Debt Management Process in USA 2026

Introduction: Why Talk About Debt Management?

Debt Management Process in USA, Debt can feel like quicksand. The harder you struggle to get out, the deeper you seem to sink. If you’ve ever sat staring at a pile of bills, wondering how you’ll ever dig your way out — you’re not alone.

In fact, studies show that the average American household carries over $100,000 in total debt (including mortgages, credit cards, and loans). For many families, debt isn’t just numbers — it’s stress, sleepless nights, arguments at home, and dreams put on hold.

The good news? There is a way forward. One of the most effective methods people use is a Debt Management Plan (DMP).

But here’s the catch: most people don’t know how the process really works. That’s why in this guide, I’ll walk you through the Debt Management Process in USA — explained in simple, human language, as if a friend is breaking it down over coffee.

We’ll cover:

- What debt management really means

- Each step of the process (from counseling to becoming debt-free)

- Pros & cons you should know before starting

- Real-life examples of Americans who used DMPs successfully

- Common FAQs, myths, and tips to stay on track

By the end, you’ll have a clear roadmap — not just for understanding debt management, but for deciding if it’s the right choice for you.

What Is Debt Management in the USA?

Before diving into the steps, let’s make sure we’re on the same page.

Debt Management is a structured program — usually run by a nonprofit credit counseling agency — that helps you pay off unsecured debts like credit cards, personal loans, or medical bills.

Key features of a Debt Management Plan (DMP):

- You make one monthly payment to the counseling agency.

- The agency distributes that money to your creditors.

- They often negotiate lower interest rates or waive late fees for you.

- The plan usually lasts 3–5 years.

👉 Note: This is different from debt settlement (where you pay less than what you owe, but your credit gets hurt) and bankruptcy (which wipes debts but leaves a huge credit mark). Debt management is about paying everything back — just in a smarter, easier way.

Step-by-Step Debt Management Process in the USA

Let’s break this down into simple, clear steps so you can see exactly how the process works.

Step 1: Recognizing You Need Help

This might be the hardest step — admitting you can’t do it alone.

Signs you may need debt management:

- You’re only making minimum payments on credit cards.

- You’re borrowing from one card to pay another.

- Debt collectors are calling regularly.

- You feel anxious or hopeless about money.

👉 Example: John, a teacher from Texas, realized he needed help when his credit card minimums added up to more than his rent. That was his wake-up call.

Step 2: Choosing a Reputable Credit Counseling Agency

Not all agencies are the same. Some are nonprofit, others may be shady for-profit companies.

Tips to choose the right agency:

- Look for nonprofit organizations (like NFCC-certified agencies).

- Check reviews and Better Business Bureau ratings.

- Make sure they provide free initial consultations.

- Ask about fees (usually $25–$75 setup + small monthly fee).

👉 Remember: If an agency promises to “wipe your debt overnight” — that’s a red flag.

Step 3: Credit Counseling Session

Once you find a trusted agency, you’ll have a counseling session.

What happens here:

- A counselor reviews your income, expenses, and debts.

- They help you create a realistic budget.

- They recommend whether a DMP is right for you — or if another option (like consolidation) might fit better.

👉 Good agencies don’t push you into a DMP. They explain all options first.

Step 4: Creating Your Debt Management Plan

If you move forward, your counselor sets up your personalized DMP.

This includes:

- Listing all unsecured debts (credit cards, medical bills, personal loans).

- Contacting creditors to negotiate lower interest rates.

- Arranging to stop collection calls once payments begin.

- Deciding on your monthly payment amount.

👉 Example: Maria from California had $20,000 in credit card debt at 22% interest. With a DMP, her rates dropped to 7%. Her monthly payments went from $600 → $350.

Step 5: Starting Your Monthly Payments

Now the real work begins. You’ll make one monthly payment to the counseling agency. They handle the distribution to your creditors.

Benefits:

- Simpler — no juggling 6 bills.

- Predictable — same due date every month.

- Encouraging — you see balances drop steadily.

👉 Important: Missing a payment can cause creditors to drop concessions (like reduced interest). Staying consistent is key.

Step 6: Closing or Freezing Credit Accounts

Most DMPs require you to close or stop using existing credit cards.

This might sting at first, but it’s for your protection — no adding more debt while paying down old debt.

Pro tip: Ask if you can keep one card for emergencies. Some agencies allow this, but only if you promise responsible use.

Step 7: Sticking With the Plan (3–5 Years)

This is the marathon part. Debt management isn’t an overnight fix.

How to stay motivated:

- Track your progress monthly.

- Celebrate small milestones (like paying off a card).

- Remind yourself of the “why” — less stress, more freedom, better sleep.

👉 Example: A couple in Florida treated their DMP like a gym membership — not always fun, but worth it. They hung a chart on the fridge to track every $1,000 paid off.

Step 8: Graduation — Becoming Debt-Free 🎉

When you make your final payment, the agency notifies your creditors that your accounts are settled in full.

The feeling? Freedom. Relief. Pride.

And your credit report? It shows consistent payments and reduced balances, which can boost your score. Many people see their credit scores rise within 6–12 months after completing a DMP.

Pros & Cons of Debt Management Process USA

✅ Pros

- One easy monthly payment

- Lower interest rates & waived fees

- Stops collection calls

- Can improve credit score long-term

- Emotional relief — less stress

❌ Cons

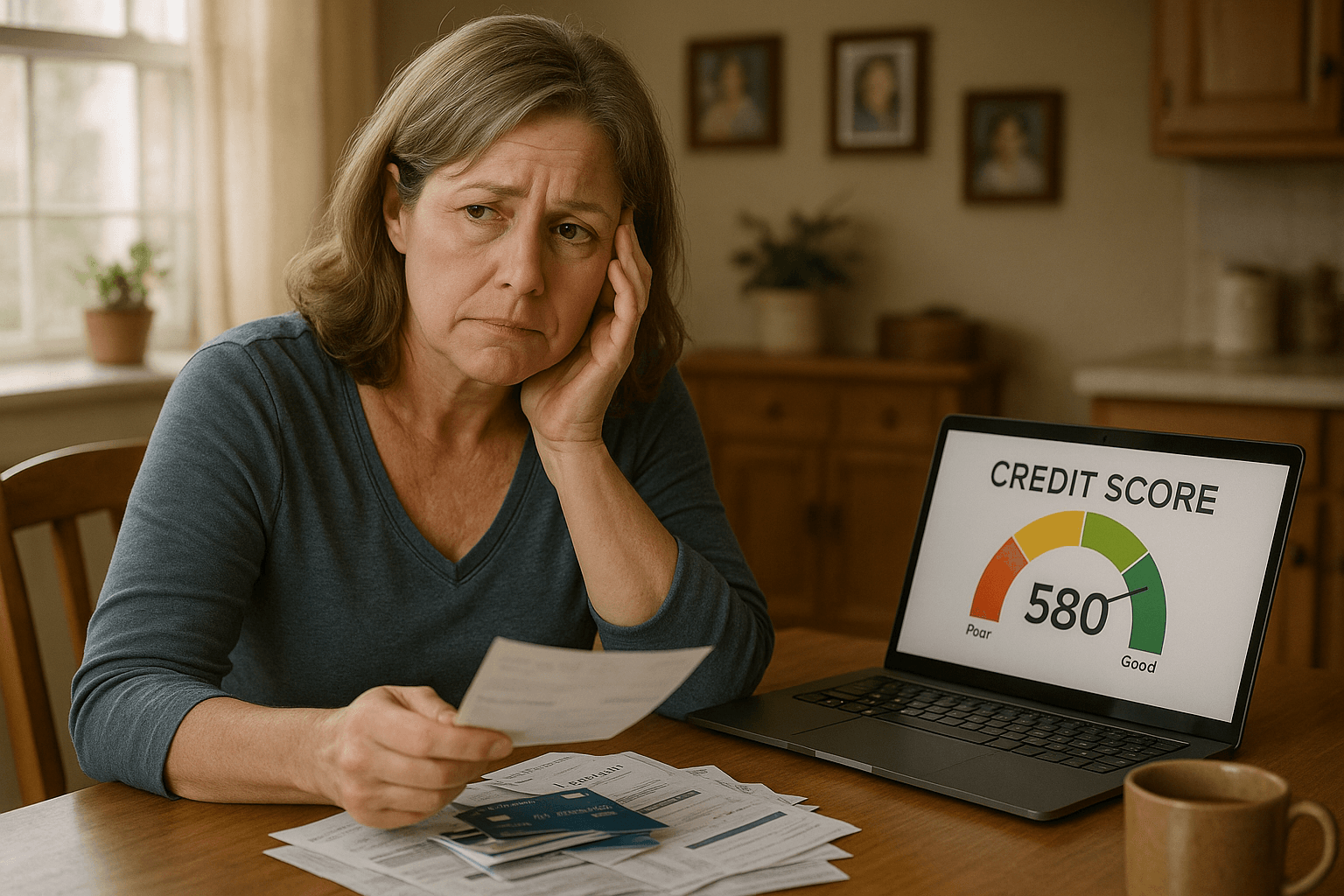

- Temporary drop in credit score (because of account closures)

- Strict commitment (3–5 years)

- Small monthly fees to the agency

- Only for unsecured debt (not mortgages or car loans)

Practical Tips to Succeed in a DMP

- Set up autopay to never miss a payment.

- Build a small emergency fund ($500–$1,000) so you don’t need new credit cards.

- Cut small expenses (subscriptions, takeout) — redirect savings to your plan.

- Check credit reports yearly to spot errors.

- Stay patient. Debt took years to build — it’ll take time to clear.

FAQs About Debt Management Process USA

Q1: Does debt management ruin your credit?

👉 Not at all. It may dip at first, but consistent payments improve it over time.

Q2: Can I apply for new credit during a DMP?

👉 Usually not — creditors want you focused on repayment.

Q3: How long does debt management stay on my report?

👉 Notes about being in a DMP may appear, but they don’t hurt as much as late payments.

Q4: What happens if I miss a DMP payment?

👉 Your concessions (like lower interest) might be canceled. Always call your agency if you’re struggling.

Q5: Is debt management better than bankruptcy?

👉 Yes — if you can afford the payments. Bankruptcy may wipe debt faster but damages credit for 7–10 years.

Conclusion: Your Road to Financial Freedom

Debt can feel like a heavy chain. But the Debt Management Process in USA gives you the key to unlock it — step by step.

👉 First, admit you need help.

👉 Then, work with a reputable agency.

👉 Stick with the plan, and slowly but surely, you’ll be free.

It won’t be easy. There will be moments you’ll want to quit. But remember: every payment is a step toward peace of mind, healthier credit, and a debt-free future.

You don’t have to do this alone. Reach out to a certified credit counselor today — not because they have magic answers, but because they’ll walk the path with you.

And one day, you’ll look back and realize: debt was just a chapter, not your whole story. ❤️