Simple Family Budget Template USA 2026 || Complete Guide

Introduction: Why Every American Family Needs a Budget

Managing money in a household isn’t always easy. Between mortgage or rent, groceries, healthcare, kids’ expenses, and saving for the future, it’s easy to feel like your paycheck disappears too quickly.

That’s where a simple family budget template USA comes in. It’s like a roadmap for your money: showing where it goes, how much is left, and how you can reach your goals without stress.

In this guide, we’ll explore:

- Why budgeting is essential for American families in 2026

- Different ways to structure your family budget

- A ready-to-use family budget template

- Real examples of families managing money better

- Tips, pros & cons, FAQs, and more

By the end, you’ll be able to create a personalized family budget USA style that works for you.

What is a Family Budget and Why Does it Matter?

A family budget is simply a spending plan that helps you:

- Track income vs. expenses

- Avoid overspending

- Prioritize essentials (housing, food, healthcare)

- Save for long-term goals (college, retirement, vacations)

Example:

Imagine a family of four in Texas earning $6,000/month. Without a budget, they spend randomly and end up with debt. But with a budget, they allocate:

- 30% for housing ($1,800)

- 15% for savings ($900)

- 10% for groceries ($600)

- 5% for healthcare ($300)

- 20% for debt/transportation ($1,200)

- 20% for everything else ($1,200)

Suddenly, they have clarity and peace of mind.

How to Create a Family Budget USA Style

Step 1 – Calculate Your Monthly Income

Include:

- Salaries

- Side hustles

- Investments/dividends

- Child support (if applicable)

Step 2 – List Fixed Expenses

These don’t change much month to month:

- Rent or mortgage

- Utilities

- Insurance

- Car payments

Step 3 – Track Variable Expenses

These can fluctuate:

- Groceries

- Gas

- Entertainment

- Dining out

Step 4 – Plan Savings and Debt Payments

- Emergency fund (3–6 months of expenses)

- Retirement accounts (401k, IRA, Roth IRA)

- Debt payoff (credit cards, loans)

H3: Step 5 – Adjust and Review Monthly

Budgets aren’t “set and forget.” Review every month and tweak where necessary.

Simple Family Budget Template USA (Free Example)

Here’s a basic template you can copy or use in Excel/Google Sheets:

Family Budget Template (Monthly Example)

| Category | Budgeted Amount | Actual Spent | Difference |

|---|---|---|---|

| Income | |||

| Salary (after tax) | $5,000 | ||

| Side Income | $500 | ||

| Expenses | |||

| Housing | $1,500 | ||

| Utilities | $250 | ||

| Groceries | $600 | ||

| Transportation | $400 | ||

| Insurance | $300 | ||

| Debt Payments | $500 | ||

| Healthcare | $350 | ||

| Entertainment | $200 | ||

| Savings | $700 | ||

| Miscellaneous | $200 |

Budgeting Methods Popular in the USA

50/30/20 Rule

- 50% needs

- 30% wants

- 20% savings/debt

Zero-Based Budgeting

Every dollar has a job (income – expenses = $0).

Envelope System

Cash-only system for variable spending categories.

Digital Budgeting Apps

- Mint

- YNAB (You Need A Budget)

- EveryDollar

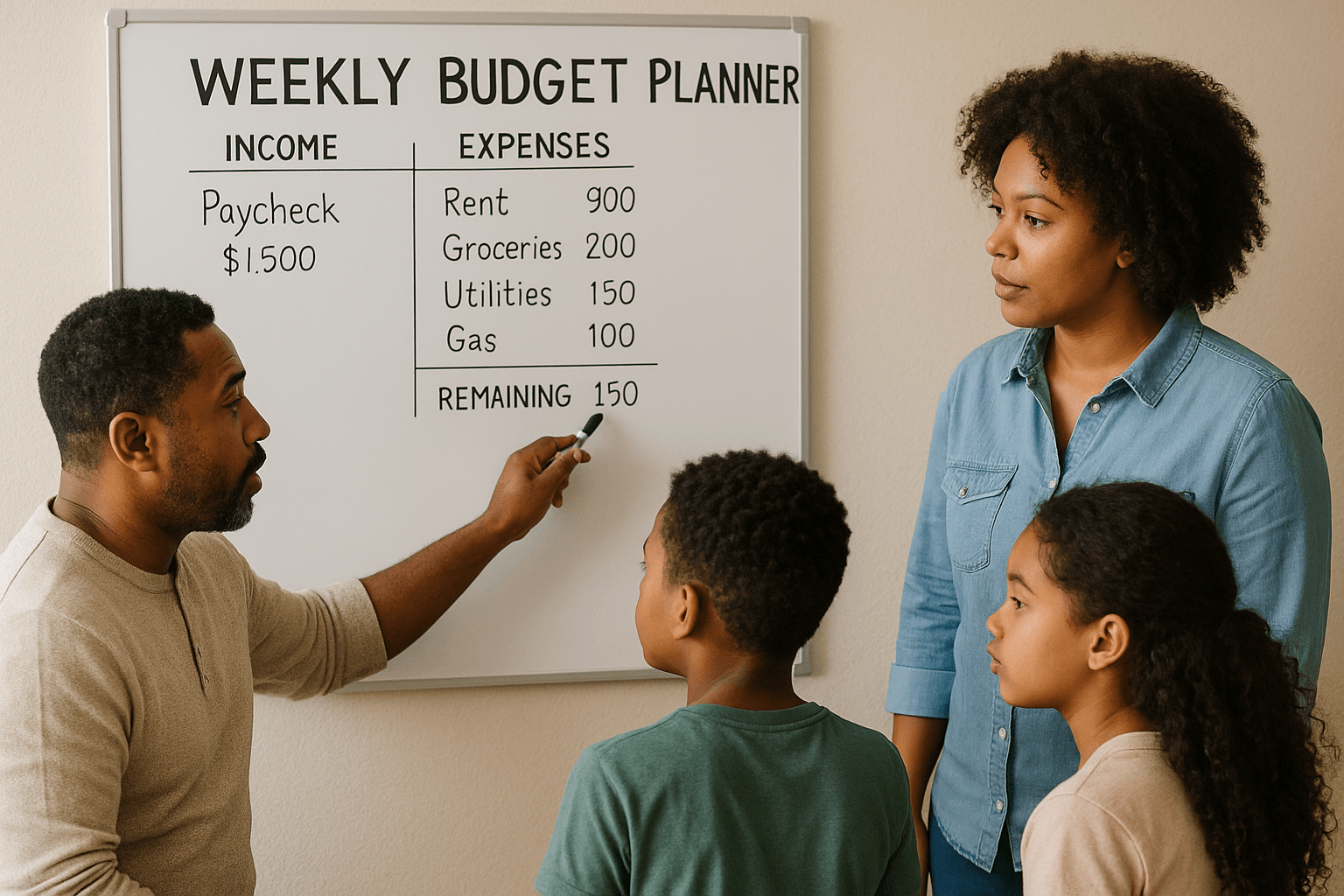

Real-Life Example – The Johnson Family

The Johnsons, a family of five in Ohio, used to live paycheck to paycheck. They adopted a simple family budget template USA and made big changes:

- Cut dining out from $600/month → $250/month

- Redirected savings to build a $5,000 emergency fund

- Paid off $8,000 in credit card debt in 18 months

Now they save for vacations without guilt.

Pros & Cons of Using a Family Budget

Pros:

- Financial clarity

- Less stress

- Helps reduce debt

- Builds savings faster

Cons:

- Requires discipline

- Can feel restrictive at first

- Needs monthly review

Tips for Successful Family Budgeting in the USA

- Be realistic (don’t cut everything at once)

- Involve the whole family (kids included)

- Automate savings to avoid temptation

- Use cashback/reward apps for groceries and gas

- Review annually for inflation adjustments

FAQs About Family Budget USA

Q1: What’s the best budgeting method for American families?

👉 The 50/30/20 rule works best for beginners, but zero-based budgeting is great for debt payoff.

Q2: How much should families in the USA save each month?

👉 Aim for at least 15–20% of income (more if paying off debt).

Q3: Should families use budgeting apps or paper templates?

👉 It depends on preference. Apps like Mint or YNAB are easier for tech users, while spreadsheets work for those who prefer manual tracking.

Q4: What if income is irregular (like freelancing)?

👉 Base your budget on average monthly income and keep a larger emergency fund.

Q5: How often should a family budget be updated?

👉 At least once a month. Review major changes like raises, medical expenses, or new debt.

Conclusion – Start Small, Stay Consistent

Budgeting doesn’t have to be stressful or complicated. A simple family budget template USA gives you clarity, peace of mind, and control over your money.

Remember:

- Track income and expenses

- Use a clear template

- Save before you spend

- Involve the whole family

👉 Start today with a simple spreadsheet or free budget app. Your family’s financial future will thank you.