for public transport or biking instead of owning a car

- Shop at thrift stores for clothes/furniture

- Limit subscriptions (share Netflix or Spotify with friends)

FAQs on Student Budget USA

Q1: How much should a college student in the USA spend monthly?

👉 Depends on location. On average: $1,000–$1,500/month for housing, food, transport, and personal expenses (excluding tuition).

Q2: Is it realistic for students to save money while in college?

👉 Yes. Even saving $20–$50 per month builds good habits and provides emergency security.

Q3: Should students use credit cards?

👉 Yes, but carefully. Pay in full monthly to build credit history without debt.

Q4: What’s the easiest budget system for students?

👉 The 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt.

Q5: Can budgeting reduce student loan debt?

👉 Indirectly, yes. Budgeting helps avoid unnecessary borrowing for daily expenses.

Real-Life Example – Jake’s Story

Jake, a college junior in Florida, used to spend $300/month on eating out. By meal prepping and using a student budget USA style, he cut it down to $120 and redirected $180/month toward paying off his credit card.

By the end of the year, he was debt-free and even saved $1,200 for a summer trip.

Conclusion – Start Small, Stay Consistent

Budgeting in college might sound boring, but it’s actually freedom. A college student budgeting tips USA approach means:

- You control your money instead of money controlling you

- You can enjoy social life without guilt

- You prepare for the future while still in school

👉 Start with a simple budget today. Track your expenses, cut small leaks, and save a little each month. By graduation, you’ll thank yourself.