Business Finance 2026: A Complete Guide for Entrepreneurs and Business Owners

Introduction: Business Finance Explained in USA 2026

If you’re running a business in 2026, you’ve probably realized that business finance is changing faster than ever before. Between rising interest rates, new digital tools, stricter compliance rules, and an evolving tax landscape, staying on top of your finances is no longer optional — it’s survival.

This guide, Business Finance 2026, is designed to break down everything you need to know in plain, friendly language. Whether you’re a small business owner, a startup founder, or a corporate manager, this article will give you clear insights, real-world examples, and practical tips to manage your money effectively.

We’ll cover:

- The basics of business finance in 2026

- New trends shaping financial decisions

- Funding options available in the USA

- Practical examples of finance in action

- Pros & cons of different approaches

- Frequently asked questions

Let’s dive right in.

What is Business Finance in 2026?

Business finance refers to the management of money, investments, credit, and financial decisions that keep a business running. In 2026, it includes:

- Budgeting for growth and sustainability

- Managing loans, credit lines, and capital

- Navigating taxes and compliance

- Using financial technology (FinTech) to make smarter decisions

- Planning for risks in an unpredictable economy

Think of it like this: finance is the fuel of your business engine. Without proper fuel management, the engine sputters and fails.

Why Understanding Business Finance in USA 2026 is Crucial

Here’s why mastering finance is essential in today’s business landscape:

- Economic Uncertainty: Inflation, interest rate changes, and global supply chain issues affect cash flow.

- Funding Opportunities: New government programs, grants, and venture capital trends can make or break your business.

- Tax Reforms: The IRS rules for 2026 have shifted in areas like small business deductions and digital transactions.

- Technology Growth: AI-driven accounting and blockchain-based payments are becoming mainstream.

💡 Example: Imagine a bakery in New York. If the owner doesn’t understand rising flour costs, loan interest rates, or how to get a small business tax credit, profits can shrink quickly. With smart financial planning, that same bakery can expand, invest in equipment, and stay competitive.

Key Components of Business Finance in USA 2026

1. Business Budgeting

Budgeting is no longer just about spreadsheets. In 2026, businesses use AI tools that automatically analyze past spending, forecast future expenses, and recommend adjustments.

Tips for Smart Budgeting in 2026:

- Use cloud-based platforms like QuickBooks AI or Xero with forecasting features

- Track both fixed costs (rent, salaries) and variable costs (materials, utilities)

- Always include a 10% emergency fund in your budget

2. Business Loans and Credit

Getting access to funds is easier in some ways and harder in others. Banks remain traditional lenders, but FinTech platforms now provide instant approvals and microloans.

Pros of Traditional Bank Loans:

- Lower interest rates

- More credibility with long-term banking partners

Cons:

- Slow approval

- Tough eligibility requirements

Pros of FinTech Loans:

- Faster access to capital

- Flexible repayment options

Cons:

- Higher interest rates

- May require personal guarantees

3. Business Taxes in 2026

Tax rules have shifted in the USA for small and medium-sized businesses. For example:

- Digital transaction reporting is stricter.

- Certain green-energy-related tax credits are now available for businesses.

- The standard deduction for small businesses has increased slightly.

💡 Example: A trucking company investing in electric trucks in 2026 can claim federal and state tax credits, reducing overall costs.

4. Investment Decisions

Business owners in 2026 are not just thinking about survival — they’re investing in growth. Common areas include:

- Expanding into e-commerce

- Buying new technology

- Hiring skilled employees

- Setting aside funds in short-term investments like treasury bills

5. Risk Management and Insurance

With cybersecurity threats and natural disasters on the rise, insurance and risk planning are now part of every serious financial strategy. Businesses invest in:

- Cyber liability insurance

- Business interruption insurance

- Employee health plans

Business Finance Trends in USA 2026

1. Digital Finance Tools

AI-powered finance apps are becoming a must-have. They track spending, generate reports, and even suggest cost-cutting strategies.2. ESG (Environmental, Social, Governance) Investments

Investors increasingly demand that businesses show environmental responsibility. Companies with green initiatives are gaining easier access to funding.

3. Blockchain and Cryptocurrency Payments

More US businesses in 2026 accept digital currencies like Bitcoin or stablecoins for faster, cheaper cross-border payments.

4. Rise of Fractional CFO Services

Small businesses now hire “CFOs on demand” — finance experts available part-time, helping with budgeting, forecasting, and compliance.

Practical Tips for Managing Business Finance in 2026

- Separate personal and business accounts (avoid IRS headaches).

- Monitor cash flow weekly — not just monthly.

- Use automation for invoicing and payroll.

- Stay updated on grants and government programs.

- Hire professionals for tax filing if your finances are complex.

Real-World Examples

Example 1: Tech Startup in California

A startup building AI software received $250,000 in seed funding. By hiring a fractional CFO, they cut unnecessary spending, applied for a California state grant, and saved 20% in taxes.

Example 2: Restaurant in Texas

A small restaurant faced rising ingredient costs. They switched suppliers, automated payroll, and secured a $50,000 FinTech loan. Result: profit margins improved by 15%.

Pros and Cons of Business Finance Approaches

Pros of Strong Financial Planning:

- Better stability

- Easier access to loans

- Improved decision-making

Cons (if ignored):

- Cash flow shortages

- Risk of bankruptcy

- Missed growth opportunities

Frequently Asked Questions

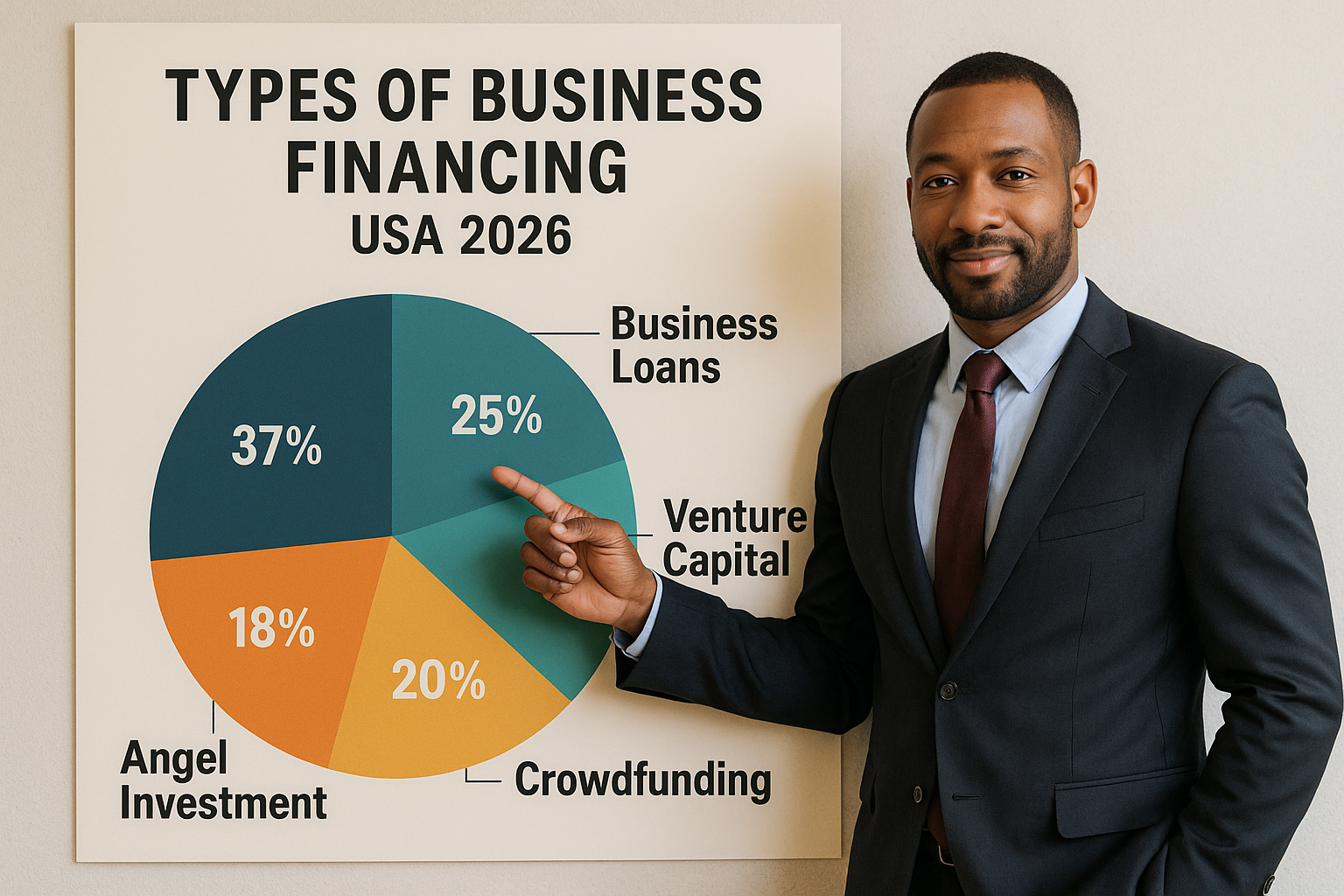

1. What is the best way to finance a small business in 2026?

👉 It depends on your goals. For quick cash, FinTech loans are great. For long-term growth, traditional bank loans or venture capital may be better.

2. Are taxes harder for small businesses in 2026?

👉 Not harder, but stricter. More reporting is required, especially for digital payments over $600.

3. How important is technology in managing business finance?

👉 Very important. Cloud accounting, AI-driven tools, and digital banking make financial management faster and more accurate.

4. Can businesses still get government grants in 2026?

👉 Yes. Many grants are available for innovation, minority-owned businesses, and green initiatives.

Conclusion

Managing business finance 2026 is both exciting and challenging. With the right mix of technology, planning, and smart decision-making, businesses can thrive despite economic uncertainty.

If you’re a business owner, start small:

- Review your budget

- Explore funding options

- Keep an eye on taxes

- Use digital tools wisely

👉 Remember: financial literacy is your business superpower in 2026.